- AUD/JPY is a barometer for global risk sentiment and its rise indicates the prevalence of risk-off sentiment

- The Bank of Japan (BoJ) just retained interest rates, give carry traders incentive to keep trading AUD/JPY

- Japan's forthcoming snap elections amidst increased government borrowing has raised the risk sentiment around the yen

The AUD/JPY pair, often seen as a gauge of global risk sentiment, has jumped to levels not seen since mid-2024, recently passing 108.00. Many traders believe this jump comes from central banks acting differently and the unique political situation in Japan. We discuss the pair’s recent performance and assess its odds of staying on the current trajectory.

Why AUD/JPY is Surging

The main reason for this climb is the increasing difference between the Reserve Bank of Australia (RBA) and the Bank of Japan (BOJ). While many predicted rate cuts for 2026, the RBA has kept its rate at 3.60%.

The Bank of Japan, on the other hand, just ended its January 23 meeting by holding rates at 0.75%. While the BOJ did increase rates to a 30-year high in December, the market wanted a stronger follow-up. When Governor Kazuo Ueda chose to pause, the Yen was immediately sold off. This difference in policy makes the Australian Dollar more appealing for carry trades, where investors borrow the Yen at a low rate to invest in Australian assets with higher returns.

Also, Japan’s internal problems add to the Yen’s weakness. Prime Minister Sanae Takaichi’s call for snap elections and plans for government spending, like tax cuts without a clear funding source, have people worried about Japan’s financial stability.

Her support for aggressive government spending has caused a sell-off in Japanese Government Bonds (JGBs), pushing long-term bond returns to record highs. Usually, higher returns help a currency, but in this case, they show concern about Japan’s financial health, which is hurting the Yen. In Australia, strong commodity prices, especially in iron ore and coal, are supporting the AUD, along with stable global risk sentiment.

What are the Risks?

The most immediate risk is intervention from Japanese authorities, either verbally or physically. Finance Minister Satsuki Katayama recently said she’s considering all options to address the weak yen. Also, the IMF cautioned on January 20 that global markets could be hurt by an AI bubble bursting. Given that AUD/JPY is a risk-on pair, a major stock market correction would probably cause traders to seek the Yen’s safety, leading to a quick turnaround.

AUD/JPY Prediction

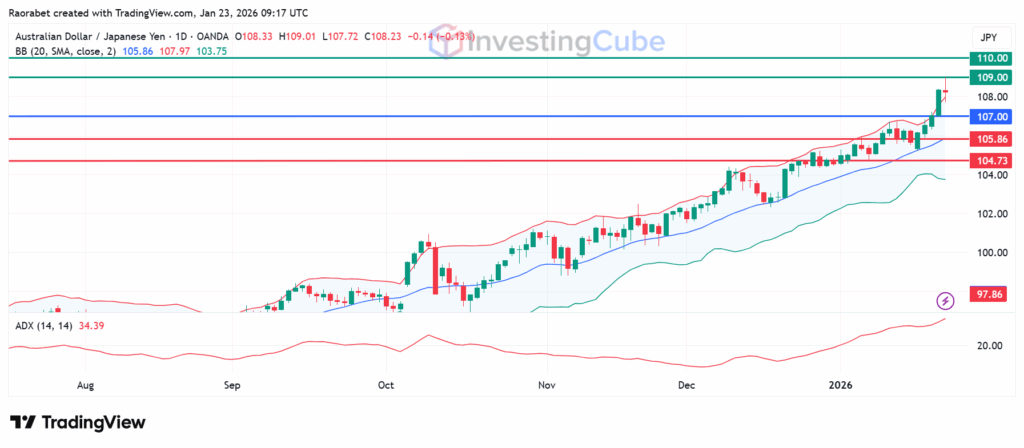

The AUD/JPY is currently showing a strong upward trend on the daily charts, supported by higher lows. The next resistance is at 109.00, and breaking this could lead to the psychological 110.00 level. On the downside, the first support is at the 20-day middle Bollinger Band at 105.86. A break below this could send the pair lower to test 104.73.

AUD/JPY daily chart on January 23,2026 with key support and resistance levels. Created on TradingView

The key factors impacting AUD/JPY are the difference in policy with the RBA’s hawkish stance widening returns, Japan’s financial uncertainties weakening the Yen, and commodity strength supporting the AUD amid positive risk sentiment.

Carry trade is a type of trade in currency where investors exploit interest rate differentials for profit. In the case of AUD/JPY, investors borrow the yen at low rates to buy Australian Dollars, which offer a higher return. This constant demand for the Aussie over the Yen pushes the exchange rate higher.

Yes. Japanese officials have expressed concern over the yen’s one-sided weakness. If the Ministry of Finance decides to intervene by buying yen directly, the AUD/JPY could see a sudden, sharp drop.