- The divergence between the RBA and BoJ brings pressure to the yen

- AUD has benefitted from China's strong economy, with heightened demand for Australia's top export, iron ore

- Potential disruption to the AUD/JPY uptrend could come from a shift on monetary policies and/or a slowdown in the demand for commodities

Since mid-December 2025, the AUD/JPY pair has been on the rise, steadily climbing within a channel since early November. It’s up over 1.5% this year, hitting levels around 106.20, which we haven’t seen since mid-2024. You may find yourself asking what factors are fueling this rise and whether it can persist.

Policy Divergence Favours AUD

The main reason for this rise is the difference in approaches between the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ). While many central banks started lowering rates in late 2025, the RBA has been surprisingly firm. Analysts at Westpac Economics forecast the RBA will keep its rate steady through much of 2026 due to ongoing inflation.

An EBC analysis suggests AUD/JPY is very sensitive to this rate difference, global risk appetite, and inflation in both countries. Rising commodity prices, especially for iron ore and coal, have also propped up the Australian dollar.

Australia’s top export, iron ore, has surprised many. Reports from Reuters and Mining.com say that China’s recent stimulus plans to boost local spending have kept iron ore prices high, near $110 a ton. Also, gold prices have hit record levels, and as Australia increases its gold exports, the AUD is benefiting.

In Japan, there’s uncertainty. Prime Minister Takaichi’s potential snap elections and fiscal stimulus plans have made the yen less appealing as a safe haven. Additionally, the Bank of Japan’s slow move toward normal policy, with Governor Ueda hinting at possible rate hikes but taking no concrete action, has kept the yen weak.

Will AUD Dominate JPY In 2026?

No trend is without vulnerabilities. Looking ahead, the outlook suggests the uptrend could endure, though with caution. The ING Think team suggests the BoJ might wait until the second half of 2026 for its next hike, which gives the AUD a clear runway for now.

However, the air gets thin at these heights. The uptrend could continue, but there are risks. The ING Think team believes the BoJ might wait until the second half of 2026 for its next hike, giving the AUD some room to grow for now.

But gains may be limited. If global risk appetite decreases, perhaps due to rising trade tensions or a slowdown in China’s manufacturing, the Yen’s status as a safe haven could cause it to bounce back strongly. Also, if Australian inflation cools faster than expected, leading to RBA cuts, the AUD could weaken.

AUD/JPY Forecast

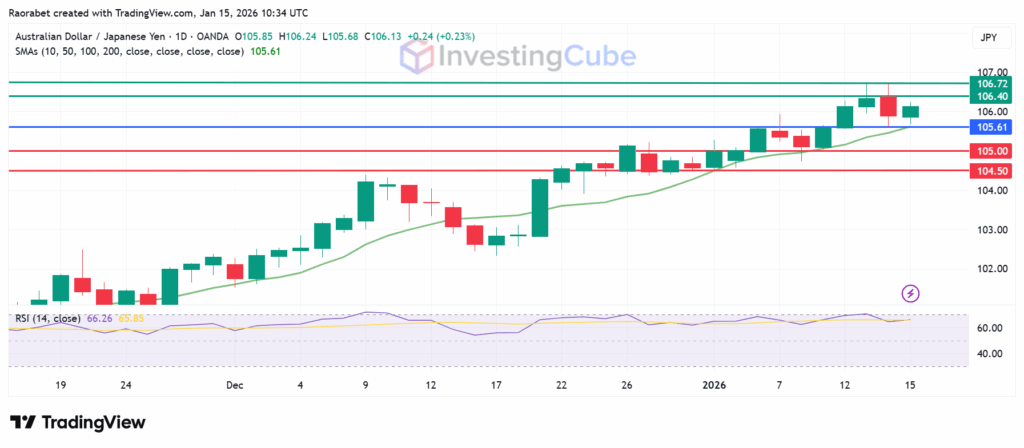

The AUD/JPY pair is currently in a strong upward trend. The Relative Strength Index (RSI) is around 66, showing that the upward momentum is still there but not yet overbought. The pivot is at the 10-day SMA at 105.61, and the upside will likely prevail in the near-term. There’s immediate resistance at 106.40, with the next one likely to be at the 52-week highs at 106.72. Primary support is likely to be at the psychological 105.00, but an extended control by the sellers could pull the action farther down to test 104.50.

AUD/JPY daily chart on January 15, 2026 with key support and resistance levels. Created on TradingView

The rise is due to the RBA’s firm policy, which is increasing yield spreads, yen weakness because of the BoJ’s caution, and commodity price increases supporting the AUD. Political uncertainty in Japan is also putting pressure on the yen.

Even at 0.75%, Japan’s rates are low compared to Australia’s. Investors are borrowing the cheap yen to buy higher-yielding Australian assets, which is constantly pushing the yen down.

If the yen weakens too quickly, the Japanese Ministry of Finance might step in to buy yen. Any global event that causes investors to reduce risk would also cause traders to move to the safety of the yen.