- The Dow Jones Index had been struggling in recent days, dropping over 2,500 points in under ten days.

- The market momentum is helped by hopes of a potential Fed rate cut and the calming of fears amid calming of AI bubble fears.

- However, weak US economic data could injure the current positive market sentiment and slow down gains.

The Dow Jones Industrial Average has bounced back nicely these past three days after some recent ups and downs. Meanwhile, Nvidia’s latest forecast-beating earnings report has calmed nerves regarding potential AI bubble. Under these circumstances, it’s easy to see why investors feel upbeat about the Dow.

This three-day win erases the dips from earlier in November, during which the Index declined from 48,383 to 45,729 points between November 12th and 20th. The current rebound is helped by lower trading volumes during the holidays that made the positive trend even stronger. Year-to-date, the Dow has advanced 9.18%, underscoring its resilience in a volatile 2025. Such swift recoveries often prompt questions about underlying durability.

Dow Jones Sustainability and the Headwinds Ahead

While the immediate environment is favorable, the sustainability of this rise throughout the remainder of the year requires careful consideration. The current climate is conducive to growth, but whether or not this trend can continue for the rest of the year is an important question. The market is currently very dependent on the Federal Reserve making the predicted cuts to interest rates.

If new inflation data comes in and the trend of moderation stops, the Fed’s dovish perspective may quickly change, which would quickly lower investor confidence. Also, Nvidia’s positive earnings results have provided support to the broader tech sector and created a positive sentiment across equities.

For the rest of the year, the market outlook remains cautiously optimistic, supported by historical seasonality trends that favor year-end equity performance. However, without a strong, structural catalyst, the market may lack the firm confidence needed for a steady, uninterrupted advance.

Forecasts see a close between 47,000 and 48,000, thanks to solid economic fundamentals and expected help from the Fed. Analysts at Edward Jones say the economy is doing well but could be affected by changes in policy. Still, there are risks: if the Federal Reserve changes course because of ongoing inflation, things could stall. Also, slower job growth and rising tariffs could cause problems.

Recent comments from Fed officials suggest that current policy is moderately restrictive, which means they might make some adjustments soon. The market seems to agree. The CME Group’s FedWatch Tool says there’s a good chance of a 25-basis-point rate cut at the Fed’s next meeting.

Dow Jones Index Forecast

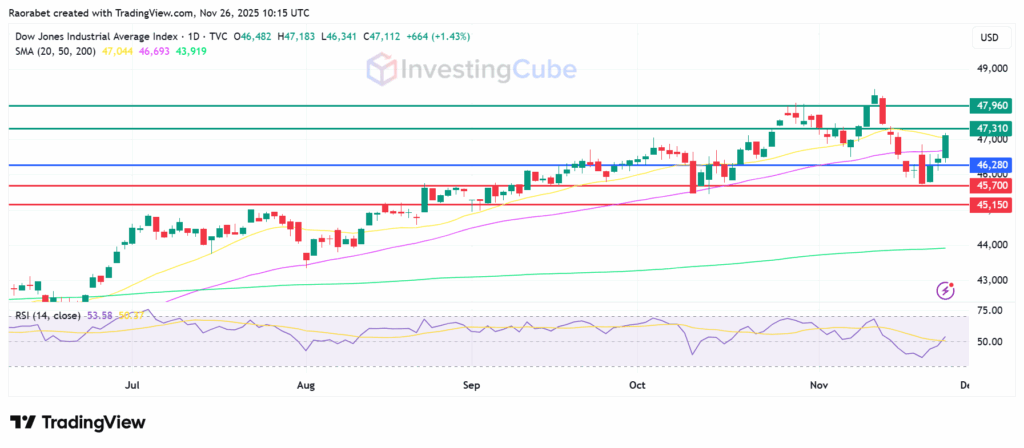

The Dow Jones index currently trades above its major long-term moving average, the 200-day moving average (MA), which acts as the ultimate long-term support, typically situated around the 44,000 psychological level.

However, the three-day rally has met some resistance near 47,100. Key support in the medium term is between 45,150 and 45,700. If the index breaks through and closes above the 47,310 resistance, that would signal more positive momentum, with a target of retesting 47,960, near recent all-time highs.

Dow Jones Index on the daily chart as of November 26,2025 with key support and resistance levels. Source: TradingView

The main driver is the growing expectation, supported by Federal Reserve statements and CME Group data, that the Fed will initiate an interest rate cut in the near term, improving future economic visibility.

The greatest risk lies in future inflation data. If reports from the U.S. Bureau of Labor Statistics show a re-acceleration of inflation, it would reduce the probability of the anticipated Fed rate cuts.

Yes, with projections for 47,000–48,000 closes amid economic resilience, though policy uncertainties could cap gains, according to Edward Jones forecasts.