- Explore the latest EUR/USD technical outlook and key economic indicators to watch, stay ahead in the dynamic forex market.

The currency pair EUR/USD opens lower by 0.21% around 1.1791. It looks for a direction amid cautious markets. The pair has been reaching a weekly high near the 1.1820 level. It remains struggling to find a direction, stuck in a very tight range between the 1.1820 and 1.1800 levels for the second day.

This struggle comes from low risk appetite in the market. The Fed Chair Jerome Powell almost repeated what he said earlier at the FOMC press conference.

The following key points from Powell’s speech yesterday led the market to trade cautiously:

balance both sides of our dual mandate

Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation

The increased downside risks to employment have shifted the balance of risks to achieving our goals,

This policy stance, which I see as still modestly restrictive, leaves us well positioned to respond to potential economic developments.

However, Powell expressed that he is comfortable with the current central bank policy, though he signaled the probability of additional cuts if the FOMC sees that it needs to be more accommodative.

Powel didn’t share his outlook on future rate moves, but Governor Michelle Bowman noted that she views the recent action as “the first step” toward returning to a neutral interest rate level.

With these permits, investors’ risk appetite is set to decline due to the unclear outlook for interest rates. As a result, EUR/USD failed to consolidate above the 1.1800 mark and continues to hover around the 1.1700 area.

Additionally, traders are shifting their focus to key economic indicators in the US and the Eurozone. With this data, investors can better anticipate monetary policy decisions in the two upcoming meetings.

Key Economic Indicators to Watch for EUR/USD | Recent &Upcoming :

- From yesterday’s releases, the US S&P Global Services PMI came in at 53.9 in September, down from 54.5 in August.

- The US S&P Global Manufacturing PMI came in at 52.0 in September, down from 53 in August.

- The Prices Paid Index in September is 62.6, which is up from 60.8 in August, with tariffs cited as a main cause of cost increases.

- These results indicate a slowdown in both manufacturing and services activity in the US. This points to continued inflationary pressures.

- Despite this, Fed Governor Bowman indicated she expects three rate cuts in 2025 to support the labor market. At the same time, Chicago Fed President Austan Goolsbee stressed the importance of bringing inflation back to the 2% target.

- Eurozone HCOB Manufacturing PMI came in at 49.5 in September, down from 50.7 in August, while the forecast was 50.9.

- Eurozone HCOB Services PMI came in at 51.4 in September, up from August and above the forecast of 50.5.

- This indicates a slowdown in manufacturing activity, slipping into contraction territory, while the services sector showed moderate growth, suggesting a mixed economic outlook for the Eurozone.

The Upcoming Data for the EUR/USD:

- For the Eurozone, the economic calendar is lighter on Wednesday, only the German IFO Business Climate.

- During the American session, US New Home Sales for August at 5:00 PM GMT.

- Speech by San Francisco Fed President Mary Daly at 11:00 PM GMT.

- It’s expected that the market will trade sideways ahead of the US GDP and Durable Goods Orders on Thursday.

- Along with the most important data ahead on Friday: The US Personal Consumption Expenditures Price Index data (PCE).

Until these data are released, markets are expected to trade cautiously.

Technical Outlook for the EUR/USD:

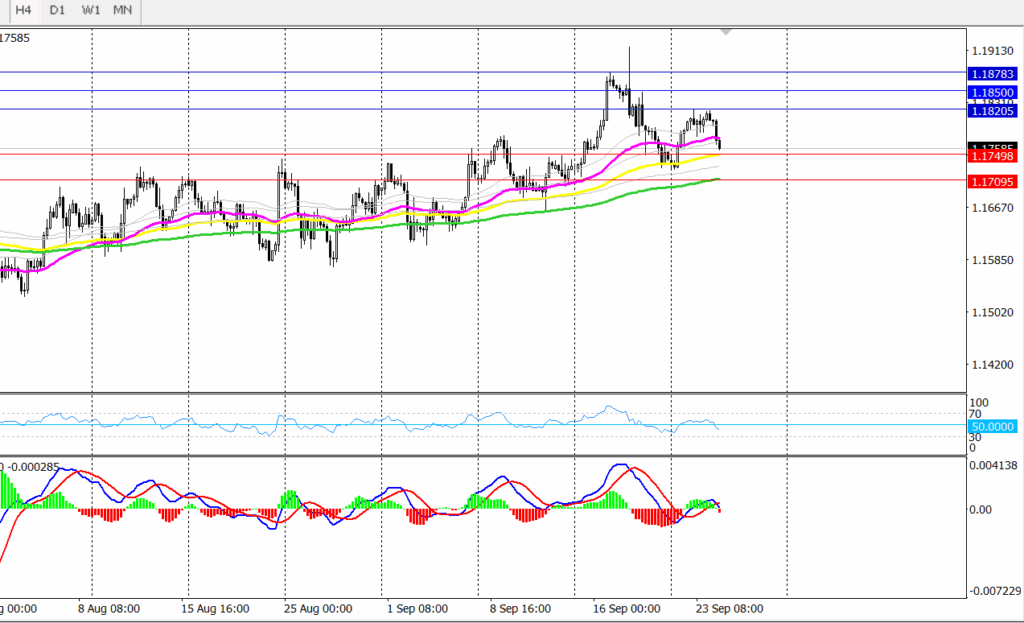

The EUR/USD currency pair is hovering within a tight range. On the 4-hour time frame, MACD indicates an initial bearish crossover. While the RSI moves lower the 50 mark. This indicated that the currency pair may go for more lower levels within the day.

A clear 4-hour close below the 50-day moving average level of 1.1763 could pave the way toward 1.1749. The 1-hour time frame confirms the bearish scenario with a strong bearish crossover on the MACD indicator, as the EUR/USD is currently trading below the 50-day, 100-day, and 200-day moving averages on the 1-hour chart.

On the upside, rallies are limited by Tuesday’s high at 1.1820. Above that, the next targets are 1.1850 and 1.1878.

The European Central Bank (ECB) is in Frankfurt, Germany. It’s the Reserve Bank of the Eurozone. The ECB is responsible for setting the interest rates and managing the monetary policy. The ECB Governing Council holds eight meetings a year to make monetary decisions.

Inflation data impacts the euro’s value because it influences expectations about the European Central Bank’s (ECB) monetary policy.

Higher-than-expected inflation: Suggests stronger price pressures, making the ECB more likely to raise interest rates to control inflation. Higher rates usually strengthen the euro, as they attract investors seeking better returns.

Lower-than-expected inflation: Suggests weaker price pressures, making the ECB less likely to raise rates (or even cut rates), which tends to weaken the euro.