- EUR/USD had been on a steep decline for the previous month, with the Eurozone lacking strong data during the period

- US President Donald Trump's perceived aggression in pursuit of Greenland has created uncertainty about the dollar's safety

- The European Central Bank (ECB)'s appointment of Boris Bujcic to the Executive Board could usher a period of hawkish monetary policy

After a few weeks of decline from its December highs, the EUR/USD pair has bounced back this week. From late December 2025 to mid-January 2026, the pair steadily declined because of a strong U.S. dollar and a lack of positive news from the Eurozone. But around January 21, 2026, things changed, and the pair recovered from a two-month low of 1.1576, trading above 1.1700.

We will look at what caused this, how long it might last, and any possible problems.

Greenland Pressures the Greenback

The main reason for the change in EUR/USD momentum is a weaker U.S. dollar because of increased geopolitical uncertainty. President Trump’s tariff threats on eight European countries about Greenland have, strangely enough, put pressure on the dollar. These tariffs, set to begin at 10% on February 1 and increase to 25% by June if there’s no agreement, have been seen by markets as a risk to U.S. policy instead of just a hit to Europe.

By linking trade policy to territorial acquisition, the U.S. government has created a level of risk that investors don’t like. Even though the dollar often acts as a safe haven currency, this situation makes the U.S. look unstable. As a result, the dollar index (DXY) has gone down, allowing the euro to regain value even as European industry faces its own tariff-related difficulties.

Also, the European Central Bank (ECB) has provided some stability. With the recent appointment of Boris Vujcic, who is expected to favor higher interest rates, to the Executive Board. Many in the markets expect that the ECB will keep interest rates as they are, while the U.S. Federal Reserve is under pressure to lower them.

Is It Sustainable?

While the EUR/USD recovery looks good, it’s unclear if it will last. For a sustained uptrend, U.S. economic data needs to weaken enough to change the Fed’s position, along with positive news from the Eurozone, as reported in European Business Magazine. The current moves might just be corrections rather than a change in the trend, and a decrease in tensions or better risk appetite is needed for it to continue.

The Greenland rally is mostly based on headlines, so any sign of eased tensions at the World Economic Forum in Davos could quickly see the dollar regain its strength. The real test for the euro will be if it can break through the strong resistance it met during its recent decline.

EUR/USD Forecast

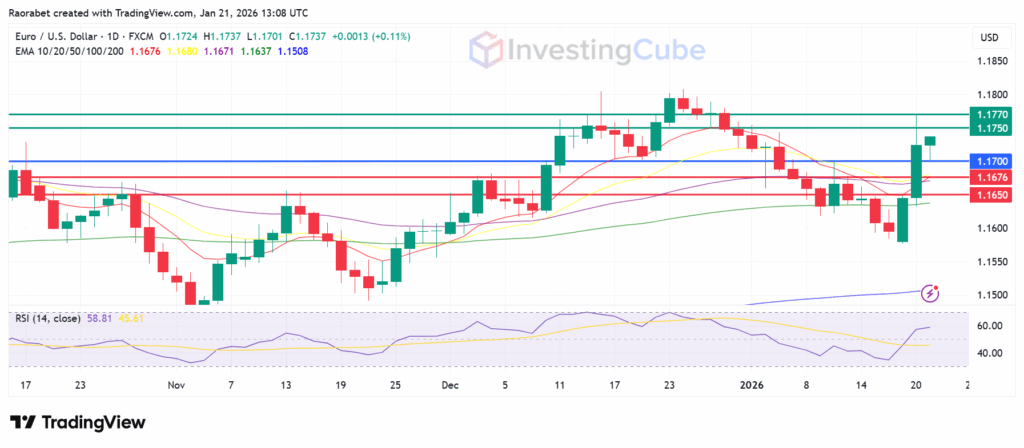

The EUR/USD has successfully rebounded and currently trades above the 10, 20,50,200 and 200 Exponential Moving Average (EMA) levels. The RSI has risen from near-oversold levels to about 58, suggesting there is room for further gains. The pair now faces immediate resistance at 1.1750, above which it could encounter the next barrier at the previous session’s high of 1.1770 level.

The downside has the first support at the 10-day EMA at 1.1676, below which the upside narrative will be invalid. An extended control by the sellers could send EUR/USD lower to test 1.650.

EUR/USD daily chart on January 21, 2026 with key support and resistance levels. Created on TradingView

A sell-off in the U.S. dollar, triggered by President Trump’s tariff threat to European allies over the Greenland dispute and it undermined confidence in the dollar’s stability.

Not necessarily. While the pair has bounced off long-term support, technical indicators like the MACD remain bearish. A sustained break above 1.1800 is likely required to confirm that the downtrend is officially over.

The key risks include escalating U.S.-EU trade wars, Fed policy shifts, and oil volatility could strengthen USD, embedding Europe risk premiums.