- Comprehensive analysis of GBPUSD amid UK economic struggles. Explore key support and resistance levels, political risks, and expert insights shaping pound-dollar trends into 2025.

What traders need to know about the GBP/USD opportunity recently: The GBP/USD exchange rate experienced a sharp decline as the UK’s mounting financial challenges overshadowed broader weakness in the U.S. dollar.

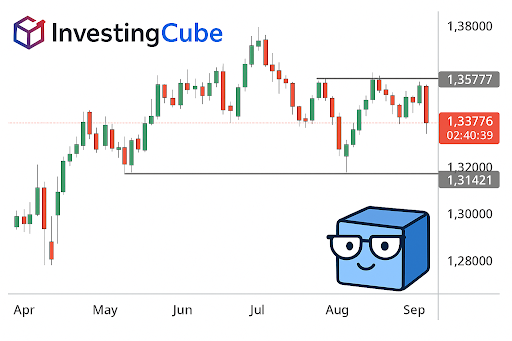

GBP/USD Daily Chart Outlook

The GBP/USD pair has posted a very bearish daily candle, opening the door for a potential test of support at 1.3142. A decisive break below this level could expose further downside risks.

GBP/USD’s Support and Resistance for Traders to Watch Out:

When trading GBP/USD, we recommend traders to monitor key support and resistance levels. These levels act as crucial indicators for potential market movements, helping traders determine entry and exit points. By watching these levels, traders can better anticipate price actions and adjust strategies accordingly. It is essential to set up Stop Loss when doing trading.

- Support Level: The key support level for GBP/USD to watch is at 1.3142. A sustained break below this level could trigger further bearish momentum.

- Resistance Level: Traders should keep an eye on the resistance level at 1.3577. If GBP/USD breaks above this level, it could signal a reversal or recovery.

Trading Opportunity: A break below 1.3142 could present a good shorting opportunity, whereas a breakout above 1.3577 might offer a buying opportunity.

UK Market Vulnerabilities

The British pound recorded its steepest one-day drop since 2023, underlining the fragility of UK markets. Growing unease about the Labour government’s fiscal policies has amplified concerns.

- Expert Views:

Lloyds Bank’s FX strategist Nick Kennedy described the UK’s fiscal backdrop as “perilous” and warned it is likely to deteriorate further. He noted investors are demanding a higher risk premium for sterling. - Government Reshuffle:

Prime Minister Keir Starmer reshuffled his economic team, bringing in three advisers to support the Chancellor ahead of the November 2025 budget. Speculation around potential tax hikes is already weighing on business sentiment and consumer confidence.

Fiscal and Political Uncertainty

BlueBay Asset Management’s Neil Mehta highlighted the risks from rising gilt yields, warning that the government’s options are narrowing. Potential scenarios could include breaking manifesto pledges or even a political shakeup, though he stressed that deep-rooted structural issues, such as energy, housing, and labor remain unresolved.

Global Dollar Dynamics

While the pound previously benefited from broad anti-dollar sentiment, renewed financial strains in the UK and France could fuel a U.S. dollar rally, reversing recent trends.

FAQs on GBP/USD and UK Economy

The pound is under pressure due to UK fiscal concerns, investor demand for higher risk premiums, and uncertainty over the Labour government’s economic strategy. This outweighs the bearish trend in the U.S. dollar.

Technical charts show immediate support at 1.3142. A break below this could trigger further declines in the GBP/USD pair.

With the annual budget expected in November 2025, speculation over tax increases and fiscal tightening could weigh on investor confidence. Political instability or a major policy shift could also intensify market volatility.