- The Dow Jones index shed more than 250 points on Tuesday and is on a week-long downtrend. How long will the decline last? Should you buy?

The Dow Jones Industrial Average (DJIA) index fell roughly 1.2% in the last week, settling at 47,085 on Tuesday following a painful 251-point plunge. That’s not a picnic, especially given the record highs above 48,000 in October. But is this just a blip or the beginning of something worse?

Why is the Dow Jones Index going down?

Currently, the fundamental problem is that tech anxieties are spilling over from the excitement around AI to the reality check. For example, Palantir’s stock price fell 6% on Tuesday even though the company topped earnings forecasts. Investors are worried that massive AI bets, like OpenAI’s $38 billion contract with Amazon, may take decades to pay off. This has exacerbated talks of a bubble. Despite being more blue-collar than the tech-heavy Nasdaq, the sentiment is pulling the Dow down with it.

Add in the bigger problems caused by inflation staying at 3.2% and Fed Chair Powell’s hint that December rate reduction aren’t “a foregone conclusion”. Meanwhile, Bank of America says that if low-income people will have to wait for food stamps, consumer spending could drop by 0.5%. In essence, earnings beats aren’t going to be able to calm macro fears, creating a perfect storm.

There’s also the uneasiness created by warnings from big-name Wall Street players. CEOs of major investment banks like Goldman Sachs and Morgan Stanley have said in public that the market is primed for a correction, which may mean a drop of 10% to 20% in the next year or two. According to them, these occasional drops are normal and good for the market. However, traders naturally get anxious when they hear such things from major financial companies and want to safeguard their profits.

There are always macro factors at play, even when looking at an individual company. People are still worried about not knowing what the Federal Reserve’s interest rate path will be. Fed rate decisions have a direct impact on the cost of borrowing and corporate profits. Also, the US government shutdown means that there isn’t any key economic data available, which adds to the general cloud of uncertainty and makes it tougher for investors to figure out how the economy is doing.

Is the Market Decline Likely to Continue?

The honest response is that the market is likely to stay volatile for a while, but a long-term bear market is not certain. If tech stocks keep going down, it might have an effect on other sectors of the DJIA that are sensitive to the economy. But it’s important to keep the context in mind. The Dow is still going up in the long term.

Dow Jones Chart

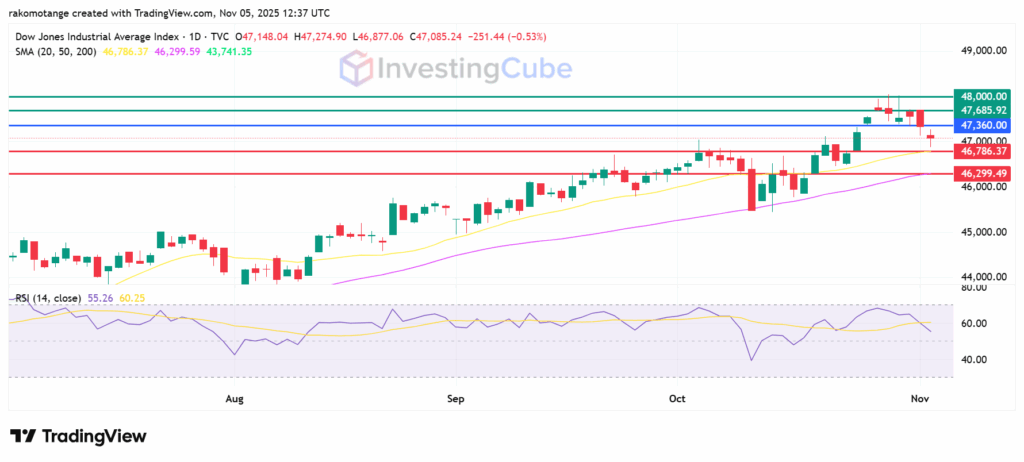

The RSI (14) fell from 65 to 55 in the last three sessions, which is signals a weakening buying momentum. The daily chart for the Dow shows that it has pulled down from its high of 47,940 on October 28 to just above the 50-day SMA around 46,300. If the price drops below that level, it might go to 46,786 points, which is the same as the 20-day SMA.

An extended control by the sellers could push the index lower to test the 50-day SMA at 46,299. Resistance is coming up at 47,360, above which the next barrier will likely be at 47,685 points. The downside narrative will be invalid if action goes above that level. Meanwhile, a stronger momentum could extend gains to retest 48,000.

Dow Jones Index chart on November 5, 2025. Source: TradingView

The decline will likely not be for long. Analysts call it a healthy pullback, not a crash. Also, holiday spending and strong company earnings could spark a rebound soon.

It is a good time to buy if you’re patient. The Dow Jones drop looks temporary, with support nearby. However, you should wait for signs of reversal, then consider strong blue-chip stocks to buy.

The technology sector, specifically stocks connected to Artificial Intelligence (AI), is causing the most concern. Investors are questioning whether the enormous capital spent on AI will deliver sufficient, sustainable profits