- The crypto market has been driven primarily by Bitcoin's momentum and performance of the ETF market. We analyse BTC ETH and BCH prices today.

Bitcoin

Bitcoin price has held the $105k support for the last four days and will likely stay on the upward trajectory in the near-term if it stays above that level. The coin’s daily RSI is at 55, and it has held above the middle Bollinger Band for the last two days, adding credence to the likely continuation of the upside.

A barrier has been emerging at the $108k in the last three days and flipping that mark to a support could provide traction to march towards $110k. Inflows from Bitcoin spot ETF market have stayed steady, with Wednesday’s session recording $547.7 million worth of net inflows. Institutional appetite for the coin remains strong, and that could help keep the action to the upside.

On the downside, however, BTC price is currently down by 0.5% and its 24-hour trading volume is up by 2%. That signals a potential takeover by the sellers, which could put a lid on the upside.

Bitcoin price prediction

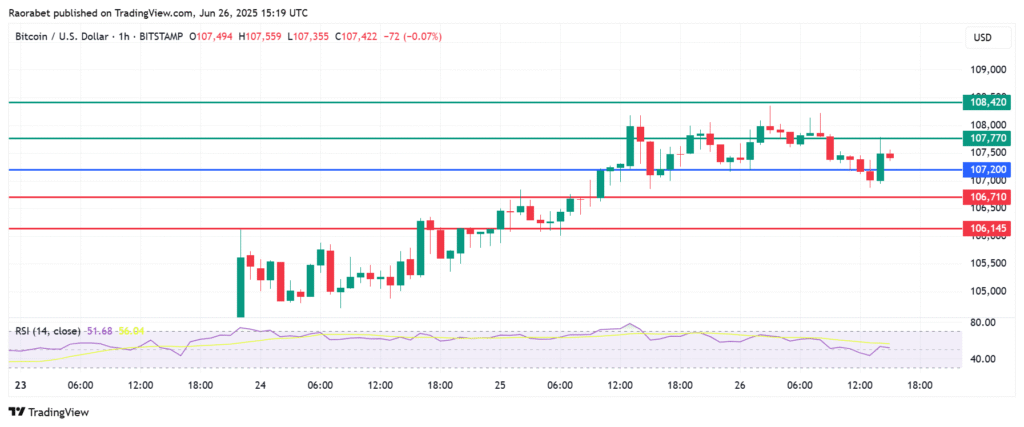

Pivot: Bitcoin price pivots at $107,200 and the upside will prevail if action stays above that level. Otherwise, the sellers could take control.

Resistance: Primary resistance likely at $107,770. Secondary at $108,420.

Support: Initial support likely at $106,710. Action below that level will invalidate the upside narrative. Second support likely at $106,145.

Bitcoin Cash

Bitcoin cash has been on an ascending channel on the daily time frame since early April, and has a strong accumulation around $400k, which will likely serve as near-term support. Notably, it is the top performing crypto coin among the top ten ranked assets in the last 24 hours, having gained 2.45% in that time frame. In addition, Coinanalyze data shows that the coin’s Open Interest rose by 15% in the same time frame to $316 million.

BCH price momentarily broke above the upper Bollinger Band earlier in the day, and the $500 mark is the key psychological barrier. The coin formed a golden cross in mid-June, affirming the bullish hold. However, the Bitcoin cash price gains in the last 24 hours have also been accompanied by a 10% decline in the trading volume in that time. That signals a weakening buying appetite that could trigger a reversal.

Bitcoin Cash Prediction

Pivot: Bitcoin cash will likely find a pivot at $484. The momentum favours the upside to prevail.

Resistance: The first resistance will likely be at $500. Breaking above that level could clear the path to test $515.

Support: Initial support at $480. Breaking below that level will invalidate the upside narrative. Second support could come at $475.00

Ethereum

Ethereum price upside is primarily supported by a strong performance in the ETF market, which is pushing it towards the $2,500 mark. The crypto coin is trading at $2,449, and a break outside the $2,380-$2,520 range could signal the onset of either a stronger upside or downside price action.

Elsewhere in the ETF market, Ethereum spot ETFs have been going toe-to-toe with Bitcoin, and had $60.4 million worth of net inflows on Wednesday. That was the third successive day of gains and it signals strong institutional confidence in the coin’s upside potential.

However, Ethereum price upside is likely to be limited by the underperformance in the DeFi market. According to DeFiLlama, Ethereum chain has experienced a 2.6% decline in DeFi TVL to $61.622 billion; denoting reduced utility for the coin.

Ethereum Price Prediction

Pivot: Ethereum price pivots at $2,425 and action above that level calls for further upside. Resistance: The first resistance will likely be at $2,470. Breaking above that level will clear the path to test $2,500.

Support: First support is likely to be at $2,380. The upside narrative will be invalid if the price breaks below that level. Such momentum could push the action lower and test $2,340.