- Check the major factors that change the pricing of the FTSE 100, and the technical outlook of the index on the daily timeframe

UK stocks opened higher on Friday in response to the optimistic consumer confidence in May and amid the ongoing talks between Southeast Asian leaders on Monday.

Today’s start for the FTSE 100 was positive, with 26.50 points, or 0.3%, up at 8,765. However, the index closed yesterday at 8,739.26, a 47.20-point decline (0.5%).

Also, the sterling pound opened early Friday higher at 1.1318, compared to late yesterday’s trading at 1.1285. Despite the ongoing concerns about inflation, the consumer confidence edged up in May as U.S. tariff tensions eased.

The GFK consumer confidence index rose by 3 points to reach -20, but it is still firmly negative. The positive impact comes from an increase in personal finances by five points, however, this is still not as good as they were at the same time last year.

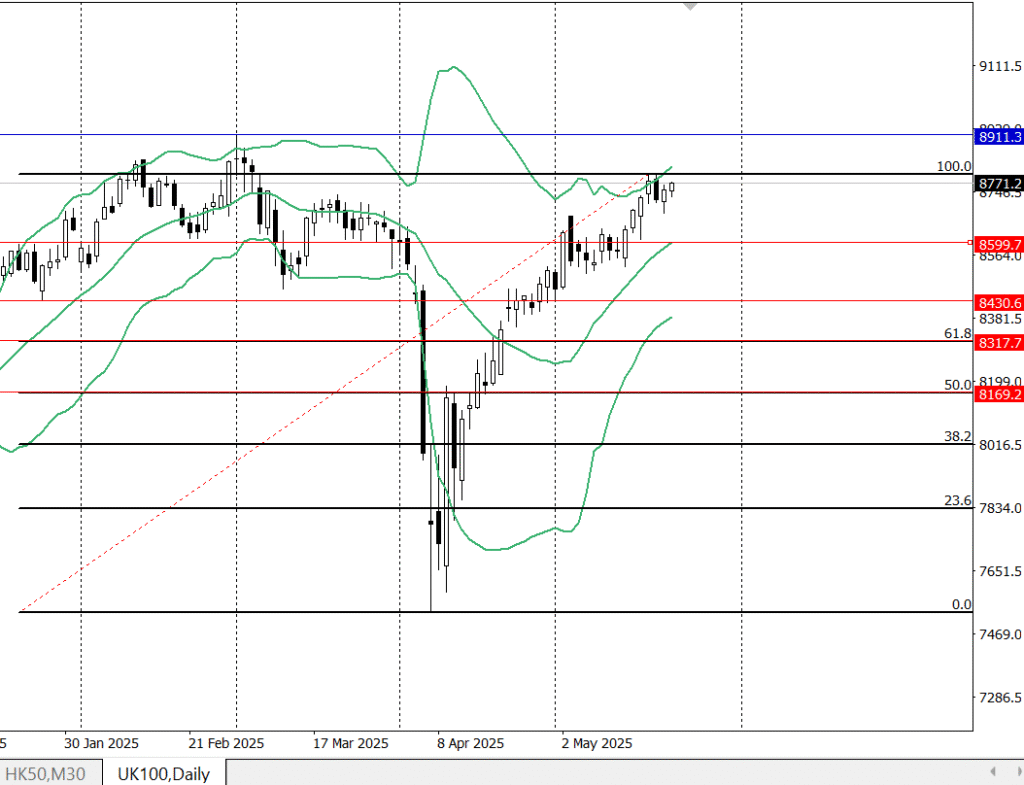

Technical Outlook for the FTSE 100:

From a technical perspective, the FTSE 100 is now trading under the pressure of the strong resistance point at 8798.0. which is a little bit higher than its opening point today. So if the price successfully exceeds this resistance level, it will open the door to reach higher levels towards 8911.3.

On the flip side, if the FTSE 100 doesn’t find any catalyst to break out the resistance level, this may lead the price to go down and will face many strong support levels, such as 8599.0. Any breakthrough may bearish the price towards lower levels, such as 8430.0 and then 8317.0.

The Underlying Market Drivers:

On Monday, the Southeast Asian leaders will meet at a summit, and they will express their concerns about Trump’s tariffs. They also believe that this will cause a big issue against the economic growth and stability in Southeast Asia.

US tariffs caused significant trouble in global markets and international trade, so the association of southeast asian nations’ leaders are seeking to find strategies to limit the negative impacts on their economy, which is mainly reliant on trade.

The situation for ASEAN is difficult because they are between the trade conflicts of its two largest partners, the US and China. So, after the upcoming summit on Monday, the ASEAN leaders will hold a one-day summit with China and Middle Eastern oil producers.