- the EURUSD trying to find the direction amid The US-China talks and trump posts, check out the technical analysis for the EURUSD today.

Investors are paying close attention to the U.S.-China trade discussions in Switzerland on Saturday. Additionally, this trade war between Washington and Beijing is a key mover for the downward revisions in the global economic growth, given the labor cost competitive advantage of China.

While the US index today is quickly reversing as it trades near 100.45 at the time of writing, however, the index was hitting near its monthly high of 100.86 earlier today. And this is in response to waiting for the U.S.-China trade discussions.

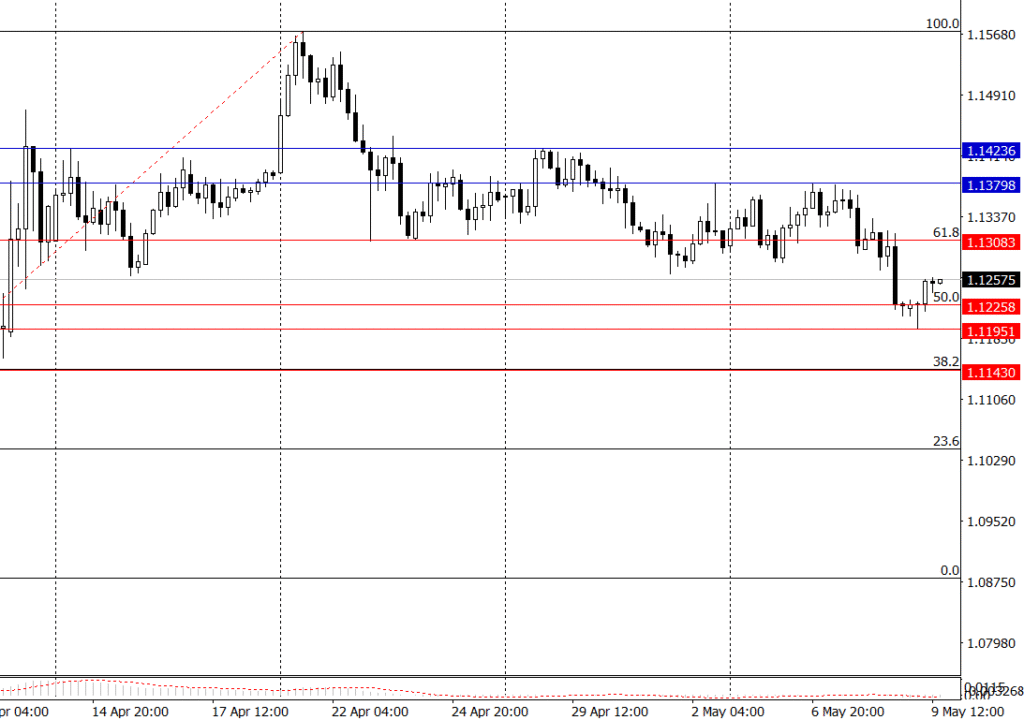

EURUSD Technical Levels

According to the live chart, the EURUSD has attempted many times to break down the key support line at $1.12258, but has been too hard. This has caused the pair to reverse and trade now trade approximately $1.1250. This upward movement may push the EURUSD to reach the key resistance level at 61.8 %Fibonacci retracement at $1.13083. Any breakout above this level could lead to $1.1335 and then $1.1379.

On the bearish side, if the EURUSD cannot make a daily close above $1.12258, this will confirm the downward direction to reach $1.11957.

This chart is on the 4-hour time frame.

President Donald Trump surprised the market with a post on social media hinting at an 80% tax on goods from China, which caused a negative impact on the market. S&P 500 futures gains went down from a 0.4% increase to only a 0.10% increase after this post.

Despite the uncertainty of the post, the investors and market are still wondering if this tax war would last a long time, or if the current tax of 145% might be decreased to 80%.

Key Resistance & Support levels on the Daily time Frame:

- Support 1:1.09224

- Support 2: 1.07348

- Pivot Point at: 1.12261

- Resistance 1: 1.15298

- Resistance 2: 1.17174

Be Cautious for the end-of-weekend:

The waiting US-CHINA talks will be held this weekend, on Saturday and Sunday, which means that the outcome of this talk will be reflected in the market on Monday. This may cause a price gap while the market is open. especially for the US.Dollar.