- AUD/JPY has been on an uptrend since mid-October 2025, propelled by rising commodity prices

- China's Caixin index dropped recently, signaling potential cooling of demand for commodities

- The 106.80 mark is a key action area, beyond which a stronger rally could ensue

If you’ve been watching the AUD/JPY pair recently, it’s been quite a ride. But as we move through January, the price isn’t moving as much. For the last few trading days, the pair has been stuck, unable to push past the 106.80 mark. We discussed the pair’s surge and how things may play out for it in 2026.

Why AUD/JPY Surged

The rally that began in October was largely driven by two factors: a resilient Australian economy and a surprisingly dovish Bank of Japan (BoJ). According to reports from Bloomberg Terminal data, the AUD/JPY carry trade returned in full force during the final quarter of 2025. This created a powerful tailwind that pushed the pair toward multi-month highs.

Is this a Short Breather or an Imminent Change in Direction?

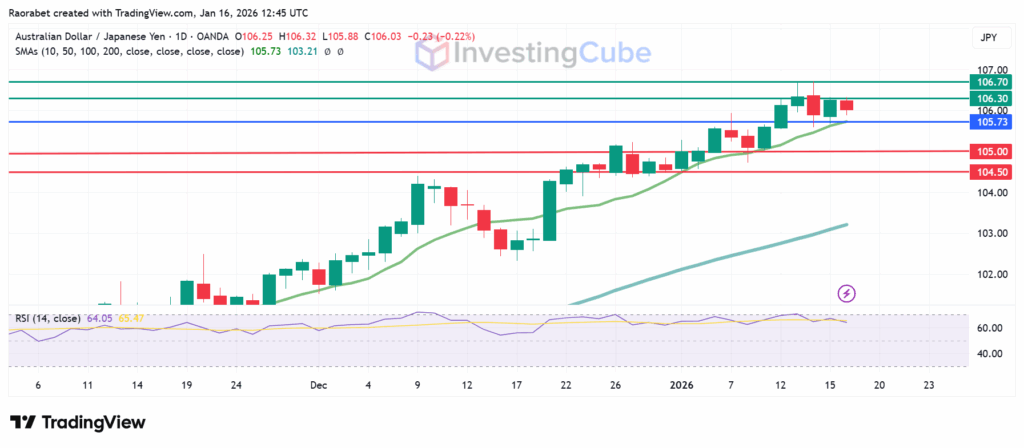

Over the last three days, the AUD/JPY rally has seemingly stalled, with prices staying between 105.88 and 106.32, struggling to go higher. The pair started at 106.24, went up to 106.32, but closed near 106.19. Whether this is just a pause or a sign of a bigger change depends on what happens next.

Many analysts at firms like Westpac and HSBC have pointed out that 106.80 has historically been a tough level to breach. Traders are probably taking their profits here, unsure if the next leg of growth is justified.

A look of the current market setup favours continued strength due to favorable differentials and technical setups. A temporary consolidation seems more likely, allowing for fourth-wave retracements before further upside.

Furthermore, we are seeing a shift in the narrative. Recent inflation numbers from Japan suggest that price increases are proving harder to control than the BoJ thought. If the market starts to expect an unexpected rate increase from Tokyo, the Yen could quickly get stronger, changing the direction of the market.

On the other side of the pair, the Australian dollar is sensitive to Chinese economic performance. With recent manufacturing data from Caixin showing a slight cooling, the appeal of the Aussie is being tested.

AUD/JPY Analysis Today

AUD/JPY is trading at 106.03, showing some short-term negative signals even though the trend is still mostly up. The Relative Strength Index (RSI) has dropped from 72 to 64, suggesting that the market is less overheated, and momentum is slowing. The pivot is at 105.73, which is the 10-day Simple Moving Average (SMA). With the buyers in control, the 106.30 level is the next major resistance point.

If the buyers clear that hurdle, they could build the momentum to test 106.70. A successful flipping of that mark into a support could bring 106.80 within reach. On the downside, the first support level is at 105.00. A drop below the 104.50 support would likely mean a trend reversal.

AUD/JPY forex pair daily chart with key support and resistance levels on January 16,2026. Created on TradingView

The trend was fueled by a strong Australian labor market and a significant interest rate differential. While the RBA remained hawkish, the Bank of Japan’s hesitant approach encouraged carry trades, driving the Aussie dollar higher against the Yen.

It’s a key historical resistance and a point where traders often react. The pair hasn’t been able to pass it in three tries, meaning sellers are active and buyers need a reason to push higher.

Most likely, it’s a temporary dip. The upward trend holds as long as it stays above support levels. Dropping below those levels could mean the Yen is gaining strength and the trend is reversing.