- India and the United States are engaged in trade talks and a successful resolution could see USD/INR back off 90.30

- Amidst the strong 7.4% Indian GDP growth forecast in 2026, Foreign investor outflows limit the rupee's upside

- Global crude oil prices present an existential pressure point for rupee and recent gains could keep USD/INR rising

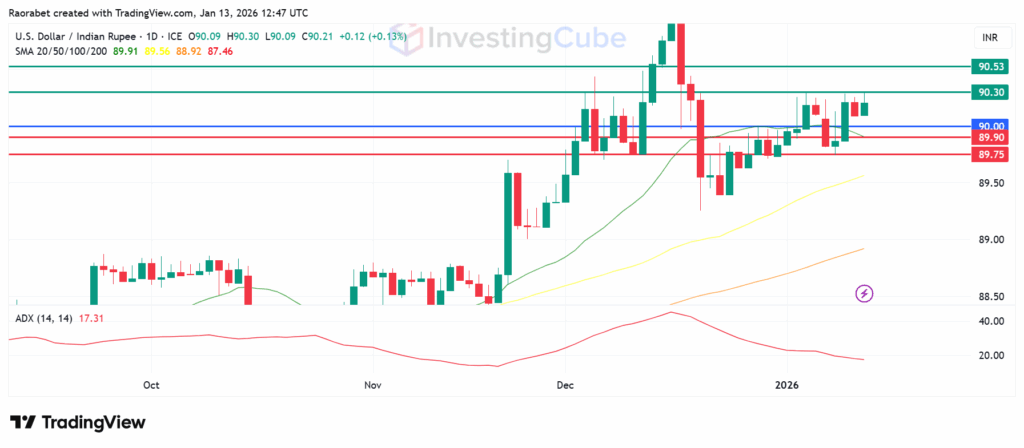

The USD/INR pair has indeed posted gains since late December 2025, with a 0.3% rise over the last five days, yet it continues to falter near the 90.30 mark. The currency pair has not gone past that mark since mid-December, underlining its significance in defining the upside momentum. We explore the likelihood of surpassing this level and the underlying forces at play.

USD/INR Struggles Near 90.30

The 90.30 level has turned into a key defense point for the Reserve Bank of India (RBI). In early January, the RBI appeared to sell dollars heavily through state banks to prop up the rupee. When the pair reached 90.30 last week, importers quickly bought dollars, while the central bank tried to manage the situation and prevent a one-way surge.

It looks like even with growing momentum, whether it rises depends on outside events more than the RBI’s actions. The RBI has been active around the 90.20-90.30 range but might eventually permit a range increase given ongoing demand.

The odds of breaking through 90.30 largely depend on the outcome of the ongoing US-India trade talks. Markets are tense after US Ambassador Sergio Gor said that the two countries are meeting to fix serious tariff problems. In 2025, the US put high 50% tariffs on some Indian exports because of trade differences and policies on oil. If these talks don’t go well, the tariff risk could push USD/INR past 90.30 toward 91.00.

Potential Disruptors to the Trajectory

Several factors could alter this path. First, the dollar’s strength against the rupee is mostly because of high oil prices and importer demand. While the Indian government projects a GDP growth of 7.4% in 2026, Foreign Institutional Investors (FIIs) have sold off over ₹15,000 crore in January, which naturally weakens the Rupee. Also, with Brent crude around $61, India’s huge import bill keeps weakening the Rupee.

Also, a sudden RBI retreat from intervention might accelerate gains beyond 90.30 if dollar inflows intensify. Conversely, softer US data or dovish Fed signals could prompt a rupee rebound. In essence, while fundamentals favor gradual appreciation, unexpected policy shifts remain key risks.

USD/INR Forecast

Even though the short-term trend for USD/INR is up, the Average Directional Index (ADX) at 17 suggest there is no definitive trend, whether to the upside or to the downside. The pivot is at the psychological 90.00, while immediate resistance is at 90.30. A break past that level could potentially trigger a stronger momentum and send the pair to test 90.53. On the downside, immediate support is at 89.90, near the 20-day SMA. If it drops below this, it could go on to test the 89.75 mark.

USD/INR on the daily chart with the ADX and key support and resistance levels on January 13, 2026. Created on TradingView

India’s economic growth is strong, but capital flight is the issue. Foreign investors (FIIs) have been net sellers in early 2026, rotating money out of Indian equities. This exodus reduces the supply of dollars, weakening the local currency.

If a favorable deal is reached to lower 2025’s heavy tariffs, it could draw big foreign investments, which would make the rupee stronger. If talks fail, it keeps a risk mark on the pair, pushing USD/INR higher.

India imports most of its crude oil. When oil stays high or goes up, India needs to sell more rupees to buy dollars for these imports, naturally lowering the rupee’s value.