DAX index trading 0.98% lower at 11,565 as investor’s got hit by terrible German and EU macro data. The German ZEW Economic Sentiment came in at -44.1 below expectations of -28.5 for August, the Current Situation came in -13.5 also below expectations of -7 in August. Another disappointment also came from the EU Economic Sentiment which came in at -43.6, below expectations of -21.7 in August.

Weakness of Yuan continues as PB of China set the fixing at 7.0326 versus yesterday’s fix of 7.0211. Poltical turmoil in Italy also weighs on traders sentiment as Prime Minister Salvini aiming for snap election as early as October.

DAX index makes today fresh two month lows, dragged by Henkel AG -6.75%, Deutsche Lufthansa AG -4.39%, Thyssenkrupp AG -2.89%, and Deutsche Bank -2.80%. On the other hand, Fresenius SE is 1.29% higher while Deutsche Telecom is 0.29% higher.

Recent disappointing macro news support a dovish stance from European Central Bank as poor economic data may push the European Central Bank to proceed with further stimulus to support the EU economy in September.

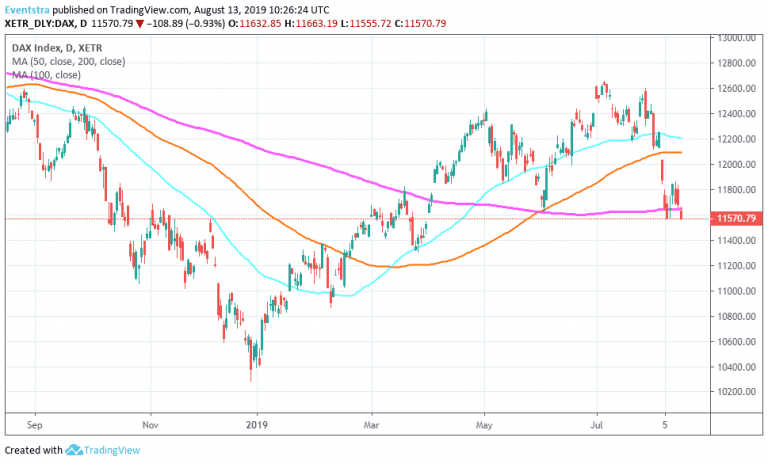

DAX negative momentum is accelerates after the index broke below the 12,000 mark and the 100 day moving average. Today the index breached the 200 day moving average as bears are ruling the game. Immediate support for the DAX index stands at 11,386 the low from March 27th while extra bids will emerge at 11,000 round figure. On the upside immediate resistance stands at 11,663 today’s high and then at 12,094 the 100 day moving average.

In London the FTSE 100 gives up 0.56% at 7,186, while CAC 40 is 0.61% lower at 5,277. In Wall Street, the futures also trading lower, the Dow futures are 0.17 percent lower at 25,810 while the S&P futures are 0.19 percent lower at 2,874 and the Nasdaq is 0.34% lower at 7,541, signaling a negative start for U.S. equities.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.