- The U.S. dollar stays firm after Powell curbs dovish bets. Traders now wait for Friday's PCE to decide the dollar's next move.

The U.S. dollar is holding firm as Powell reins in dovish bets. With traders eyeing Friday’s PCE inflation, the next move looks finely balanced. The dollar index (DXY) climbed to 97.75 on Wednesday, extending its rebound and approaching the 98 handle. The move was sparked by Jerome Powell’s remarks cautioning against cutting rates too soon.

His message was measured: inflation risks remain, even if the labor market is showing cracks. That blend of hawkish restraint reassured dollar bulls that the Fed is unlikely to rush into aggressive easing. In turn, it put a floor under the U.S. dollar, shaping a more constructive US Dollar Price Prediction heading into the end of the week.

Why the Dollar is Holding Up

Beyond Powell’s comments, global dynamics have lent the dollar a helping hand:

- Euro weakness after Germany’s Ifo index fell to 87.7, dragging EUR/USD lower.

- Sterling softness, with GBP/USD slipping 0.4%, though EUR/GBP stayed flat.

- U.S. yields nudged higher, with the 10-year at 4.13% and 2-year at 3.59%。

- Fresh U.S. data, with new home sales topping forecasts, gave the economy resilient backdrop.

Each of these adds up to a cautious but supportive setting for the dollar. For anyone making a US Dollar Price Prediction, the message is clear: fundamental and positioning are not yet aligned with a sharp reversal.

Market Narrative: Between Data and Expectations

Markets are still pricing in two rate cuts by year-end, but Powell’s tone made clear that the hurdle for faster action is high. That has left investors in limbo — waiting on data, rather than central banks rhetoric, to set direction.

Friday’s PCE inflation is the immediate test. If the monthly print comes in below the 0.2% consensus, it will hand dovish traders’ ammunition, capping the dollar’s rally. A stronger number, however, would reinforce Powell’s warning and potentially fuel another push higher.

In the meantime, the eurozone’s weak backdrop offers USD an additional layer of support. With Germany underperforming and sentiment deteriorating, the euro is struggling to provide any counterweight.

Technical Picture: Dollar Testing Key Levels

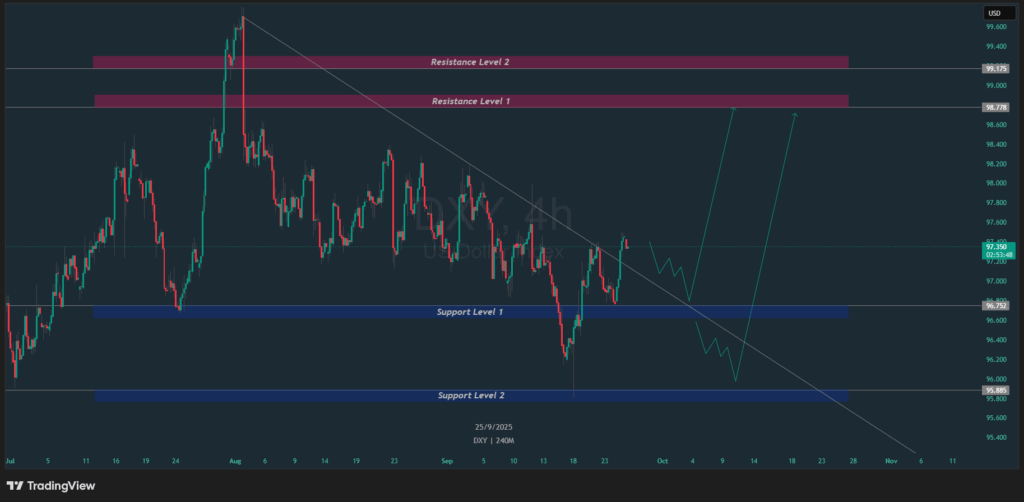

The H4 chart above shows the dollar breaking out of a descending trendline and heading into an important zone.

- Resistance Level 1: 98.78 — first major upside test.

- Resistance Level 2: 99.17 — stronger barrier if momentum builds

- Support Level 1: 96.75 — immediate downside cushion

- Support Level 2: 95.88 — deeper support if selling intensifies.

The structure suggests a pivotal moment: either DXY builds momentum and challenges 98.78 – 99.17, or a pullback sends it back to 96.75. Which path unfolds will depend largely on Friday’s PCE print.

Outlook: Dollar Has the Edge, But It’s Conditional

For now, the balance of risks tilts modestly in favor of the dollar. Powell’s stance and Europe’s weakness give DXY a constructive base. Still, the rally is not bulletproof — it’s data-dependent.

- Bullish scenario: Strong PCE — momentum toward 98.78 and possibly 99.17.

- Bearish Scenario: Weak PCE — rejection below 98, with support retested at 96.75 or lower.

In short, U.S. Dollar Price Prediction hinges less on Fed rhetoric now and more on the data in front of us. Until Friday, traders are positioned cautiously long, watching for confirmation.

Because cutting too soon risks reigniting inflation. This provides the dollar with policy support, limiting downside bets in the near term.

Not necessarily. Even if data is soft, euro weakness limits upside in EUR/USD, keeping the dollar supported within a range rather than collapsing.

Primarily U.S. data. External weakness supports USD, but pushing through major resistance usually requires a domestic catalyst such as stronger inflation.