- Trading week is starting slow with EURCHF traders awaiting the SNB total sight deposits w.e. 9 August due at 8:00GMT. The ZEW Economic Sentiment

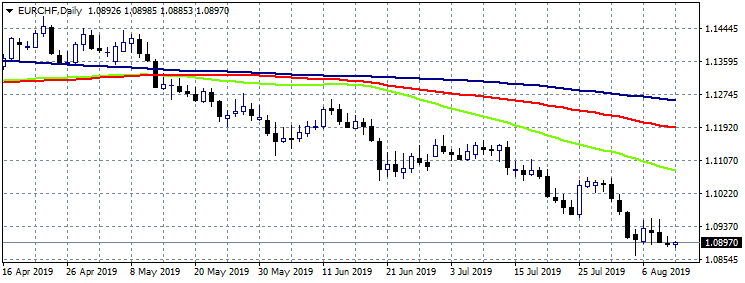

Trading week is starting slow with EURCHF traders awaiting the SNB total sight deposits w.e. 9 August due at 8:00GMT. The ZEW Economic Sentiment Indicator tomorrow will be the main driver of EURUSD. The EU GDP (q/q) and Employment data will be released on Wednesday. On Thursday the UK and US retail data will be on focus.

US Federal Budget Balance Statement will be released at 18:00GMTwhile Reserve Bank of Australia’s member Kent will deliver a speech at 22:00GMT.

The People’s Bank of China has set the Yuan reference rate at 7.0211 versus Friday’s fix of 7.0136.

In United Kingdom the MPs may try to stop PM Johnson from leaving the European Union without a deal by forcing the government to seek an extension to Brexit.

Traders around the globe will follow the developments on US – China trade conflict.

New Zealand Treasury confirmed that the Reserve Bank of New Zealand could cut OCR to minus 0.35% in a case of crisis.

Fitch Credit rating agency on Friday, affirmed Italy’s credit rating at ‘BBB’ with ‘Negative’ Outlook.