EURJPY was lower as the market awaits retail sales data from the Eurozone this morning. The move lower is setting the Euro up for a third-straight daily loss versus the Japanese Yen after a good run of late. The pair pushed higher last week on news that Japanese PM Shinzo Abe would be retiring, but the market has pulled back as they believe the country will not diverge from its monetary policies of the last decade,

Despite being less affected by the coronavirus outbreak, the Japanese economy still took a big hit in the second quarter with a drop of -7.8%. The European economy was worse hit with a drop of -11.9% and this growth gap may be a key to the pair going forward. Japanese interest rates are currently -0.1%, while the European rate is 0% and there is still the potential for either country to go lower.

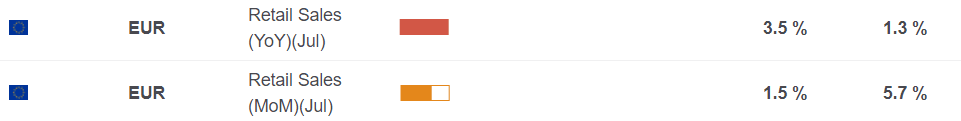

Eurozone Retail Sales Data

This morning sees the release of Eurozone retail sales with the market expecting a headline figure of 3.5% year-on-year, which would be an improvement from last month’s 1.3% figure. The monthly number is expected to dip from last month’s big 5.7% number, but this was based on the lockdowns ending and consumers returning to the shops.

The EURJPY pair will be keeping an eye on the Japanese election race with a vote set for September 14th. Defence Minister Taro Kono said this morning he supports Yoshihide Suga as the country’s next leader but also predicted he would be prime minister himself one day. Suga has committed to “picking up the baton of Abenomics,” in reference to his predecessor’s policies.

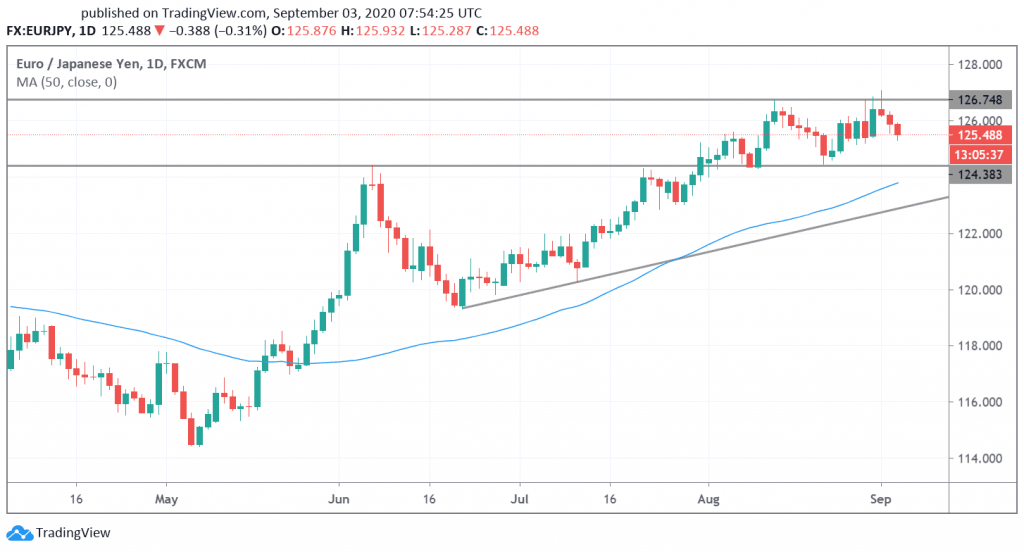

EURJPY Technical Outlook

The 126.75 level has contained the EURJPY pair and created a double top formation. There is some support at the current price of 125.50, but the market may want to try the bigger support at 124.50 and if that gives way then the market will move to the uptrend support line. Strong data from the Eurozone today could see buyers emerge once more and the 126.75 level is the key upside obstacle. Investing Cube has a Trading Course for those who wish to learn more about trading.

Don’t miss a beat! Follow us on Telegram and Twitter.

EURJPY Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.