- USD/INR remains in a steady uptrend, holding firm inside its ascending channel despite resistance near 90.

- Market sentiment is shaped by upcoming US data and shifting Fed expectations toward earlier rate cuts.

- India’s strong GDP outlook and ongoing US-India trade developments provide mixed but influential signals for the pair.

The USD/INR advances today by 0.09% trades around 89.22. The Reserve Bank of India’s intervention helped the Indian rupee to rebound from near its all-time low. Yesterday, the rupee ended at 89.23 against the US Dollar. This is up by 0.3% from its close at 89.48 in the previous session.

The USD/INR pair’s appreciation stems from the capping of US Dollar gains. Despite rising expectations of a new Fed rate cut in December, the US Dollar gains ground. On the other hand, the Reserve Bank of India sends signals that it will not allow the pair to run freely beyond 88.80 with its intervention.

How RBI GDP Expectations Shape the USD/INR Outlook:

According to a Reuters poll of economists:

- India’s economy likely recorded 7.3% growth in the July-September quarter, driven by solid rural consumption and increased government spending.

- During the last quarter, household consumption accounted for 60% of GDP.

S&P Global Ratings reported on Monday the following:

- In the current fiscal year the India’s economy could grow 6.5% and 6.7% in FY27.

- This growth will be driven by tax relief and easing monetary policy, which could lift consumption.

- In the April-June quarter, the real GDP expanded by 7.8%.

- The official data for Q2 FY26 GDP will be released on November 28, according to FE Bureau.

With this GDP outlook, we can say that a higher GDP usually implies stronger economic momentum and improved investor sentiment toward indian assets. These factors can support the INR by increasing foreign and direct investment inflows.

On the other hand, strong GDP helps, but it doesn’t fully shield USD/INR from global USD strength or higher commodity prices. Higher GDP growth leads to higher consumption and investment, which means higher import demand. Especially for crude oil, which India relies on. This can increase India’s trade deficit and add downward pressure on the INR.

Growth helps the currency, but only if import-related pressures remain controlled

Impact of Upcoming US Data on USD/INR and the Fed Rate Path:

As of now, the US Dollar index is trading around 100.06, down 0.09%, and stabilizing ahead of key US economic data releases. The US economic calendar has several releases later today:

- ADP Employment Change 4-week average.

- US Producer Price Index.

- US Retail Sales.

According to the CME Fed watch tool, market participants are pricing an 81% probability that the Fed will cut the overnight borrowing rate by 25 basis points in December. Moreover, the Fed Governor Christopher Waller said on FOX Business on Monday that inflation is “not a big problem” considering the weakening in employment data.

Waller also suggested that September payroll numbers will likely be revised down and warned that concentrated hiring is not a good sign, reinforcing his support for a near-term rate cut.

John Williams, New York Fed President, also contributed his suggestions to shifting expectations toward earlier rate cuts. He noted that the interest rate could be lowered in the near term, ahead of the U.S. data releases this week.

The USD and India have been negotiating a trade agreement for months, but have not finalized a deal yet. They only signal that a bilateral trade pact is “coming soon.” Recently, President Trump said he intends to lower tariffs on indian imports “at some point.” This hint for a gradual softening of trade tensions supports the INR and leads to new foreign institutional inflows. But the US tariffs on indian goods are still around 50% including an extra 25% penalty for India’s oil purchases from Russia.

Impact on USD/INR:

- Delayed trade agreement puts pressure on the INR.

- Potential reduction in US tariffs could support the rupee, improving trade flows and boosting the sentiment of the FIIs.

- Until the deal is accomplished, USD/INR may stay sensitive to trade headlines as the USD gains whenever uncertainty rises.

The Technical Outlook for the USD/INR:

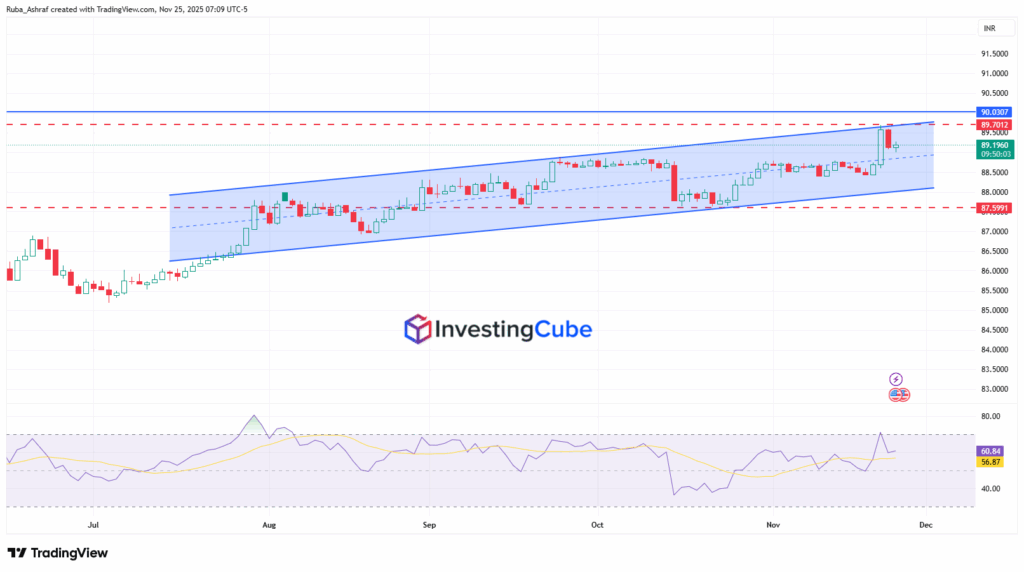

The USD/INR chart shows that the pair is moving within an ascending channel. It signals a clear bullish trend. The pair is holding above the channel’s midpoint, which indicates that buyers remain active.

A clear daily close above the upper boundary of the channel at 89.70 could pave the way toward the 90.03 level. The key support levels sit around 87.60-88.00 at the lower boundary of the channel.

The RSI indicator near 61 indicates healthy bullish momentum without overbought conditions. Overall, the trend remains upward, but a decisive break above 90.30 is needed for further gains.

US inflation, employment, and GDP data influence Fed policy expectations. Strong data supports a stronger USD, while weak data increases rate-cut expectations, often easing USD/INR upward pressure.

A strong GDP outlook boosts investor confidence in India, attracts foreign inflows, and helps support the rupee. Slower growth or rising deficits usually weaken INR against the USD.

The 90.00–90.30 zone acts as major resistance, while 87.60–88.00 remains key support inside the broader ascending trend channel.