- The Dow Jones Index has been on a downtrend in recent days. We discuss how Nvidia's impressive earnings and NFP release could shape things.

The financial markets are at a crossroads today, with two major, competing factors threatening to steer the Dow Jones Index (DJI) in opposite directions. On one side, we have the bullish momentum from a spectacular earnings beat by tech giant Nvidia. On the other, the crucial economic data from the Non-Farm Payrolls (NFP) report looms large, and that could shake things up.

Nvidia’s Beat and Spillover Potential

Nvidia’s fiscal Q3 2026 results, released after the bell on November 19, delivered a resounding beat that could provide some counterbalance to the DJIA after recent troubles. Revenue soared to $57.0 billion, 22% above the prior quarter and 62% year-over-year growth, surpassing estimates of $54.92 billion, as detailed in the company’s press release.

Net income increased 65% to $31.91 billion, and adjusted profits per share reached $1.30, exceeding the $1.25 consensus from LSEG. Guidance for Q4 at $65 billion further stoked optimism, with CEO Jensen Huang underscoring ongoing AI demand. According to CNBC, shares rose more than 4% in after-hours trade. More crucially, its Data Center sales soared 66% year-over-year, driven by unprecedented demand for its Artificial Intelligence (AI) processors.

While the index is more focused on industrial companies like Boeing and Caterpillar than tech-heavy Nvidia, good tech earnings often improve the overall market sentiment. Past trends, according to Investopedia, show that Nvidia’s positive results have led to 0.3-0.5% gains in the Dow the next day, amid increased inclination to believe that businesses are set to gain from AI investments.

The NFP Wildcard: A Macroeconomic Reckoning

But the excitement caused by one company’s great success will shortly have to give way to a scheduled macroeconomic release. That will come in the form of the delayed September Non-Farm Payrolls (NFP) report, scheduled to be released by the Bureau of Labor Statistics at 8.30 ET today. A moderate increase of 50,000 jobs is expected, with the unemployment rate remaining unchanged at 4.3%, according to Reuters’ estimates.

If the jobs report is much better than expected, it suggests that the job market is tight, which could lead to inflation. This could cause the Federal Reserve to take a tougher stance, possibly raising interest rates further or delaying expected rate cuts. Higher interest rates usually hurt stock values, especially for industrial stocks in the DJIA, so a strong NFP report could quickly cancel out the positive Nvidia effect.

On the other hand, a weak report would indicate that the job market is cooling and the economy is slowing. While this is bad for economic growth, it could make the Fed more likely to ease its policies sooner. This situation, where bad economic news leads to a stock market increase, often happens because investors anticipate a more accommodating financial environment.

Dow Jones Chart and Levels to Watch

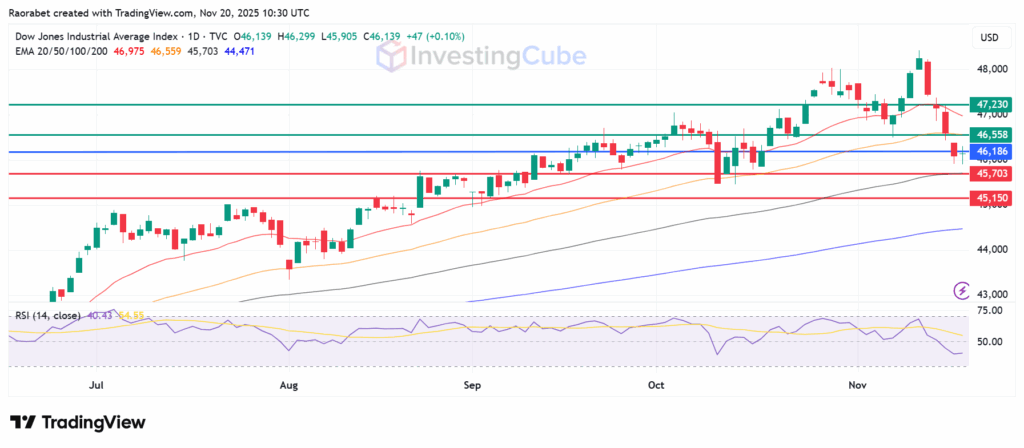

The Dow Jones Index is trading above both its 100-day (45,703) and 200-day (44,471) Exponential Moving Averages (EMA), which signals that the long-term trend is good, even with last week’s dip. According to TradingView charts, the RSI is at 42, which favours the sellers to be in control.

The pivot is at 46, 186 while the 100-day EMA at 45,703 is the first level of support. If it goes below there, it could drop to 45,150. Above the pivot point, the next resistance is around 46,558. If it closes above that, it could go for 47,230.

Dow Jones Index daily chart as of November 20, 2025 pre-market with key support and resistance levels. Created on TradingView

Nvidia’s massive earnings beat acts as a bellwether for the tech and AI sectors, boosting overall market confidence and helping to counteract the recent bearish sentiment on the Dow.

The 66% year-over-year surge in Data Center revenue validates the continued, robust demand for AI infrastructure. That adds support to the strength and sustainability of the ongoing AI investment cycle.

A strong NFP report suggests a tight labor market. That could potentially lead the Federal Reserve to maintain or raise high interest rates. In turn such a could be detrimental to stock valuations, including those in the Dow Jones Index.