Gold price is trading steadily above the crucial level of $1,800 ahead of the US CPI data on Wednesday. A decline in the US dollar and Treasury yields has boosted the precious metal. Lower-than-expected consumer prices will likely offer additional support to the metal.

Gold price prediction

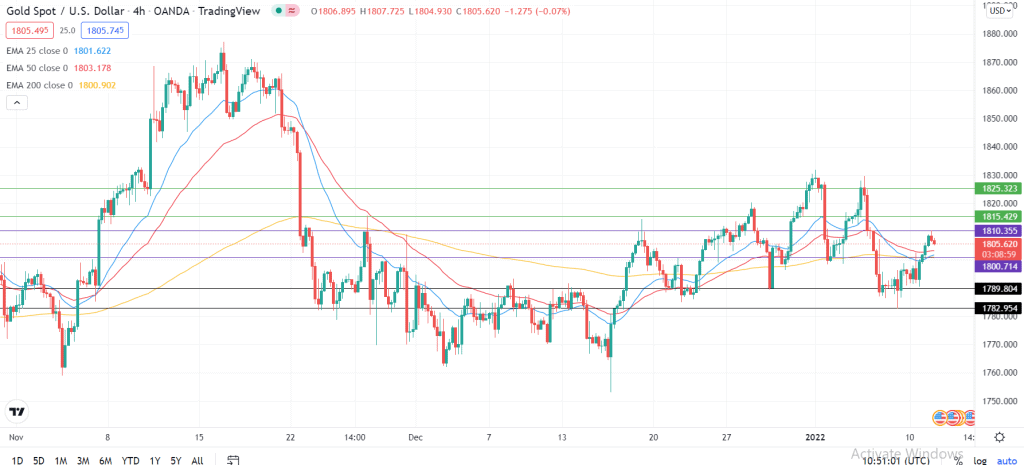

Gold price is finding resistance at 1,810.35 after Monday’s surge that saw it bounce back above the psychologically crucial level of 1,800. On Friday, the precious metal dropped to a three-week low of 1,782.95 before rebounding.

At the time of writing, it was up by 0.23% at 1,805.74. On a four-hour chart, the safe-haven is trading above the 25 and 50-day exponential moving averages. It is also above the long-term 200-day EMA. The formation of a mini golden cross, with the 25-day EMA having crossed above the 200-day EMA to the upside, signals further gains in the short term.

1,810.35 will likely remain a key resistance level for gold price as the bulls gather enough momentum to push the price to the next target at 1,815.42. As such, it may trade within a rather tight range with the 200-day EMA at 1,800.71 being a support level to look out for.

As a reaction to the Fed’s Chair testimony on Tuesday, which may have a hawkish tone, it may drop past 1,800 to around 1,797.41. Additionally, higher-than-expected US CPI numbers on Wednesday may push it further down to 1,789.80 or last week’s low of 1,782.95.

On the flip side, a move above the current resistance level will have the bulls eyeing 1,815.42 or the upper target of 1,825.32.