- Bitcoin price is likely to stay on the upside, with key metrics signaling agressive institutional accumulation and low selling pressure.

Bitcoin price has retested the $107k mark for the first time in four days, signaling a potential breakout after its recent range-bound trading. The crypto coin was up by 1.07% and traded at $106,750 at the time of writing, but the underlying momentum calls for further upside. According to CoinMarketCap, approximately $43 billion worth of BTC was traded in the 24 hours leading up this article, representing a 22% uptick in trading volume in that time frame. That signals growing buyer appetite, which augurs well for the price upside.

Whale Appetite Pushes Bitcoin Price Up

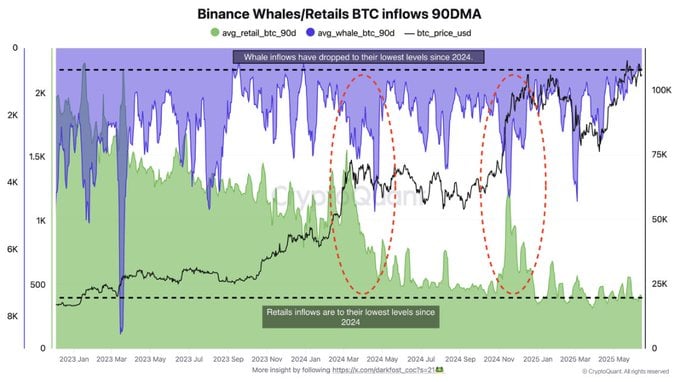

Meanwhile, CryptoQuant reports that both institutional and retail inflows into Binance have dropped to their lowest level since November 2024. That signals a rising affinity to hodl the coin rather than trade it, and a continuation of that trend favours gains by Bitcoin price. Japan’s MetaPlanet is the latest large scale institutional buyer, with its total BTC holdings hitting 10,000 coins-more than Coinbase’s-after purchasing 1,112 BTC in its latest purchase. Meanwhile, Strategy’s latest accumulation was a 10,100 BTC acquisition, bought for $1.05 billion at an average price of $104,080.

Inflows into Binance exchange. Source: CryptoQuant

The strong institutional appetite for Bitcoin is also reflected in the ETF market, where Bitcoin saw $301.7 million worth on net inflow on Friday and is on a five-session winning streak. That momentum is likely to continue as the United States and China trade trade talks promise positive outcome. This sentiment carries low risk, which favours gains by digital assets.

Bitcoin Price Prediction

The momentum on Bitcoin price favours the upside to continue above the pivot mark at $106,570. That will likely meet initial resistance at $107,520. However, an extended control by the buyers will break above that level and potentially test $108,300.

Alternatively, BTC price could break below $106,570 and shift the momentum to the downside. In that case, the first support is likely to be at $105,835. Breaking below that level will invalidate the upside narrative and an extended control by the sellers could send the price lower to test $104,870.