- EUR/USD trades near 1.1620, quiet on the surface, but pressure is building beneath. A breakout may arrive sooner than expected.

The euro isn’t having an easy October. Despite constant chatter about a U.S. government shutdown, it is the euro rather than dollar that looks more fragile. EUR/USD has been sliding steadily, unable to regain momentum above 1.167, and this morning’s price action near 1.1620 reflects the underlying nervousness in the market. For traders, the question now is whether this weakness is a temporary pause — or the start of a deeper move back toward the mid – 1.15s.

Politics Drive the Narrative

It is hard to talk about the euro right now without looking at France. Another prime minister gone — Sébastien Lecornu lasted barely a day — and the revolving door in Paris is beginning to spook investors. When a major eurozone economy struggles with political leadership, it isn’t just headlines; it feeds directly into markets. The spread between French and German government bond yields had widened, signaling that investors want extra compensation to hold French risk. That in turn bleeds into the euro, keeping it heavy.

Meanwhile, in Brussels, another no-confidence motion against Commission President Ursula von der Leyen is set to be debated. It probably won’t pass, but the symbolism matters. Repeated political battles erode confidence in the EU’s institutional stability, and when confidence slips, the currency tends to follow.

Data Not Offering Support

Economic numbers are not helping the euro’s case either. August retail sales came in at just +1.0% year-on-year, missing forecasts, while the Sentix investor confidence index stayed negative at -5.4. These are not catastrophic figures, but they don’t give investors any reason to step in on the long side. Instead, they confirm the sense that the eurozone economy is running well below potential at a time when external shocks remain a risk.

Central Bank Contrast

ECB President Christine Lagarde has kept her message cautious: risks are balance, decisions will remain data-dependent, and the ECB stands ready to adjust if needed. The tone is reasonable, but it doesn’t inspire conviction. Markets hear hesitation.

By contrast, the Fed continues to repeat its “higher for longer” stance and yields back it up. Even with Washington in gridlock, the U.S. is still seen as the studier option. That contrast explains much of EUR/USD’s current direction.

Technical Landscape

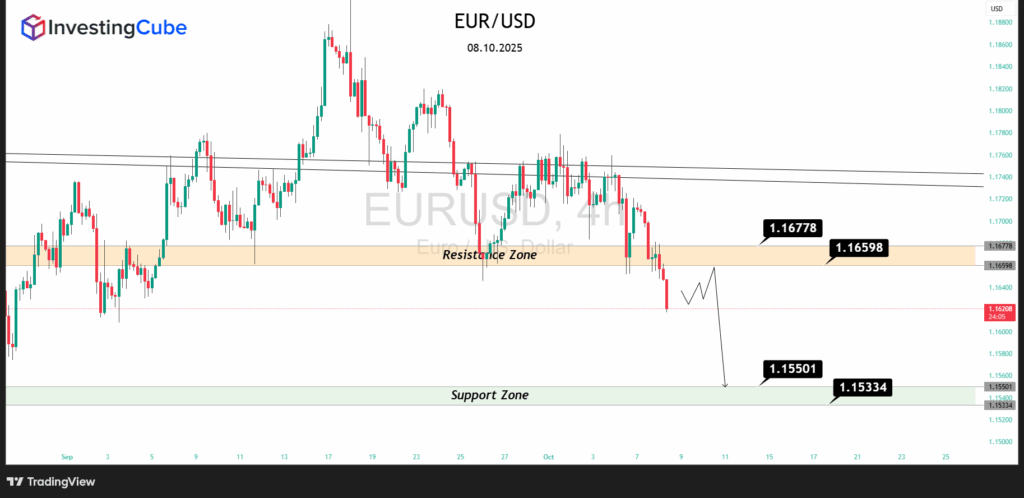

Technically, the pair has painted a clear picture. Every attempt to clear the 1.1659 – 1.1678 resistance zone has failed, and sellers are stepping in quickly. Momentum indicators such as RSI are leaning lower.

- Resistance sits at 1.1660 – 1.1680.

- First support is 1.1620, with a more critical cluster at 1.1550 – 1.1530.

- A decisive break below 1.1530 could open the door toward 1.1450.

In other words, unless buyers can force a close above 1.1670, rallies are still opportunities for sellers.

Outlook and Strategy

For now, the path of least resistance is lower. The combination of shaky European politics, uninspiring data, and a confident Fed leaves little room for the euro to rally. Traders might look to fade strength into the 1.1660 – 1.1670 zone, with downside targets near 1.1550 if 1.1530 gives way, the bearish momentum could gather pace quickly.

That said, there are wildcards. The U.S. labor report later this week could flip the scripts if payrolls disappoint, softening the dollar. Likewise, political dysfunction in Washington could eventually hurt sentiment toward the greenback. But at this moment, the euro remains the weaker side of the equation.

Reader Q&A

A weaker U.S. jobs report or signs the Fed is softening its stance.

They affect sovereign spreads, raise doubts about eurozone stability, and push investors away from euro assets.

It’s the neckline of a topping pattern; breaking it would likely accelerate selling toward 1.1450.