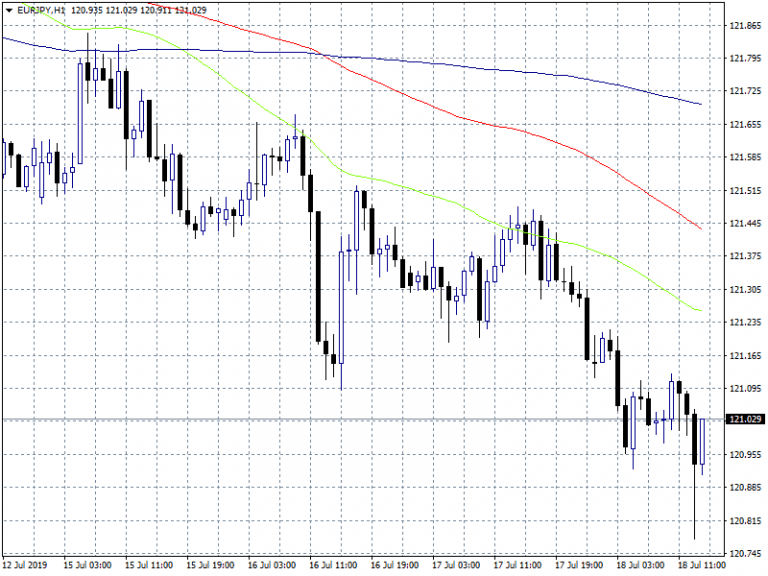

EURJPY is under heavy selling pressure after ECB studying the potential revamp of the bank’s Inflation Target. The news is dragging the euro lower against JPY making a quick visit at 120.77 from 121.02 levels earlier.

The pair faces the first resistance at today’s low at 120.77 while a break below will accelerate the downtrend to the low from Feb.7 2017 at 119.33. On the upside the pair will meet resistance at 121.26 the 50 hour moving average while more offers will be met at 121.44 the 100 hour moving average. Japanese yen may attract more buyers as it will act as a safe haven asset until we have a clear view about the inflation target. All in all traders has to be very cautious as there is possibility of a major reprising in global forex markets. A wait and see stance is the best investment decision for now until we have more details about ECB thoughts on inflation target.Don’t miss a beat! Follow us on Twitter.