- Explore the latest EUR/USD technical outlook and discover key market movers influencing currency trends. Check it now!

The EUR/USD remains in the same range as yesterday, with traders being cautious ahead of the ECB interest rate decision. The softer PPI could weigh on the US Dollar, as it boosts bets on the Fed easing rates in September. On the other hand, markets await the European Central Bank (ECB) interest rate decision due later today.

It’s widely expected that the ECB will keep rates unchanged as inflation rates remain on target for a third month. In this article, we will cover the key daily market movers for the EUR/USD, along with the technical outlook for the currency pair. Finally, we will address the most frequently asked questions by traders.

Key Market Movers for EUR/USD:

- The European Central Bank interest rate decision will be released later today. Markets are cautious, waiting for the decision.

- The ECB will likely keep rates unchanged, as market participants are pricing in a 93% probability of that and only a 7% probability of a 25 basis points cut.

- Moreover, Fitch Ratings Agency expects the ECB will not project any further rate cuts.

- If the decision meets expectations, the EUR/USD will likely fall once the decision is released.

- The US consumer price index is due later today, and it’s projected to rise 2.9% YoY from 2.7%, while the core CPI is expected to hold steady at 3.1%.

- Fitch expects the Fed rate cuts of 25 basis points in September and December, with three more reductions in 2026.

- Yesterday, the US PPI was released softer than expected, easing to 2.6% from 3.3% YoY. Core PPI came in moderately at 2.8% YoY.

- After the US PPI release, Fed rate cut expectations priced in a 90% probability of easing a 25 bps and a 10% of a 50 bps cut.

- The geopolitical tensions have to be watched closely by traders, as russian drones violated Poland’s airspace.

- This triggered a risk-off reaction in EUR/USD, turning the pair negative.

- U.S. President Donald Trump urged the EU to impose 100% tariffs on China and India to put pressure on Putin to end the war in Ukraine.

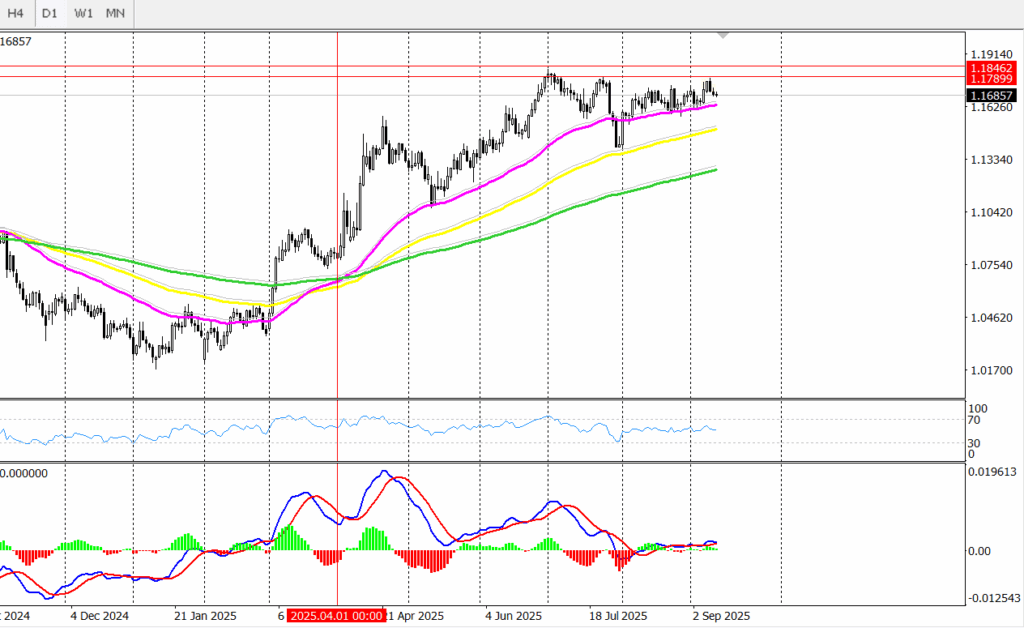

EUR/USD Technical Outlook | The main trend remains bullish despite struggling around 1.1700

From a technical perspective, the EUR/USD in the long term has a steady bullish trend. If you look at the daily chart, you can spot a great performance for the pair. The EUR/USD has remained consolidated above the 50-day,100-day, and 200-day moving averages since March 2025. However, it’s struggling now below the psychological level at 1.1700. A clear day close above 1.1700 could pave the way toward higher levels like 1,1750, ahead of July 24 at 1,1788.

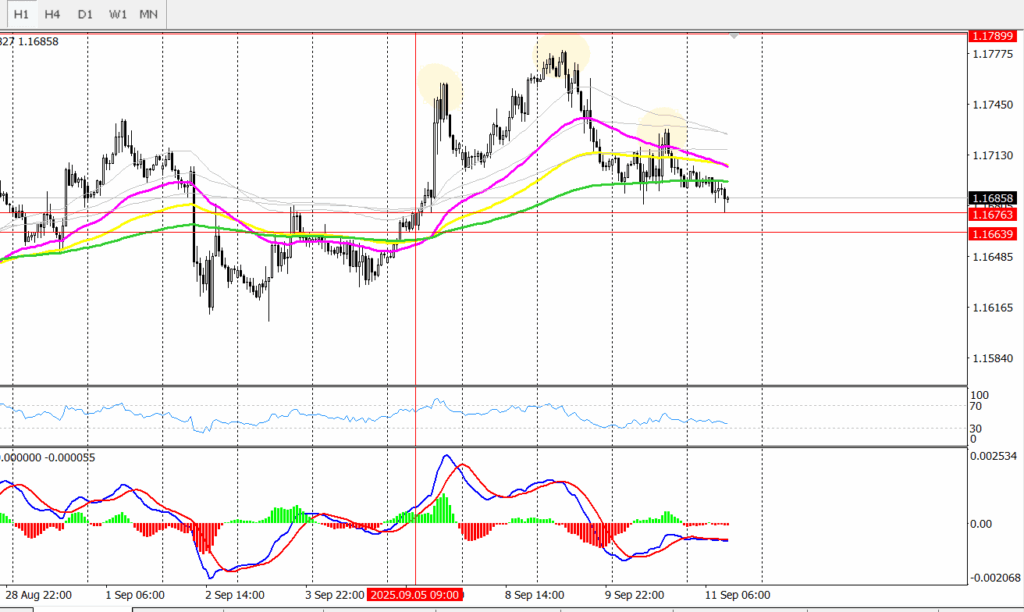

On the 1-hour chart, the price action shows a head and shoulder pattern. This signals that the uptrend is nearing its end. Also, the MACD signals bearish momentum, while the RSI is falling from 50 to 40, indicating that buyers are losing strength and sellers are exerting bearish pressure.

A clear 1-hour close below 1.1676 could pave the way toward 1.166,4, the low of 5 September. You can check our latest outlook for EUR/USD to stay informed about the History.

The ECB’s main job is to keep prices stable by controlling inflation or boosting growth. Its key tool is interest rates; higher rates usually strengthen the Euro, while lower rates weaken it. The Governing Council, led by Christine Lagarde, meets eight times a year to set the policy.

If inflation rises above the ECB’s 2% target, the bank may raise interest rates to control it. Higher rates make the Eurozone more attractive to investors. This usually supports the Euro’s value compared to other currencies. Conversely, if the inflation rate is below the ECB’s target. They will have to lower the interest rate, which will weaken the Euro.

These fundamental factors have a significant impact on the price movements of the currency pair, which could affect your trades and put your money at risk.