The EUR/USD is rising ahead of the ECB interest rate decision that will come out at 12:45 GMT and the US jobless claims numbers that will be released in the afternoon session. The EURUSD is trading at 1.2130, which is slightly higher than yesterday’s low of 1.2050.

What’s happening: The biggest mover today will be the first ECB rate decision of the year. The bank is expected to leave interest rates unchanged and possibly sound a bit dovish in its bid to continue devaluing the euro. Also, the ECB will leave its target for the pandemic quantitative easing program intact at 1.35 trillion euros.

The EUR/USD will also react to important economic numbers from the United States. The BLS will publish the first jobless claims numbers during the Biden presidency. These numbers are expected to show that more people applied for jobless claims last week. That’s because of the recent lockdowns and the fact that the recent stimulus package encouraged more people to sign for claims. We will also receive the housing starts and building permits numbers today.

EUR/USD ECB prediction

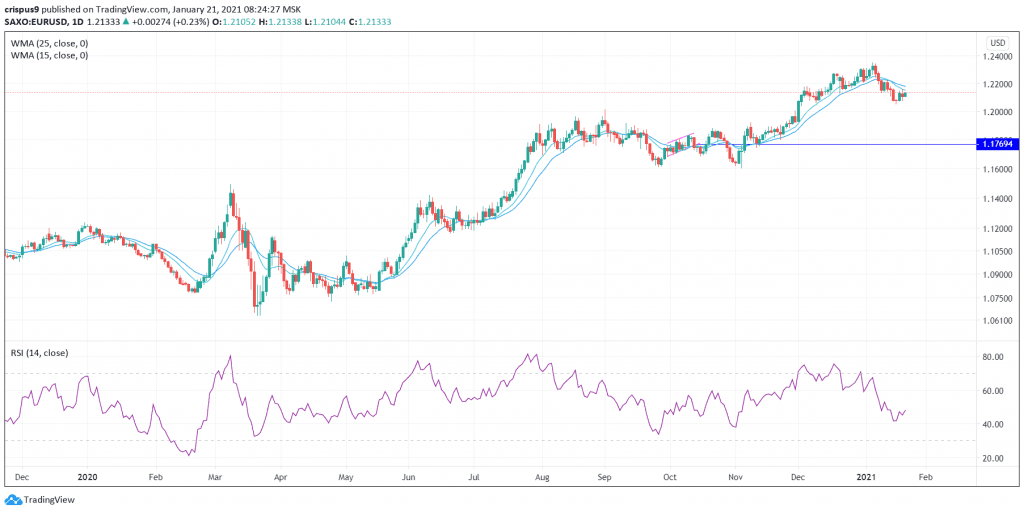

On the daily chart, we see that the EURUSD formed a doji pattern on Monday, leading to more fains in the past three days. Still, the pair remains below the 25-day and 15-day weighted moving averages. Therefore, despite the recent gains, we believe that the pair will resume the downward trend, with the next level to watch being Monday’s low of 1.2050. However, in case of a hawkish ECB, the pair will possibly soar to 1.2200.

Don’t miss a beat! Follow us on Telegram and Twitter.

EUR/USD technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.