- The crypto market has been showing signs of weekness in recent days, but even in this, its still possible to find winners.

The crypto market has been showing signs of weakness, with an extended period of consolidation. Nonetheless, Bitcoin, Ethereum and Tron prices still have it in them to take a contrarian posture.

Bitcoin

Bitcoin price has been in consolidation for the most part in the last two weeks, with an evident struggle to reclaim the $115k support. That has put it at an inflection point, with the potential to swing on either side. Despite its recent struggles, many whale investors are actively accumulating the crypto market bellwether.

According to IntoTheBlock data, the number of transactions valued at $100,000 or more has risen from 7,748 to 10,540 in the last two days. That signals an underlying bullish sentiment that will likely shift the momentum to the upside in the coming days.

In addition, BTC price upside is favoured by the significant rise in exchange outflows in that period. The net flow volume declined sharply from $-31.97 million to -$515.92 million in the last two days, indicating low selling pressure. This set up favours Bitcoin price to keep prodding the $115k barrier and potentially break above it.

Bitcoin Price Prediction

Pivot: BTC pivots at $113,625.

Resistance: First barrier will likely be at $114,770. Second one at $115,956.

Support: Initial support at $112,625. Action below that level will invalidate the upside view. That could clear the path to test the second support at $112,000.

Ethereum

Ethereum’s upside this year has largely been supported by a strong uptake at the spot ETF market. After successive losses in the previous two sessions, Ethereum spot ETFs registered net positive outflows worth $73.3 million on Tuesday, signaling the recovery of investor confidence.

Meanwhile, Ethereum price has held steady above the psychological $3,500 support, with its 24-hour trading volume down by 11%. With Ethereum price down by 1.3% in that time period, it is likely that the selling pressure could decline and give way to bullish control. In addition, Ethereum chain’s DeFi performance remains strong, with DeFiLlama data showing that its Total Value Locked (TVL) grew by 27% in the last month to hit $81.87 billion. That shows strong utility that could bring tailwinds to Ethereum price in extension.

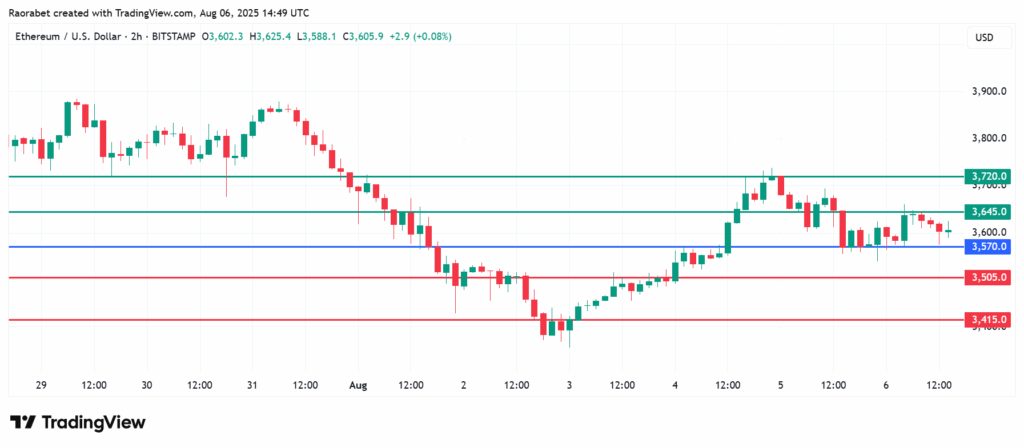

Ethereum Price Prediction

Pivot: ETH price pivot is likely o be at $3,720. Action above that level signals bullishness.

Resistance: Initial resistance will likely be at $3,645. Secondary resistance at $3,720.

Support: First support likely to be established at $3,505. The upside narrative will be invalid below that level. Second support likely to be at $3,415.

Tron

Tron stands out among the top cryptocurrencies, being the only one among the top ten ranged coins with gains in the last week. That has resulted in a more positive sentiment that will likely provide near-term support. The Tron ecosystem has been experiencing a strong burn rate, with about 40 billion TRX permanently removed from circulation. This increasing supply reduction augurs well for the coin’s medium-term and long-term growth prospect and many investors will find it attractive.

In terms of technicals, Tron share price has its Relative Strength Index (RSI) at 66 on the daily chart, aligning with the upside narrative. Furthermore, at its current level, the coin trades above the 10,20, 50, 100 and 200 SMA levels on the daily chart, adding credence to the likelihood of continuation of the upside movement.

Tron Price Prediction

Pivot: TRX price pivots at $0.331 and action above that level favours the buyers to stay in control

Resistance: Primary Resistance is likely to be at $0.336. Breaching that level could push the action higher to test $0.340.

Support: First support will likely be at $0.326. Action below that level will invalidate the upside narrative. Second one could come at $0.321.