The GBP/JPY is trading flat after today’s GDP data, and the picture is that of a Pound that is inherently weak and was unable to take advantage of the Yen weakness brought on by the strong performance in the Nikkei 225 index.

Data released today by the Office of National Statistics indicates that the Preliminary GDP data for the latest quarter stands at -0.1%. This was much lower than the previous quarter’s 0.8% growth. However, the result was not as bad as economists had expected, as the consensus was for a 0.2% contraction. The monthly GDP data showed a contraction of 0.6%, which was not as bad as the market consensus of a 1.2% contraction. This also showed that the UK economy’s growth had fallen way below the last monthly growth of 0.4%.

The Pound should ordinarily have had some joy, no matter how temporary. But this has not been the on the contrary. The gloomy outlook painted by the Bank of England in its 4 August press conference and Wednesday’s gloomy outlook painted by Rabobank for the Pound indicate worse times ahead. Consequently, the GBP/JPY has lost some of its earlier modest gains of the session and is now down 0.15%.

GBP/JPY Outlook

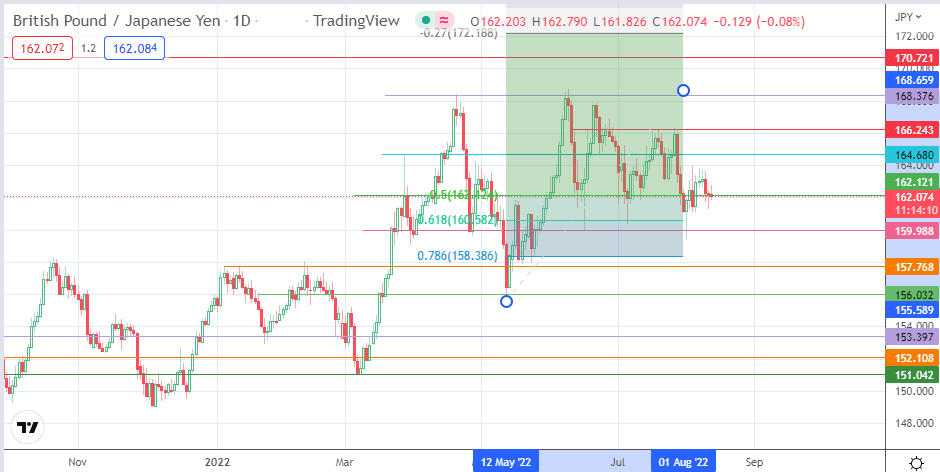

The pair barely hangs on to the immediate support at 162.121, which is the 50% Fibonacci retracement level from the swing low of 12 May to the swing high of 9 June. A decline below this support clears the path toward the 61.8% Fibonacci retracement level and 6 July low at 160.582 initially, before the 159.988 support (25 March and 26 April lows) comes into the picture as an additional downside target. The 5 January and 11 February highs at 157.768 come in next, followed by the 156.032 pivot formed by the previous lows of 11 February and 18 March.

On the other hand, the bulls will only have some joy if there is a bounce on the 162.121 support. This would enable a push toward the 164.680 price barrier (13 April and 26 July highs) and the 166.243 resistance (13 June and 27 July highs). Only a break above the 168.376 resistance (20 April and 9 June highs) restores the uptrend on the GBP/JPY.

GBP/JPY: Daily Chart