- Discover the main fundamental factors affecting the USINR and how the Indian NIIP affects the rupee against other Asian currencies

The rupee is likely to lag in a softer dollar environment, and also due to its negative net international investment position (NIIP), which refers to an imbalance between what the country owes and owns abroad.

NIIP is the gap between what the country owns overseas and what it owes to the rest of the world. According to India’s NIIP, as of December 2024, it had a negative NIIP. owing about $350 billion more to the world than it owned in foreign assets. Compared to other asian countries, they hold a positive NIIP, which means that their ownership of foreign assets exceeds their external liabilities.

In a softer dollar environment, the value of those assets tends to drop. Therefore, investors hedge by selling dollars and buying their currencies, which tends to boost the local units.

India’s NIIP indicates that the rupee may lag the rest of Asia. On the other hand, minutes of the Federal Reserve’s meeting cited hedging demand, which is one of the factors contributing to the dollar’s decline.

All the eyes are on the United States-China Talks. The first day of talks conveyed a little bit of cautious hope. Some comments give a sense of that, such as: “The meeting went well,” said US Treasury Secretary Scott Bessent.

Commerce Secretary Howard Luntick described the discussions as “Fruitful”, while Donald Trump said that “China is not easy,” but expressed satisfaction with his negotiators epressing that by saying “Doing well” and “delivering good reports”

The most likely outcome of these talks is an improvement in the trade situation for the United States compared to the pre-Trump 2 period. till they reach a deal, it will affect all the markets, and investors will stay reluctant and cautious while trading.

On the Geopolitical side, nearly three weeks after the end of the India-Pakistan war, but yesterday the New Delhi warned that the root causes of the conflict remain unchanged and India is ready to strike anywhere in Pakistan if any terrorist attacks happen. It spreads some sense of uncertainty in the markets. All of these factors fundamentally impact the pricing of the USD/INR.

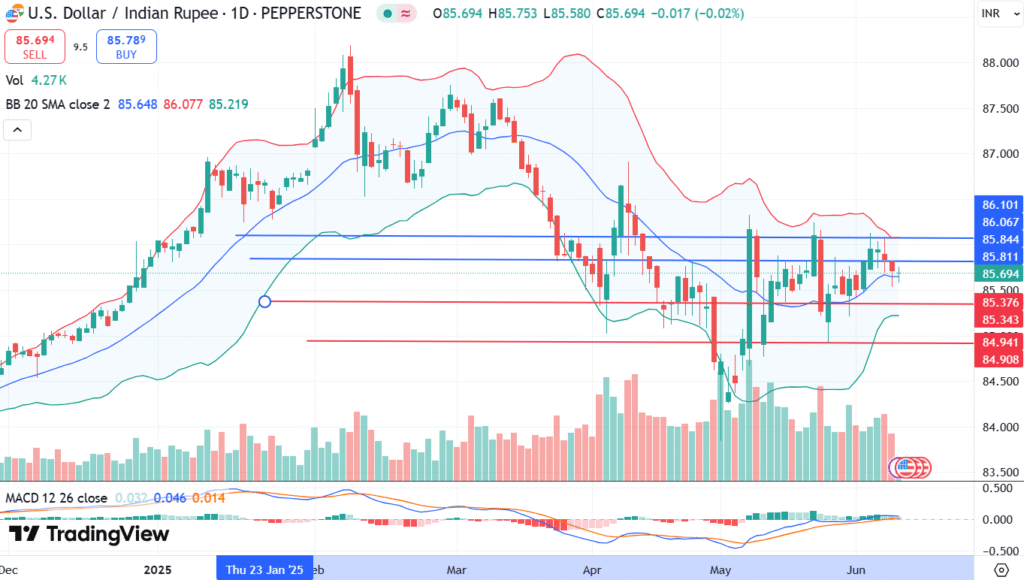

The Technical Outlook for the USD/INR:

The USD/INR ticks down, reaching 85.55 within the Asian session. The pair struggles, indicating no specific direction for the near-term trend. From the technical perspective, the USD/INR is trading now above the support level at 85.30, which is the June 3 low. A downside break below it could expose the pair to reach a lower level of 84.90.

For the bearish side, any breakout above the resistance level at 85.80 could support the pair to reach the May 22 high of 86.10.

USD/INR Price Forecast: Rupee Slides Ahead of RBI Decision