- Explore the latest technical outlook for USD/INR. Stay informed on fundamentals , forecasts affecting the currency pair. Check it now!

The USD/INR finds ground and rebounds to near 88.00 as the US Dollar trades higher. The market is optimistic about the upcoming India-US trade talks. Moreover, the greenback appreciates ahead of key discussions between US Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng, which are expected to address trade imbalances and monetary coordination between the world’s two largest economies.

In this article, we will examine the fundamental factors influencing the USD/INR and the technical outlook for the pair.

Key Fundamental Factors Influencing the USD/INR:

- US and Chinese officials will have another round of trade talks in Malaysia this weekend. Both countries try to ease tensions before the upcoming meeting between US President Donald Trump and Chinese Leader XI Jinping.

- The negotiations between US Treasury Scott Bessent, Trade Representative Jamiseon Greer, and China’s Vice Premier He Lifeng will be just a preparation for the scheduled meeting between Trump-Xi next Thursday in South Korea.

- Treasury Secretary Scott Bessent told Fox Business before leaving Malaysia, he was still “Optimistic” regarding the upcoming discussion, but did not rule out tougher actions if no progress is made on easing China’s rare earth policies.

Investors and traders will closely watch these high-stakes trade talks between the US and China. Such a meeting will affect the global market sentiment. The traders will be cautious in recent weeks due to ongoing tensions with no clear direction yet. Rising tensions between us and China or a stronger dollar could push the USD/INR higher.

On the other hand, when the global sentiment is good with progress in India-US trade relations, that will support the Rupee, leading the USD/INR to edge lower.

On the domestic front, US Inflation Softens, Weighing on the Dollar:

- A key driver in today’s USD movements was the US inflation report. According to the US Bureau of Labor Statistics, the annual change in the consumer price index rose to 3% in September from 2.9% in August. This reading came in below market expectations of 3.1%.

- The monthly change, CPI rose 0.3% following the 0.4% increase recorded in August, while the core CPI increased 0.2% compared to market expectations of 0.3%.

The immediate reaction saw the US Dollar Index ease 0.12% at 98.80. This softer-than-expected inflation may support expectations of a potential Fed rate cut in the next policy meeting.

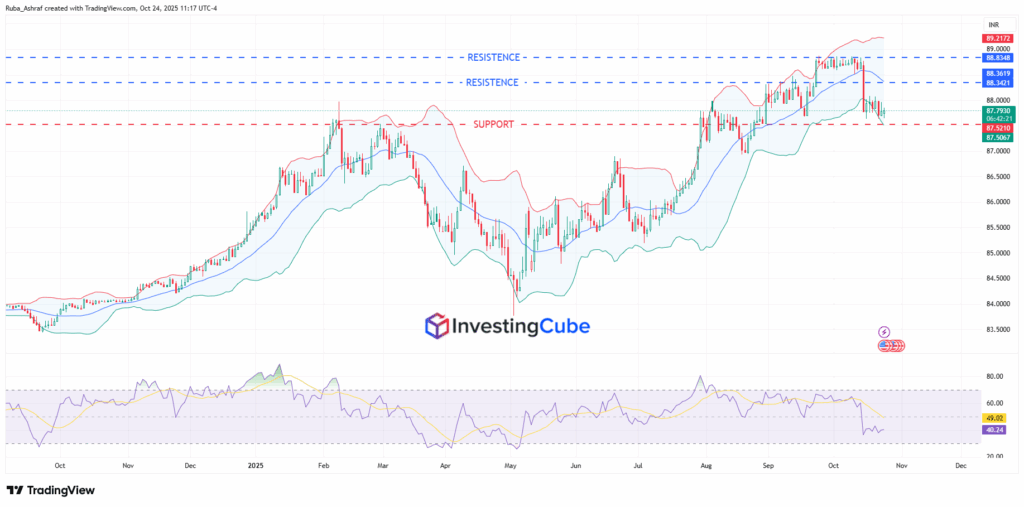

The Technical Outlook for USD/INR:

The USD/INR gained earlier in the day to near 88.00. At the time of writing, the currency pair is trading in a tight range. USD/INR is trading under pressure of the resistance level at 88.34 and above a strong support level at 87.52.

The RSI is at the 40 mark, indicating that the USD/INR is neither overbought nor oversold. It has mild bearish momentum but is not extreme.

- A clear daily close below the support level of 87.52 could pave the way toward 87.00, the low of August 27.

- On the upside, a clear daily close above 88.34 could pave the way toward the high of the day at 88.00.

The inflation, GDP growth, trade balance, and interest rate policies in both the US and India can influence the USD/INR. Global events, investor sentiment, and capital flows can also influence the exchange rate of the pair.

The US consumer price index can affect the expectations for Federal Reserve rate decisions. Higher than expected inflation strengthens the USD, which potentially pushes USD/INR higher. Conversely, softer than expected inflation may support the Rupee, encouraging capital inflows and easing upward pressure on the currency pair.