- EUR/PLN lacks strong data for either the euro or the zloty to break out

- Poland's economy is growing faster than the broader Eurozone's average

- There's a good chance that the National Bank of Poland (NBP) could raise interest rates before ECB and that could add pressure on the euro

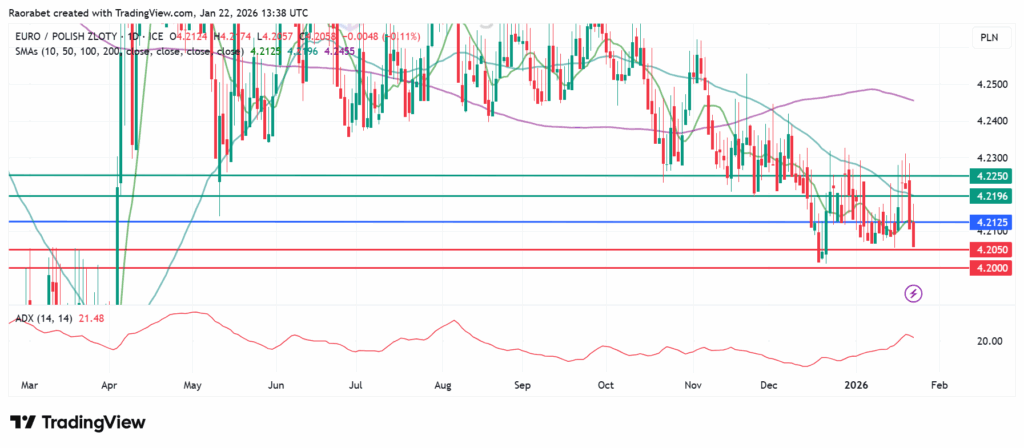

The EUR/PLN pair hasn’t moved much since December 2025, staying between 4.20 and 4.23. After dropping to a nine-month low around 4.20 last month, it seems like the forces are balanced right now. While other currencies have been all over the place because of global data changes, the Zloty and the Euro seem to be stuck in place.

Why the Stalemate?

This sideways trend shows that the Polish zloty’s support and the Euro’s pressures are canceling each other out. According to ING Think’s January 2026 report, Poland’s economy is doing well, growing faster than the EU average, which has helped the PLN.

The NBP recently kept its main interest rate at 4.00% in January 2026, stopping the rate cuts from late 2025. At the same time, the ECB is dealing with a Eurozone where inflation is almost at the 2% target, but slow growth is stopping them from talking about raising rates. Since neither side is changing their interest rates right now, investors don’t have a reason to switch from one currency to the other, which is why we’re seeing this sideways movement.

What will break the tie?

Disrupting this equilibrium would require significant shifts in economic indicators or policy. Poland’s domestic economy’s performance is probably the answer. The European Commission and Citi Handlowy forecast that Poland’s GDP could grow to 3.5% , and possibly higher by 4% in 2026. That’s way better than the Eurozone’s expected 1% growth.

This difference is because of a spike in spending from EU recovery funds. Since 2026 is the last year to use the post-pandemic RRF money, a lot of investment is going into the Polish economy. Usually, this kind of growth would help the zloty, but there’s a problem: these investments require a lot of imports, and there’s a constant 6% budget deficit, which limits how much the Polish currency can grow.

Forecasts generally predict modest PLN appreciation, with UBS holding quarterly levels at 4.20-4.23, citing Poland’s growth and German recovery. If the National Bank of Kenya (NBP) has to raise rates or keep them high for longer while the ECB starts cutting rates to save the struggling German economy, the EUR/PLN will probably go down.

EUR/PLN Prediction

Immediate support is firmly established at 4.2050, a level tested multiple times in January without a breakdown. On the upper end, primary resistance sits at the 50-day SMA at 4.2196. If the daily close goes below 4.2000, it would mean the Zloty is gaining value long-term, while a move above 4.2250 would suggest the Euro is becoming stronger again.

EUR/PLN daily chart with support and resistance levels on January 22, 2026. Created on TradingView

The ECB and NBP are holding interest rates steady at the start of 2026, causing this stalemate. Without a clear interest rate winner, the pair can’t break out.

The main threat is differences in economic performance. If the Eurozone continues to struggle with slow growth while Poland speeds up, the ECB might have to cut rates sooner than the NBP, making the Euro less appealing.

Key influencers are likely to include interest differentials, EU funds, growth outperformance, and risks like elections.