- USDPLN remains range bound as a softer US dollar offsets reduced monetary support for the Polish zloty.

- Poland's easing cycle is slowing, limiting both sharp PLN weakness and sustained appreciation,

- The US dollar stays under pressure from Fed rate-cuts expectations but retains structural support.

Overview

USDPLN is consolidating, moving in a tight range as both U.S. monetary policy expectations and the local Polish outlook are being re-rated by markets. Trading has been in a range between around 3.60 – 3.63 in recent weeks, not far above last year’s peaks but still well clear of multi-month lows. This sideways movement is essentially a result of an equilibrium between a structurally weaker U.S. dollar and a reducing policy cushion for the Polish zloty.

Poland: Monetary Policy and PLN Dynamics

The sentiment of the NBP is one of the main factors behind USDPLN. Poland has already experienced a material easing cycle, with market rates now just over 4.00%. Crucially, policymakers have hinted that the pace of easing may be slowing.

NBP Governor Adam Glapiński said December that the central bank may adopt a more cautious “wait-and-see” mode, adding that decisions ahead would be based largely on incoming inflation and growth data and far less on an already-charted rate-cut path. The comment, reported by Reuters, was a departure from expectations of aggressive easing.

In currencies, this positioning is mixed for PLN. Postponed aggressive cuts, on the one hand, diminish the risk of sharp depreciation. In contrast, amid slowly declining real interest rates and less vigorous growth momentum, there is also no longer particularly robust yield support for the zloty. As a result, PLN strength versus the dollar is getting harder to maintain.

United States: Dollar Weakness with Structural Support

The support that has been established for the US dollar enables its weakness to be maintained in this way. But on the US side, there is still pressure on the dollar from expectations that are affected may eventually cut rate as both inflation and growth slow. Citing recent market commentary summed up by Reuters, point out that investors now believe US monetary policy may be sufficiently restrictive, and that the next major move is down rather than up.

Nonetheless, what is most striking about the weakness of the dollar has been its orderliness, rather than a wild plunge. A fundamentally stronger American economy, combined with episodes of risk-off continues to provide occasional respite for the US dollar. This helps explain why USDPLN has not broken decisively lower in spite of widespread dollar softness.

Macro Balance: Why USDPLN is Range-Bound

The present structure of USDPLN reflects two macro forces pulling in the opposite direction with a less favorable outlook for the US dollar pointing to renewed pressure on the pair and an equally and supportive Polish monetary climate tending to cap PLN appreciation. As a result, neither party is sufficiently strong to force a sustained trend. In fact, price action instead suggests that there is simply more consolidation than anything else. This balance of power has led to significantly decreased volatility and repeated failures around critical junctures in the technical charts.

Technical Structure and Key Levels

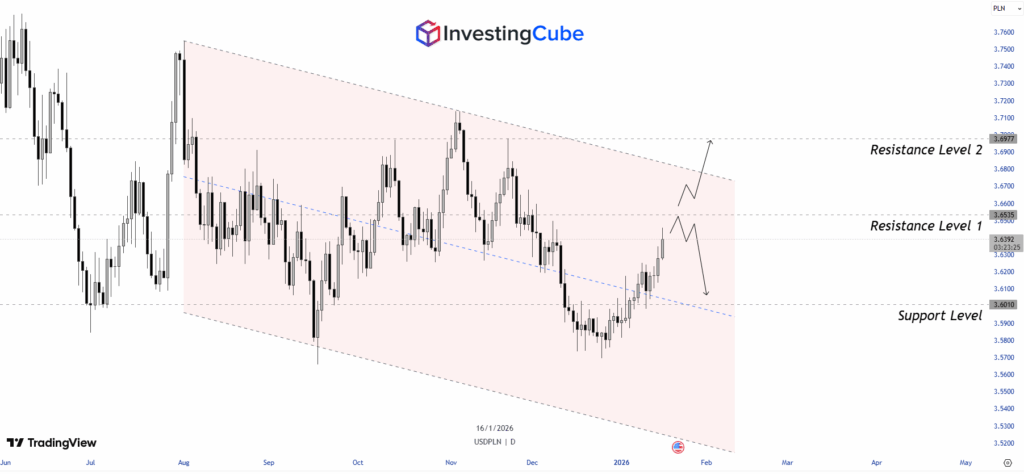

USDPLN’s technical picture is that it has been in a broad consolidation range for some time now.

Key support: At close to 3.60. It has regularly sparked support buying if the range won’t hold or starts to give way, thereby implying renewed PLN strength a window is opened to the mid 3.50s.

Key resistance: Near 3.65, where would be advances fall consistently short. A penetration of this area with signal shift of the range to higher level.

Medium-Term Range: Still 3.54 – 3.70, not too different from our recent forecasts and historical pattern.

Momentum indicators don’t suggest that either side is clearly in the lead, reinforcing the view that markets are still range-trading.

USDPLN Price Prediction

Short-Term (1-4 Weeks)

In the short term, we anticipate that it was the USDPLN will remain in its current range of 3.60 to 3.65 following surprise US data or further deterioration of global risk appetite. There could be minor recovery from this low levels. For the time being, however, the scope for any substantial upside is limited because there has still not been any significant change in terms of what the Fed is communicating.

Medium-Term ( 1-6 Months)

Looking further ahead, the most probable outcome is still range-trading underway. If the Fed ends up more accommodative than markets are expecting, USDPLN could work its way towards the bottom end of the range. Slowly, but surely, weakening Polish growth or another outbreak of global aversion would allow the pair to get back toward its previous high mark near 3.70.

Conclusion

USDPLN currently reflects a market in equilibrium rather than transition. A weak-but supported dollar and a zloty lacking strong policy backing have produced a sideways structure. Until a clear macro catalyst emerges, range-based strategies are likely to outperform trend-following approaches.

Frequently Asked Questions

Because PLN also lacks strong support. As NBP easing reduces yield advantages, the zloty struggles to capitalize fully on dollar softness.

A decisive shift in Fed policy expectations or a sharp deterioration in Poland’s economic outlook could break the balance and force a directional move.

In the short term, US data and Fed expectations dominate. Over the medium term, Poland’s growth and inflation trajectory will play a larger role.