- The transition from bonds to on-chain yield infrastructure represents more than just a cyclical market rotation.

The traditional fixed-income thesis is fast collapsing under its own weight because while a ten-year treasury currently yielding 4.13% sounds respectable, once inflation enters the chat, the real returns dwindle to barely 2%. This, by any metric, is hardly enough to offset erosion in purchasing power, let alone compensate for holding long-duration assets in a fiscally stressed environment.

And, while corporate bonds do offer marginally better incentives (4.75% for investment-grade credit, 7.2% for high-yield), with inflation and institutional investors in the mix, the mathematics of it all becomes grim once again.

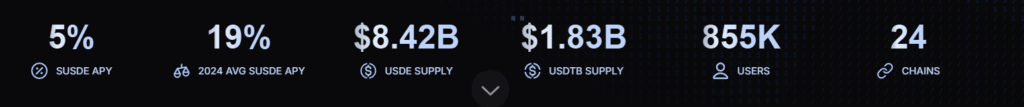

Amidst this environment, an unexpected emergence has occurred with yield-bearing stablecoins (YBS) maturing from mere curiosities to institutional-grade yield vehicles. For instance, Ethena’s synthetic dollar stablecoin sUSDe currently offers 5-8% APY with no lock-ups and instant redemption.

This infrastructure didn’t exist three years ago, but today it is beginning to attract eight-figure institutional checks as well as interest from a myriad of players seeking yields but on-chain.

A structural inversion is in the offing currently

The transition from bonds to on-chain yield infrastructure represents more than just a cyclical market rotation, offering a glimpse into how institutions now perceive yield and liquidity. This is because, for decades, bonds were considered illiquid, opaque, but still somewhat dependable, and institutions held them because they had to, not because they wanted to.

Within this broader context, what assets like sUSDe actually offer compared to bonds is stark. Unlike a treasury earning 4.13%, with inflation corroding two-thirds of its returns, sUSDe’s yield comes from delta-neutral short positions in Bitcoin and Ethereum, funded by clearing house fees.

Not only that, the mechanisms underlying these synthetic stablecoins are transparent, such that every week, on-chain data makes their yield machinery fully visible with clear accounts being provided for collateral, derivatives positions, funding rates, etc.

For institutions accustomed to quarterly GP reports buried in legalese, this level of transparency alone is jarring.

That said, a certain level of skepticism still exists primarily due to the fact that institutions still are unclear as to how their capital can be deployed at scale and that too on-chain (all while managing aspects such as rebalancing, hedge durations, etc, without enormous slippage?)

This is where emerging offerings like Terminal Finance have entered the fray and addressed a critical gap, i.e. rather than treating yield-bearing stablecoins (YBS) as generic crypto tokens, they capture accumulated yields systematically, redistributing them to liquidity providers proportional to their share.

In simple terms, instead of yield becoming a price discrepancy for arbitrage, it becomes pool revenue with the practical result being that institutions providing liquidity to sUSDe pools on Terminal can receive three income streams simultaneously via a native sUSDe yield (5-8% APY), trading fees from volume, and protocol incentives (via Root Points).

The evidence is there for everyone to see as Terminal recently accumulated $280 million in pre-deposit commitments within just sixty days, something that is uncommon for most DEXs, as they tend to struggle to maintain their TVLs almost immediately post their debut (despite offering aggressive incentives).

In addition to all of this, Terminal also offers a permissioned exchange layer, which is distinctly separate from its aforementioned permissionless spot DEX, attracting traditional asset managers interested in tokenized real-world assets (RWAs). For example, BlackRock’s BUIDL token, which represents shares in Treasury bill funds, trades on Terminal’s permissioned venue.

Analyzing the broader reallocation cycle and what lies ahead

The shift from bonds to on-chain yield infrastructure is no longer speculative, as structural drivers and even major studies have suggested that inflation will continue to hover between 2.5% – 3.5% for the foreseeable future (with even bonds never approaching the returns they offered back in the 1990s and 2000s).

Within this environment, yield-bearing stablecoins and their supporting infrastructures represent a real alternative avenue, one that is accessible, transparent, liquid, and efficient. Interesting times ahead!