- GBP/USD has moved upwards only to reverse those gains a short while later

- Both the Federal Reserve and the Bank of England (BoE) seem reluctant to cut interest rates in the first quarter of the year

- Hawkish BoE has strengthened the pound but strong US economy limits GBP/USD upside

As we start 2026, the British Pound and U.S. Dollar are in a standoff, keeping the GBP/USD pair stuck in a range. The pound has gained a little, but mostly it’s been a stalemate. Overall, the cable has gone up by a measly 0.1% year-to-date. So, why the stagnation and what could become of the pair this year?

Why the Sideways Shuffle?

Both the UK and the U.S. are waiting to see what happens next before they make their next monetary policy moves. The Bank of England (BoE) is surprisingly hawkish. They lowered rates to 3.75% in late 2025 but don’t seem ready to cut more just yet. This keeps the Pound appealing, but the strong U.S. economy offsets that.

The Federal Reserve isn’t making any sudden moves. The dollar’s attracting safe-haven demand because of global geopolitical uncertainties, which adds to the balance. Right now, traders aren’t sure what to do because there’s no solid data pushing them one way or the other. This is why we’re seeing this long period of sideways movement.

What Will Break the Deadlock?

For a decisive breakout, we need different actions from central banks or a big surprise in the economy. Soon, U.S. CPI data and the UK’s Q4 GDP numbers will be important. If the UK economy is still slow and U.S. inflation remains high, the Dollar could take over.

On the other hand, if the Fed indicates that it worries more about job losses than inflation, the pound could pass the 1.3500 mark. Also, if concerns about Fed freedom are resolved or the BoE gives clearer plans for 2026 cuts, that could cause a breakout. All things considered, JP Morgan Research forecasts that the GBP/USD pair could rise to 1.36 by March.

GBP/USD Forecast

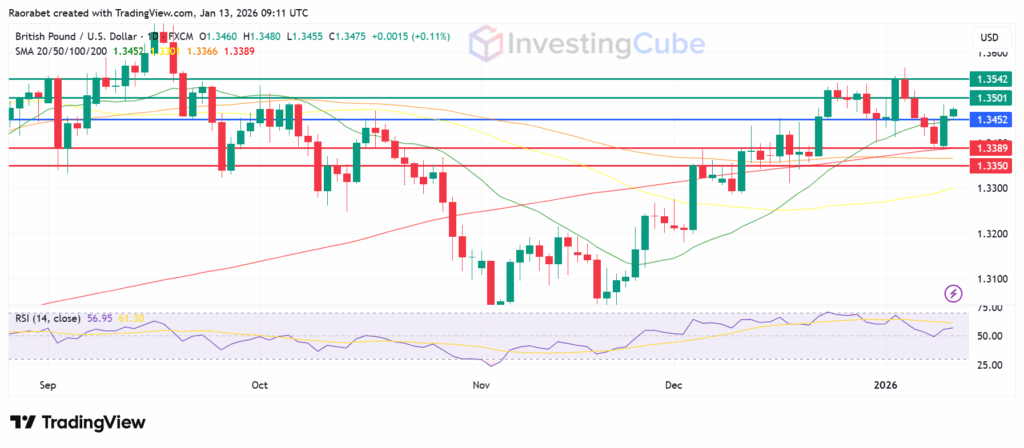

GBP/USD displays a neutral-to-bullish bias on daily charts. The pair pivots at the 20-day SMA at 1.3452 an the upside looks set to continue if action stays above that level. Resistance will likely come first at 1.3501, beyond which it could reach for 1.3542, where the price has struggled to go higher. The RSI is around 56, meaning there’s no strong momentum in either direction.

On the downside, primary support will likely be at the 200-day SMA at 1.33890. If the price falls below that, it could drop to 1.3350. A breach here opens the door to 1.3350.

GBP/USD daily chart on January 13, 2026 with key support and resistance levels. Created on TradingView

The pound is getting a boost from the Bank of England’s tough stance on inflation, but the U.S. dollar is staying strong because of good jobs numbers and high interest rates. This standoff is keeping either currency from taking the lead.

Stronger inflation could strengthen the dollar, pushing GBP/USD below 1.34, while softer readings might weaken it, favoring upside.

When things get uncertain globally, investors usually look for safe investments. If global tensions go up or trade arguments get worse, the U.S. Dollar usually becomes more attractive, which could push GBP/USD downward.