- The Iranian rial is on a free-fall to record lows, with international sanctions and domestic challenges biting hard

- The Iranian government is attempting to salvage the rial by deleting some zeros from notes but it will almost certainly fail

- Families are struggling to purchase essential goods, with food prices rising sharply by the day

The Iranian rial has fallen sharply against the dollar, losing much of its value in the everyday black market. In January 2026, it hit new lows, going past 1.4 million rials per US dollar. So, how did the rial find itself here and what could become of it?

Historical Performance of the Rial

After the 1979 revolution, the rial was fairly stable. Federal Reserve data shows rates around 9,000 to 10,000 rials per dollar from 2006 to 2010. Records show it stayed steady until late 2011, then dropped fast, losing two-thirds of its value in two years as international pressure grew.

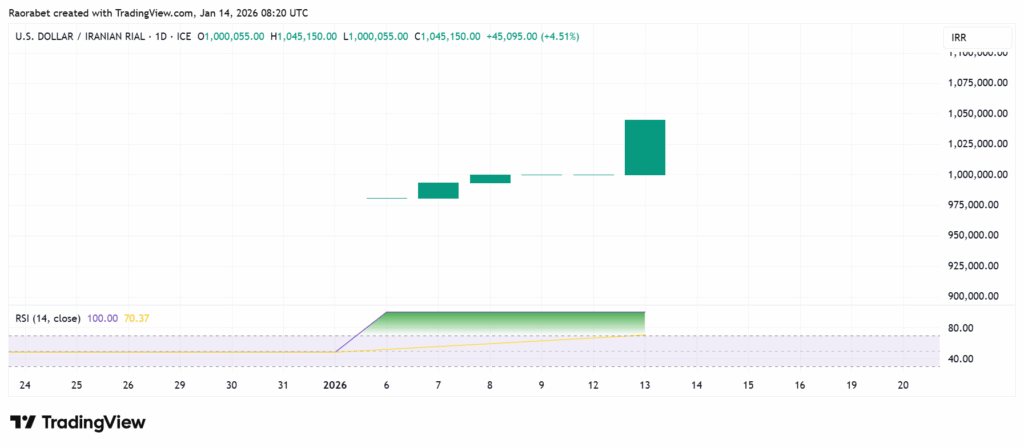

By 2012, the unofficial rate was 17,000 rials per dollar after a 50% drop in days, according to reports. The decline has sped up recently. CEIC Data shows monthly averages rose from about 100,000 in 2020 to over 594,000 in November 2025. The rate jumped to 1,092,500 by January 13, 2026, a 9.22% daily increase and a 2,281% yearly drop. This shows a steady decline in the rial’s buying power.

How did the Rial Get Here?

The rial’s drop is due to external pressure and internal choices. International sanctions have played a big part, limiting Iran’s access to currency and markets. Iran International blames policies like hostility toward the West, poor management, and isolation. EBC mentions five things: sanctions cutting reserves, high inflation, weak growth, and rising food prices hurting families.

When sanctions came back in 2018, Iran’s oil sales, its main source of currency, were hurt. Without that money, the government printed money to cover deficits. More rials and fewer goods mean high inflation. By December 2025, inflation was about 42.5%, making the rial undesirable. People buy dollars or gold to protect themselves, which lowers the rial’s value.

Recent events have added fuel to the fire. The June 2025 military escalations involving Israel and the US damaged infrastructure and sent the “risk premium” for Iran through the roof. When people fear war, they buy dollars and the ongoing mass protests in January 2026 have turned that panic into a full-scale rout.

Can the Rial Recover?

The Iranian rial’s prospects appear dim in the near term. First, the Iranian economy is in deep recession. World Bank projections of GDP contraction by 1.7% in 2025 and 2.8% in 2026, due to trade constraints and weak investment. For the Rial to recover, the country would likely need a combination of major sanctions relief and painful internal reforms.

The New York Times says the regime is struggling with economic and external problems, while Forbes reports that market confidence is gone for now, hurting recovery hopes. Currently, the government is trying to remove zeros from the currency to make transactions easier, but that doesn’t change its value. Sanctions relief could help, but it’s not likely soon.

USD/IRR Forecast

Immediate resistance on the USD/IRR currency pair sits at the 1,500,000 mark. If breached, the next psychological “ceiling” is effectively non-existent. Momentum indicators like the Relative Strength Index (RSI) are pinned in overbought territory at 100, signaling an exhausted but desperate market. Support is found at the 1,300,000 level, though this has proven “soft” during recent panics.

USD/IRR on the daily chart on January 14, 2026. Source:TradingView

In the unofficial open market, which reflects real prices, the rial is trading at about 1.4 to 1.5 million per US dollar as of January 2026. Official government rates are much lower but are not easily accessible to the general public.

It is devastating. With the rial falling, buying power is gone. Food inflation is high, making staples unaffordable. Savings in rials are wiped out, leading to strikes and protests.

A significant recovery is unlikely for the rial without less tension and a return to oil markets. The IMF and World Bank expect continued economic decline through 2026, meaning the rial will stay under pressure.