- USD/INR have surged to all time-highs as US-India trade uncertainty, tariffs and strong dollar demand pressure the rupee.

- Technical signals also show potential for a short-term correction, with resistance at 90.44 and support levels guiding near-term moves.

The USD/INR advances in the early trading session by 0.66%, trading around 90.39. The main driver behind this move is the growing US-India trade uncertainty. The sharp decline in the Indian rupee against the US Dollar is pushing the USD/INR currency pair to new all-time highs.

Additionally, the Federal Reserve reduced interest rates by 0.25 basis points to 3.50%-3.75%. This decision signals that there is another rate cut in 2026. This article explores the technical outlook of the USD/INR and factors driving its movements.

The Technical Outlook for the USD/INR:

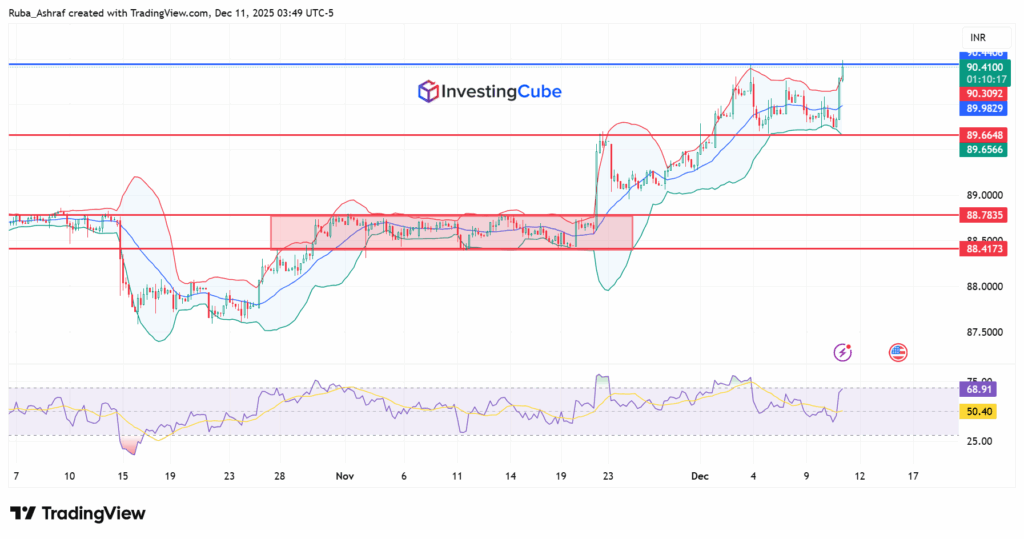

From a technical perspective, once the price broke out of the 88.41-88.78 rectangle-shaded area, bulls took control. The 88.78 level turned into strong support instead of resistance. Bulls then pushed prices higher with a decisive breakout above 89.66, which now acts as support according to the Bollinger bands.

Currently, USD/INR bulls are facing pressure from the 99.44 resistance. It marks an all-time high. This could trigger a short-term correction toward the Bollinger Bands’ middle line at 89.98. The RSI supports a pullback, sitting at 68.05. This indicates the pair is slightly overbought and may face a near-term correction.

On the bearish side, if the bull market drives the USD/INR below the support level of 89.66, a deeper correction could occur toward 89.00. As the Bollinger band tightens, it indicates a consolidation period.

Core Economic and Market Events Impacting USD/INR:

The indian rupee is the worst-performing currency in Asia this year, falling more than 5% against the dollar year to date. Several factors are putting pressure on the indian rupee, key ones are listed below:

- The 50% US tariffs imposed on indian goods have badly affected exports to its biggest market and diminished the attractiveness of domestic stocks to foreign investors.

- On Wednesday, the Federal Reserve lowered interest rates by 24 basis points to 3.50%-3.75% as widely expected. The softer US labor market conditions are the main driver of this decision.

- Fed members are betting that there will be another cut in 2026. Chairman Jerome Powell expressed that:

“The bar for further monetary easing is very high, and we are well positioned to wait to see how the economy evolves”.

US-India Trade Talks Updates:

- Regarding the US-India trade talks, the US trade representative, Jamieson Greer, said the US has received the “best” offers ever from India in ongoing talks.

- With the 6 rounds of talks between India and the United States with no clear deal, it seems that they will reach a win-win situation deal. However, the delay in finalizing the deal raises uncertainty among investors.

- The main goal of these talks is to increase the bilateral trade to $500 billion by 2030 from $191 billion at present.

- Although India is the largest trading partner for the US for the fourth consecutive year, India’s exports to the US dipped from 8.58% to $6.3 billion. This puts pressure on the indian rupee.

- Additionally, foreign institutional investors are losing confidence in Indian equities due to the weaker rupee and the lack of a clear deal between the two nations.

- The FIIs have sold nearly $18 billion of indian equities on a net basis over 2025 so far.

- Today, the Bank of India likely intervened to help the rupee from more losses, aiming to slow the rupee’s fall instead of holding it at a specific level, Reuters reported.

Triffs reduce export demand, lowering foreign earnings, and can weaken the rupee due to reduced US dollar inflows

Trade uncertainty increases risk, discouraging foreign capital and reducing the attractiveness of domestic equities.

Lower exports lead to a reduction in dollar inflows into India, putting pressure on the rupee and driving USD/INR higher