- EURGBP remains range-bound near 0.87, as markets await clearer policy signals from the ECB and BoE.

- Sterling strength, rather than euro weakness, has dominated recent price action.

- UK data surprises could quickly revive BoE rate-cut expectations and weaken the pound.

- ECB officials remain cautious, limiting euro downside despite weak euro zone growth.

[InvestingCube, 9 January 2026] The euro was little changed against the British pound this week, signaling ongoing investors skittishness as markets refreshed their view on interest rates both in the euro zone and in Britain. EURGBP plays a game of patience and during a rare spell of quiet, with the European Central Bank, ECB and the Bank of England, failing to provide obvious signals that divergence is nigh. EURGBP has dawdled in consolidation while macro forces elsewhere struggle for inspiration.

EURGBP was trading around the 0.87 level early in January, little changed on the week according to market data collated by Investing.com. The pair has been struggled to gain traction following a retreat from late-2025 highs, marking an equilibrium between a relatively robust pound and weaker growth expectations associated with the euro zone.

Sterling Strength Dominates Near-Term Price Action

Recent price action shows that the downside of EURGBP is more to do with strength and GBP rather than weakness in EUR. Sterling has gained versus the euro in recent sessions on better risk-sentiment and a reassessment of how aggressively the BOE might need to ease policy this year.

The pound meanwhile, hit its highest level in months against both the dollar and the euro earlier this month as investors ratcheted down political risk premiums factored into the UK markets, Reuters reported. “Markets have wagered less on a BoE rate cut in early 2026, which is providing some near-term relief for Sterling,” analyst at Reuters said.

That said, economists remain cautious. The UK economy remains very delicate, and signs of labor market cooling could quickly change rate expectations. “Sterling’s recent resilience is not an indication of strong growth fundamentals,” said a London-based FX strategist at Reuters. “It’s about relatively positioning and the lack of bad news.”

Should such data shows the downside surprise, interest in easing expectations will likely be revived and, with it, the pound brought lower; above this levels, EURGBP would slide from current values.

Euro Outlook: Weak Growth, Cautious ECB

On the euro side, the macro background is still tough. Economic numbers across the euro zone still indicates slow growth — particularly in Germany, where industrial activity has lagged. Although inflation threats have receded, the ECB has been reluctant to give its blessing to aggressive rate-cut expectations.

European Central Bank President Christine Lagarde has stressed that policy action is dependent on data. She used similar language late last month, saying the central bank was “ not yet declaring victory” over inflation, a comment analyst took as an attempt to temper market hopes based on rapid easing. Some ECB Governing Council members have expressed similar views, emphasizing the importance of confirming that inflation is sustainably in line with a 2% goal, according to Bloomberg.

This cautious stone has lacked downside value against Sterling. “As long as the ECB does not sound materially more dovish than the BOE, EURGBP should not have too much on the downside,” said one strategies cited by Bloomberg.

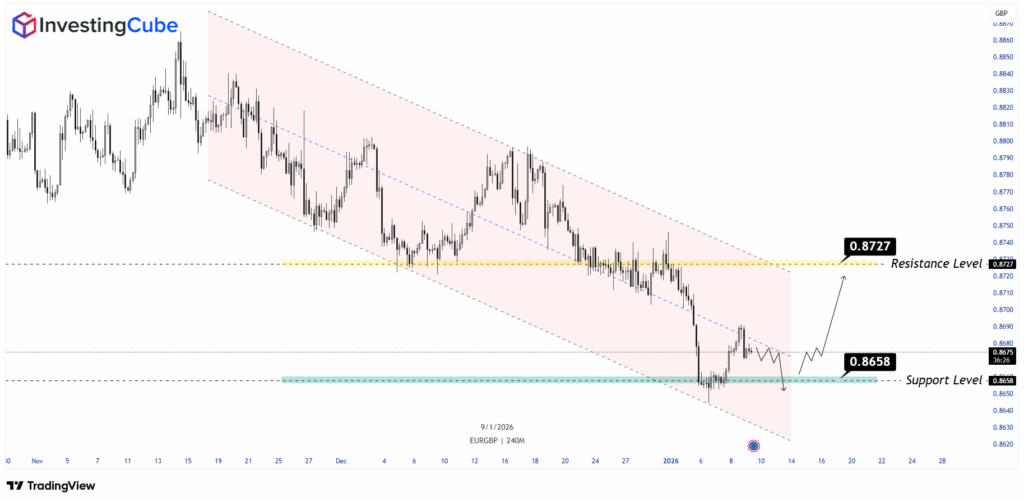

Technical Structure: Persisting Downward Channel

Technically speaking, there is not much in the way of a clear directional bias for EURGBP, which continues to oscillate within the descending channel, therefore given the impression that the overall medium-term downtrend is alive despite recent steadying.

Price just tested the bottom of this channel and found support around 0.8658, a level which has become an important demand zone. The recovery from here indicates that a temporary bottom has been reached although technicals do not confirm a trend yet.

To the upside, 0.8727 is an important resistance in a short term, a level which coincides with the previous consolidation and the mid-channel area. As long as the pair fails to move above it, any corrective pullback should be treated as just that within the current downtrend, with downside risk then next aimed at 0.8542 and 0.8495.

Technically, the prevailing spike marks consolidation within the firmly bearish backdrop. To start to negate the downward channel and alter the bias to a more neutral view, a sustained break of 0.8727 and a daily close above here would be needed. Alternatively, a fresh failure accompanied by a move back below 0.8658 would add to the downside and open up channel support once again.

EURGBP Price Prediction: Key Scenarios

Going forward, the EURGBP path will be determined by relative economic surprises and policy pains.

Bullish EURGBP scenario

If UK data softens, especially in labour market and growth metrics, markets may advance the timing for BoE rate cuts. Add a still-firming or very-firming ECB tone and EURGBP momentum can pop back again towards 0.88 – 0.89 — some considered this latter level as being key for confirming a constructive change in mood among traders, if re-sustained on the final way down likely ahead of us.

Bearish EURGBP scenario:

If UK data proves more resilient than expected reinforcing sterling demand, while euro zone data remains soft, it could push up through 0.8600. A clear break below might start the way towards 0.8500, also part of the multi-month range .

Conclusion

essentially, for now EURGBP is a cross being driven not so much by directional conviction and more by relative central bank expectations. “Tt’s going to be a waiting game – it’ll be on the first central bank that blinks,” said one strategist briefed on the matter, speaking to Bloomberg.

The pair is expected to be range-bound as long as there are no clearer indications in the macro data or policy advice, while weak resistance is accumulating under the surface and one should expect increasing volatility.

Frequently Asked Questions

Pound strength is dominating in EURGBP on a re-price of timing on BoE rate cuts, but ECB offers remain high.

A breakout is probably to be stimulated by a significant UK data surprise or a distinct move in ECB or BoE policy guidance.

At present, EURGBP remains range-bound which support near 0.8658 and resistance around 0.8727 .