Euro extends rally at 2 month high as NFP came in worst than expected. The U.S. Bureau of Labor Statistics today reported that nonfarm payrolls in the U.S. rose by 75,000 in May to miss the analysts’ estimate of 185,000 by a wide margin. Moreover, April’s reading got revised down to 224,000 from 263,000 and the wage inflation, as measured by the average hourly earnings, fell to 3.1% on a yearly basis in May. We are expecting numerous revisions to follow as analysts are already talking about three rate cuts until the end of the year, with the first as soon as July. The CME Group FedWatch showed that the probability of a rate hike in July rose to 75%. In the old continent, Bank of Italy recently announced that it expects the real GDP to expand by 0.3% in 2019 driven by consumer spending and exports. Reuters reported that the EU saw the disciplinary procedure over Italy’s debt was warranted.

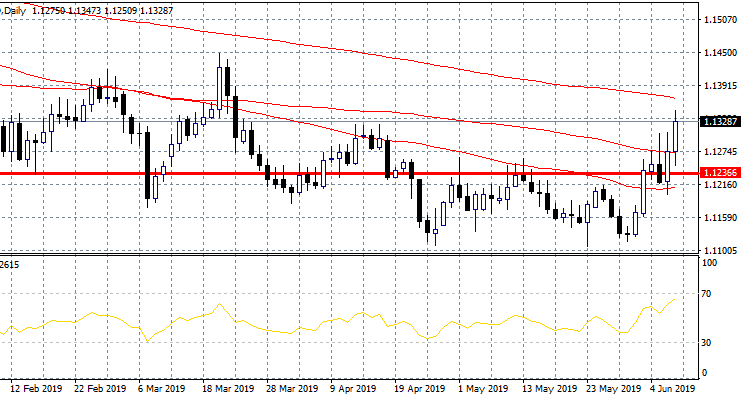

On the technical side, the bullish momentum gets stronger for the pair and now the key resistance is the 200 day moving average at 1.1371, a break above can drive prices up to 1.14. On the flipside immediate support stands at 1.13 round figure while more solid bids will emerge at the 100 day moving average at 1.1273.