- The AUD/JPY forex pair has stayed on the uptrend despite rising demand for gold and AI bubble warnings signaling underlying risk sentiment

- Australian dollar's strength is no longer seen as commodity-dependent, thanks to hawkish Reserve Bank of Australia

- Japan's government is likely to continue with high spending which could weaken the yen further

The AUD/JPY pair, often seen as a gauge of global risk sentiment, has been trending upward since April 2025. It has climbed from around 86.14 to nearly 109.74. So far this year, the pair is up over 4.96%, even with slower commodity demand like oil, warnings of an AI bubble, and strong safe-haven demand for gold, which has jumped over 70% since last year.

Under normal conditions, the Australian Dollar is supposed to sink when commodities stall, and the Yen supposed to soar when investors run to safe havens like gold. So what’s going on here? In this article, we seek to make sense of the current divergence and what it tells us.

Why “Risk-On” is Winning

Normally, if gold is at record highs, risk-on pairs like AUD/JPY should drop. But, the widening yield gap is changing this pattern. The big reason is the different monetary policy approaches of the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ).

Many people were surprised when the Reserve Bank of Australia (RBA) raised the cash rate to 3.85% on February 3, 2026. Governor Michele Bullock said that the main reasons were stickier-than-expected inflation and a labor market that was tighter than expected.

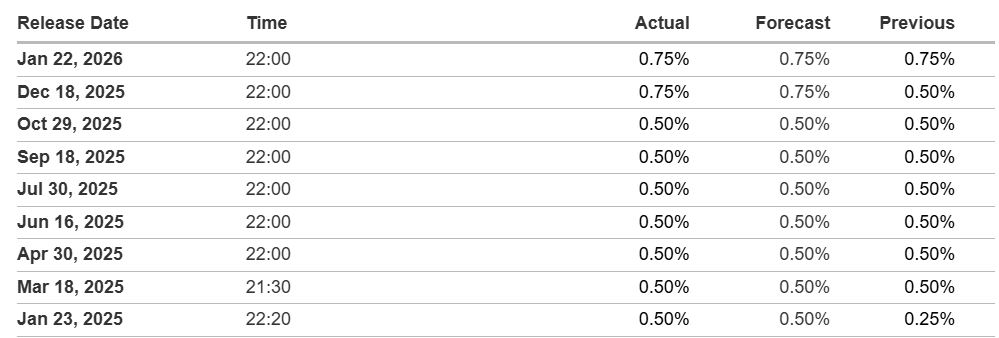

Meanwhile, across the pond, the Bank of Japan (BoJ) is in a peculiar spot. Despite raising rates to 0.75% in late 2025, the new administration under Prime Minister Sanae Takaichi is pushing a dovish, expansionary fiscal agenda.

This is good for the carry trade. Investors are borrowing Yen at less than 1% to buy Aussie Dollars yielding almost 4%. This interest rate difference is attracting capital, overshadowing concerns about falling oil prices or the tech sector.

For unique perspective, consensus overlooks how Japan’s fiscal expansion under Prime Minister Takaichi might exacerbate yen weakness, sustaining the uptrend longer than anticipated, even as gold signals caution.

Bank of Japan (BoJ) interest rate decisions in the last year. Source: Investing.com

Reserve Bank of Australia (RBA) interest rate decisions in the last year. Source: Investing.com

Challenging the Consensus: AUD Is More than A Commodity Currency

Most analysts are warning that an AUD/JPY correction is “overdue” because of commodity weakness. But the other side of the story is that Australia is no longer just a iron ore economy. The rise in 2026 is being caused by money flowing into Australian bonds, which now have some of the best real yields in the developed world.

Is AUD/JPY the Best Pair for Carry Trade in 2026 or Is this a Calm Before the Storm?

AUD/JPY remains a prime carry trade candidate for 2026, with IG International forecasting continued upside driven by commodity support and yen intervention thresholds around 160 in USD/JPY.

The Economic Calendar for late February has some Japanese inflation data that could make the yen volatile. Still, demand for the AUD carry trade is strong. We’re seeing a decoupling where AUD/JPY is acting less as a commodity proxy and more as a yield-spread play.

AUD/JPY Forecast Today

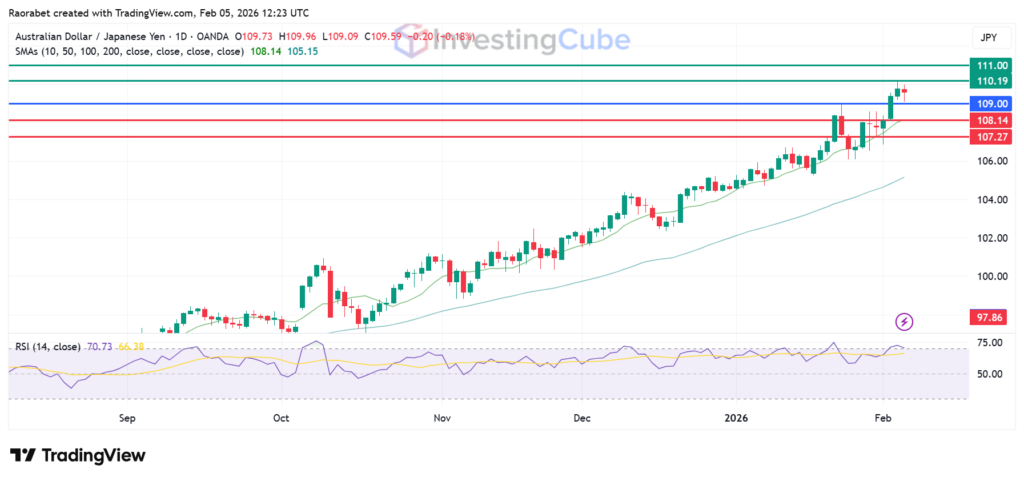

The AUD/JPY pair is now testing a resistance zone near 110 historic milestone. A break past the 110.19 mark will set the stage to target record 110.00 all-time highs. The 10-day SMA at 108.14 is the first level of support, and 107.27 is the next level down. The RSI at 70 signals that the pair is currently overbought, which calls for a cautious approach.

For new entries, wait until the price drops back to 108.00. Because of how volatile it is, keep your position size small. You should only risk 1.5% of your account equity on each trade. If the BoJ suddenly changes direction in March, a strategic stop-loss should be set at 106.90 to protect against a flash crash.

AUD/JPY on the daily chart with resistance and support levels for February 5, 2026. Created on TradingView

Policy divergence with RBA hawkishness widening yields, yen fiscal weaknesses, and low volatility sustaining carry trades defy consensus on risk-off signals from oil and AI concerns.

Gold above $5,000 shows caution in the face of tensions, but AUD/JPY’s risk proxy role continues through carry dynamics. This goes against the idea that safe-haven flows always put pressure on commodity pairs.

There is a moderate risk. Prime Minister Takaichi’s government would rather have a currency that is competitive to help exports, even though the Yen is weak. There won’t be any intervention unless the pair goes up to 115.00 in a matter of days.