- The Rupee clings to 88.90 as U.S.- India trade frictions deepen. Sideways action hides a fragile undertone.

The Indian Rupee is struggling to find direction, holding around 88.90 against the Dollar — just a whisker away from its record low of 89.10. For almost two weeks, USD/INR has been stuck in a sideways band, a sign of hesitation rather than stability. The reason is clear: U.S.-India trade tensions have not gone away, and they continue to hang over the currency like a cloud.

Washington’s decision to impose tariff of up to 50% on Indian imports is one thing, but the real political sting lies in New Delhi’s continued oil purchases from Russia. From the U.S. perspective, those flows undermine sanctions and indirectly support Moscow’s war effort. For the Rupee, it simply means external pressure is unlikely to ease quickly.

Foreign Investors Pull Back

The numbers on foreign flows speak for themselves. FIIs dumped more than ₹1.29 trillion in equities between July and September, and the selling has continued into October. The message is not about panic — India’s equity market has actually absorbed the pressure well, with the Nifty50 rallying more than 2% in the last three sessions — but about caution.

Global investors are reluctant to add exposure when geopolitical risk is rising, even if the domestic growth story looks intact. The Rupee, unlike equities, doesn’t get the benefit of local optimism; it reflects how oversea investors see the balance of risk, and right now they are voting with their feet.

U.S. Politics and the Dollar’s Ceiling

Dollar dynamics are offering little relief. The DXY index is hovering near 98.20, helped by weakness in the euro and yen, but capped by Washington’s own dysfunction. The government shutdown shows no sign of ending, and political bargaining has reached stalemate.

President Trump has made it clear he won’t budge until Democrats agree to reopen the government. Markets have heard this story before, and the longer it drags on, the more it undermines the Dollar’s ability to extend gains. In other words, the Greenback is firm, but it is hardly flying.

The Fed’s Shadow

The Federal Reserve remains the more predictable driver. Markets are now firmly pricing two 25bps cuts before year-end. Weak labor data has only reinforced that view, and Chair Powell’s speech later this week could well confirm it.

For the Rupee, easier Fed policy could provide some relief — lower U.S. yields generally temper Dollar demand. But in the current environment, Fed policy is a secondary factor. The trade dispute and persistent FII outflows are what the market is really trading on.

Technical Picture: Range Holds for Now

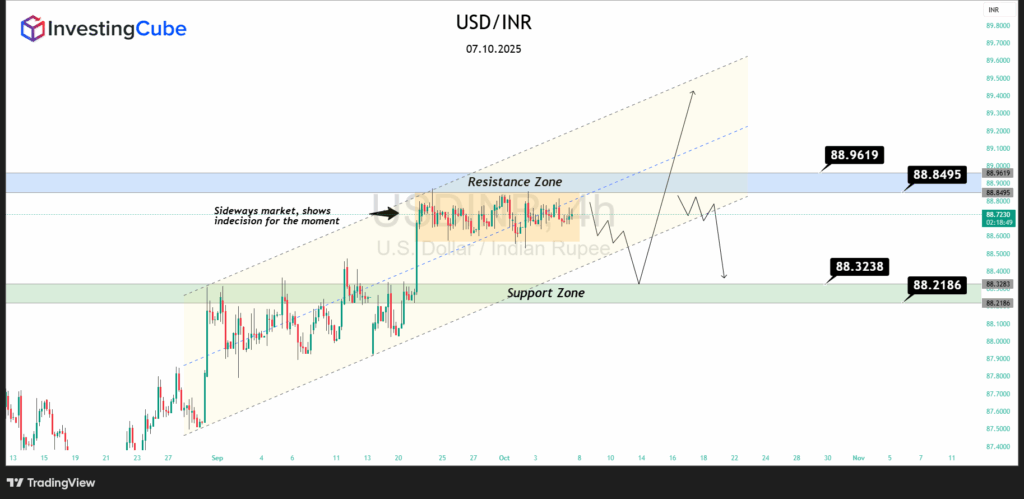

Charts underline the indecision:

- Resistance Zone: 88.85 – 88.96. If USD/INR clears this band, the 89.10 record high is back in play, and beyond that the psychological 90.00 level looms large.

- Support Zone: 88.21 – 88.32. This is where buyers are likely to step in. A decisive break lower would open the way toward 87.80.

- Market Tone: Price is boxed into a narrow corridor, mirroring the tug-of-war between political risk and policy hopes. Until that changes, breakouts are likely to fade quickly.

Outlook: Fragile Balance, Bearish Bias

The path of least resistance still tilts against the Rupee. Domestic equities may be buoyant, but the currency market is telling a different story. As long as tariffs remain in place, oil imports from Russia continue, and FIIs keep trimming exposure, the bias leans toward further INR weakness.

Yes, the Fed’s dovish stance and occasional RBI intervention can steady the ship, but the underlying balance is fragile. Traders should not be fooled by the current sideways range: it reflects hesitation, not strength.

Reader Q&A

Because equities reflect local demand, while the currency reflects global capital flows — and FIIs are still heading for the exit.

It shows the market is awaiting. A break above resistance signals fresh highs; a slip below support signals renewed selling.

They may help at the margin, but trade politics and foreign flows are the dominant story right now.