The GBP/CHF price is hovering near its lowest level since March 2020 as investors focus on the political drama in the UK. It is trading at 1.1580, which is sharply below 2021’s high of 1.3085. It has fallen by over 7% this year as the Swiss franc regains its dominance.

UK political drama continues

The GBP to CHF exchange rate declined sharply in the overnight session as the crisis in the UK continued. Boris Johnson was requested by his closest allies to resign amid several controversies during his three-year term. Over 40 government officials have resigned and there are concerns that Johnson will soon be forced out.

These events happen at a time when the UK economy is going through one of its worst performances in the recent past. Retail sales have plunged, and inflation has surged to a 40-year high while home prices remain unaffordable to most people. Therefore, there are concerns about the outcome of Bank of England’s rate hikes in a time when the country is facing stagflation.

The GBP/CHF has also declined as investors focus on the recent interest rate hike by the Swiss National Bank (SNB). In a surprise move, the central bank decided to hike interest rates by a whopping 0.50% in its bid to fight inflation. It also warned that more rate hikes were in the cards if inflation remains high.

The strength of the Swiss franc will likely help to lower the current inflation. The GBPCHF will react to the Halifax house price data in the UK and the upcoming Swiss unemployment rate.

GBP/CHF forecast

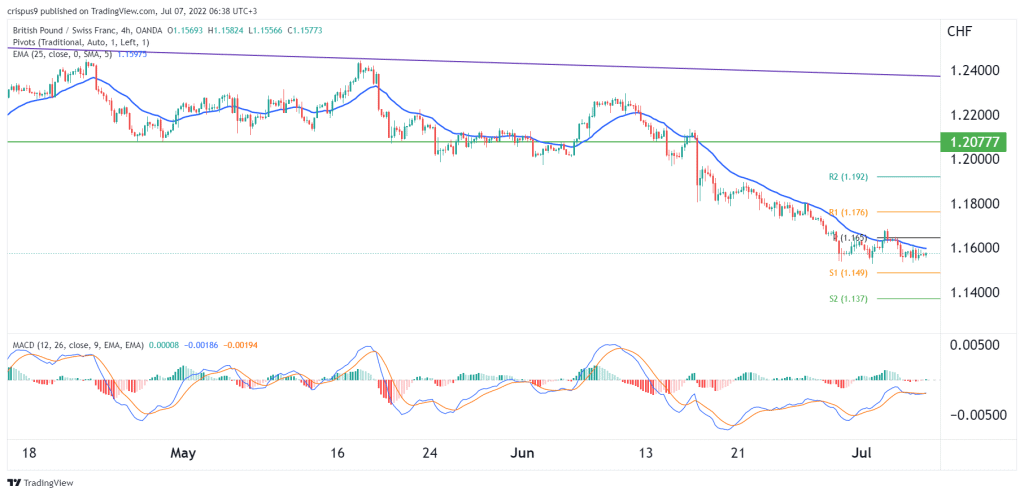

The four-hour chart shows that the GBP/CHF pair has been in a tight range in the past few days. It is trading at 1.1580, where it has been recently. This price is between the standard pivot point and the first support. It has also moved slightly below the 25-day moving average while the MACD remains below the neutral level.

Therefore, the outlook of the GBP to CHF price is bearish as the UK economic and political crisis accelerates. As such, the next key support level to watch is at 1.1400, which is the S2 of the standard pivot point. A move above the resistance at1.1653 will invalidate the bearish view.