- Nike stock price momentum is upbeat after posting impressive earnings beyond analysts' forecasts, and its guidance is similarly upbeat.

Nike stock price rose by as much as 18% in early trading on Friday, with investors putting their weight behind the company after it posted forecast-beating results. The company reported an EPS of $0.14, beating the forecast figure of $0.11 in the first quarter of the year. In addition, its revenues came in at $11.1 billion, beating analysts’ median forecast of $10.7 billion.

Despite the 12% year-on-year decline in revenue, investors are upbeat on the company’s prospects as the earnings were better than the forecast decline of 15% for the quarter under review. On the downside, the company cited a tariff-induced $1 billion headwind, which it says will be offset by price hikes and supply chain diversification . The diversification strategy will include reducing the share of US-bound inventory from China to single digit percentage from 16%.

Overall, the management gave an optimistic forward guidance, taking a contrarian posture to most analysts’ forecasts. While still expecting continued pressure on margins in the first half of FY2026, it expects better performance in the second half.

The sportswear giant says it intends to liquidate its old inventory in the next two quarters- a strategy that could bring it substantial inflows. Also, it will shift its focus to multi-channel inflows with a strong digital push. Furthermore, Nike (NYSE: NKE) will integrate greater attention to performance sportswear, including specialty models like women’s wear.

Nike Stock Price Prediction

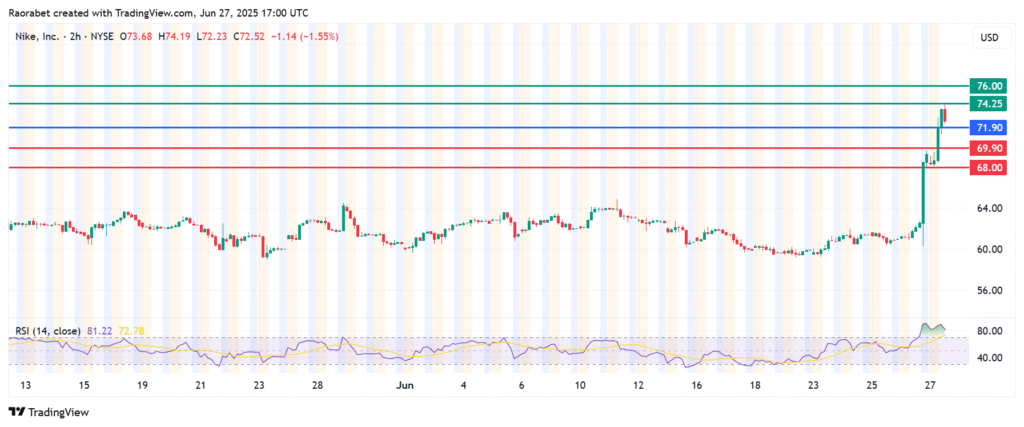

Nike stock price pivot mark is at $71.90 and the upside looks likely to continue above that level in the near-term. That momentum will likely meet initial resistance at $74.25. An extended control by the buyers will break above that level and potentially test $76.00.

Alternatively, going below $71.90 will invite the sellers to take control. That will likely see primary support level established at $69.90. Breaking below that level will invalidate the upside narrative. In addition, a stronger momentum could push the stock lower to test $68.00.