EURGBP has edged higher following this morning’s report that the UK manufacturing sector activity dropped to the lowest levels since February 2013 as the index came in at 48, and below the 50b-oom-bust threshold level.

The PMI index had as in the prior months risen as stockpiling took place ahead of the old proposed Brexit date, yet as the deadline for an exit was delayed until October 31 the stockpiling declined, and the index is now below levels seen following the 2016 EU referendum.

It could be that the effects of the stockpiling are what is driving the index excessively lower. However, similar surveys for the US, Europe, and China have all fallen in the last few months, which could suggest that the low activity in the manufacturing sector is here to stay.Source: Markit Economics

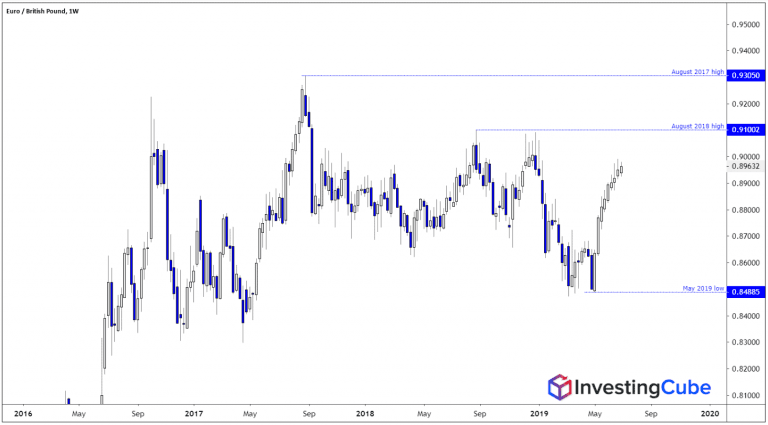

As for the Euro to British Pound pair, the price has been in a steady uptrend since May when the price reached a low of 0.8488, and the price edge higher today following the softer than expected PMI figures. The next natural resistance level is the 0.90 level, followed by the August 2018 high of 0.91, and the August 2017 high of 0.9305. The move higher can be explained with the resignation of Theresa May, and the possible election of Boris Johnson or Jeremy Hunt as the next Tory leader and likewise UK PM. Both candidates have said that they are ready for a no deal Brexit, so it is fair to assume that the move higher in EURGBP is due to their Brexit stance.

My view on the EURGBP is that the price should be able to drift higher and try to take out last year’s high at 0.91 as Boris Johnson is confirmed as the new UK PM, yet I would not trade the EURGBP, as the risk-reward ratio is bad for fresh long positions. When the election of the new PM is over the sale pressure on GBP could reside slightly as the negative news would be priced in, and the next move higher in the EURGBP would be on clear steps that the UK will leave the EU with no deal. A break to the 0.91 level, could suggest that traders have started to price in no-deal Brexit.

While hints showing the UK will be able to leave the EU with a deal should allow EURGBP to trade back to the mid-point of the last two year’s price range.Don’t miss a beat! Follow us on Twitter.