- The Dow Jones Index is in a deep correction with the tech bubble fears at the centre of it, but there's more to the current sentiment.

The Dow Jones Industrial Average (INDEXDJX: .DJI)has cooled off a bit since last week. After almost hitting 48,040 on October 29th, it’s dropped about 2.3%, from that level, and closed at 46,913 on November 6 after a 398-point drop. This takes back some of its recent gains, with investors growing jittery. We discuss what’s happening to the Dow below.

Fundamentals Pull The Dow Down With AI Reality Check

The main reason for this is tech stocks cooling off. The AI hype that boosted the market in 2025 is facing a reality check. With that, investors are beginning to second-guess those sky-high multiples on names like Palantir, which tanked despite strong earnings, dragging the Nasdaq down 1.9% on November 6.

A recent CNBC report says that AI-related stocks, once favorites, now face pressure as Wall Street worries about a possible bubble. This comes after mixed earnings from big tech firms like Meta and Microsoft. There are other economic concerns, with Revelio Labs reporting 9,100 job cuts in October, mainly in government, raising fears of a recession even with the Fed’s recent rate cut.

Reuters reported figures from Challenger, Gray & Christmas that showed job cuts in October hit a two-decade high for that month. Companies often blame these layoffs on cost-cutting and AI which are leading investors to think about a quicker economic slowdown.

Outlook for the Rest of the Year

For investors navigating this volatility, the key question is endurance. Things seem unclear for now. The Dow will probably keep bouncing around as investors look at every new piece of economic info and corporate news. The mixed earnings from different companies aren’t painting an ideal picture of the economy, with some doing well and others not so much.

Dow Jones Index Technical Analysis

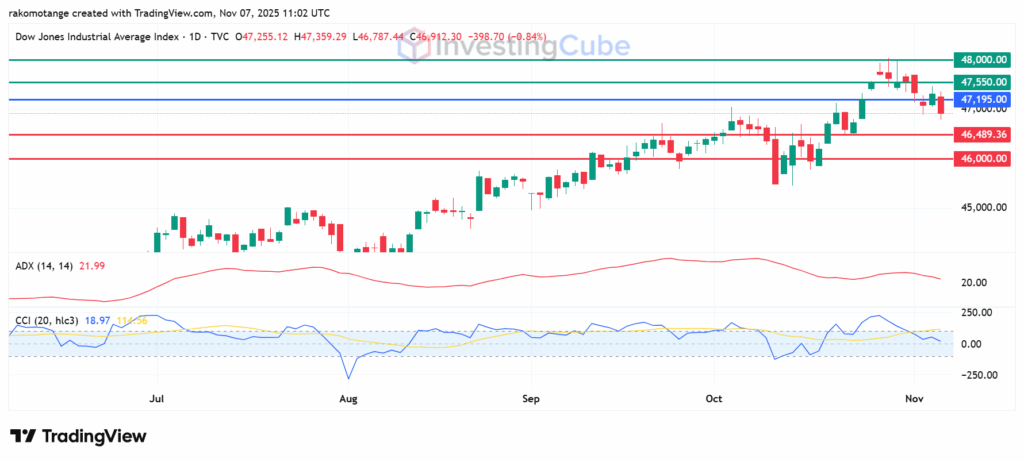

The Dow’s chart suggests a slight downward trend for now. The price has dropped below 47,195 pivot and will likely find its support at 46,000–46,489. Resistance is seen at the pivot mark, with the next two in the 47,550–48,000. Momentum shows waning bullishness: ADX at 21.11 indicates weakening trend strength, supported by CCI at 18 which flags building bearish pressure.

Dow Jones Index daily chart on November 7. Source: TradingView

The ongoing decline by tech stocks quickly translates into sell-side pressure on the broader Dow index.

No, Analysts see the current downturn as a temporary correction. With earnings tailwinds and Fed support, it could rebound by December, and long-term trajectory remains upward.

Outside tech, investors are concerned about the impact of higher-for-longer Fed interest rates and job cuts which could be indicating deeper-lying corporate struggles.