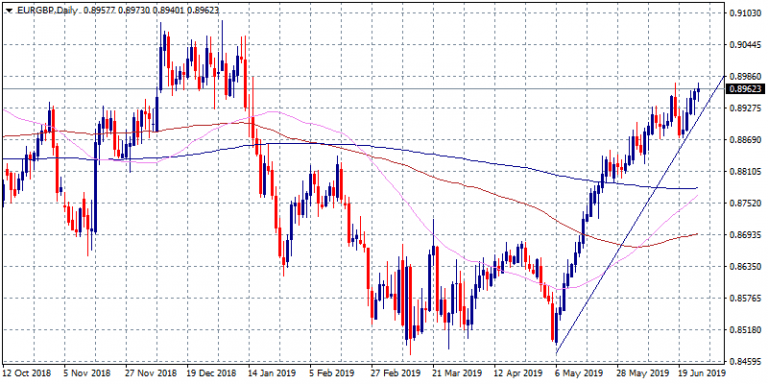

EURGBP is heading north for fifth day in a row amid pound weakness the last trading days. As we approach the October 31st deadline the uncertainty around Brexit increase enhancing the bearish bias for Sterling. BoE Governor Mark Carney in a speech today noted that UK has had the worst decade for real income growth since the 1850s. BoE’s Michael Saunders commented that the rolling Brexit deadlines increase uncertainty, and hurt economy’s growth. Earlier today the BBA Mortgage Approvals fell from previous 42.989K to 42.384K for May 2019. On the other side of the equation European Central Bank will cut the deposit rate by September, and analysts’ also expect one more follow up cut. Eurozone has its own problem called Italy. The S&P credit rating agency downgraded Italian 2019 GDP estimate to 0.1% versus it’s 0.7% previous estimate. The data coming out of the Mediterranean country are disappointing since the beginning of the year. An old EU problem, Greece is also heading to election polls in the summer, with the economy struggling to avoid another recession.

The bullish momentum holds well for the pair and an increase in volumes can drive prices up to 0.90 key resistance a convincing break above can lead price to yearly high at 0.9092 from January. On the downside 0.8860 the low from June 20 is the first support, followed by 0.8779 the 200 day moving average.