- Rolls Royce order book and broader fundamentals are currently at the best they've been in years

- However, military orders have cooled down recently

- Fed interest rate decision could impact market sentiment.

Have you noticed Rolls-Royce Holdings plc (LSE: RR.) shares seem less exciting recently? Currently, the stock is at 1,118p, down about 3% from 1,161.00p on November 10. Even though the stock has increased about 700% over the past five years, this recent drop has investors wondering what’s up. What’s causing this negative trend, and is it just a small adjustment or the start of something bigger?

What Caused the Drop?

The most immediate cause for the decline appears to be a confluence of factors, primarily driven by market dynamics following the company’s significant outperformance.

After almost doubling in value this year, some investors are taking their profits, which is a big reason for the recent decrease. Supply chain problems are adding to the stress. On November 13, Rolls-Royce said it’s still having trouble getting parts for its civil aerospace division, which is a key source of income. These bottlenecks, exacerbated by global industrial slowdowns in the UK, could delay production and erode margins.

Broader sector headwinds play a role too. Demand for military aviation, which previously helped shares, is slowing, and economic worries in Europe are hurting investor confidence. Also, the global economy, along with possible interest rate decisions from central banks like the Federal Reserve, is creating general uncertainty. In such an environment, highly-valued or volatile stocks like Rolls-Royce often see selling pressure first.

Will It Shatter the 1,000p Barrier?

Many are wondering if the stock price could go below 1,000p. It’s plausible if supply woes persist or if broader market jitters intensify. Longbridge Securities warns that a decisive drop under this support would invalidate bullish setups, potentially ushering in further erosion toward 900p.

But, fundamentally, the company is actually doing better now than it has in years. The operational turnaround is yielding strong results, with the firm confirming robust expected underlying operating profit and free cash flow for 2025. This strong fundamental health provides a solid barrier against a catastrophic collapse.

Technically, a temporary drop below 1,000p is possible, especially if the market corrects. Technical analysis indicates that sellers are targeting the 1,000p level. If selling pressure pushes the stock below this point, it could trigger stop-loss orders and briefly speed up the decline.

Rolls Royce Share Price Prediction

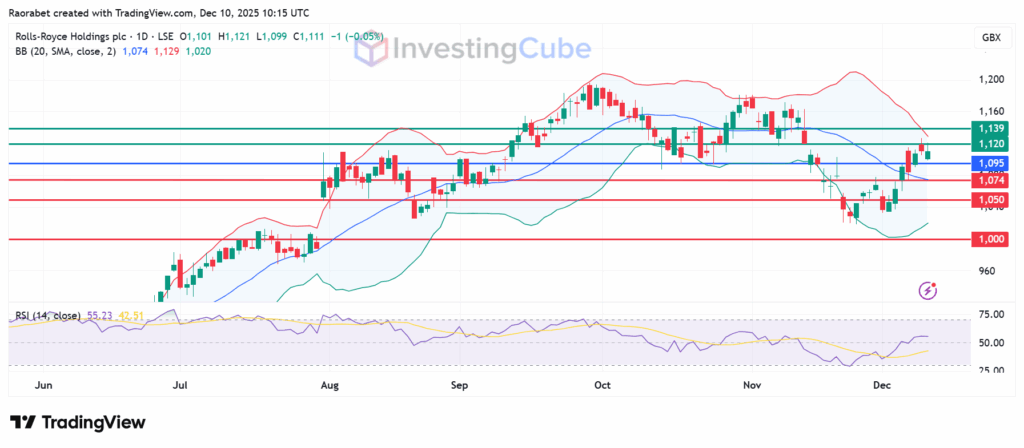

The momentum on Rolls Royce share price pivots at 1,095p and the upside is likely to continue in the near-term, with the RSI at 55. The first barrier is likely to be at the upper Bollinger Band at 1,120. Breaking above that level could create the path to test 1,139. Going below 1,095 will signal a bearish momentum with key support levels at 1,074p and the second one at 1,050p. Action below that level could trigger a deeper correction that could break below the lower Bollinger Band and test 1,000p.

Rolls Royce stock price daily chart on December 10,2025 with key support and resistance levels. Created on TradingView

The main reason appears to be significant profit-taking after the stock’s massive rally throughout the year, compounded by a stretched valuation with a high forward Price-to-Earnings ratio. This leaves the stock susceptible to minor corrections.

The 1,000p mark is a crucial psychological and technical support level. If selling pressure pushes the price below this point, it could trigger further automatic selling, potentially accelerating a short-term drop.

These disruptions delay engine production in the civil aerospace segment, a major revenue driver, especially considering the 18% higher flying hours year-over-year.