- Up by more than 23% in the last week, Hyperliquid (HYPE) is on a strong momentum, and institutions are fighting for a piece of the action.

Hyperliquid is a Layer-1 blockchain that was developed with the express purpose of facilitating perpetual futures trading in DeFi. Hyperliquid has a fully on-chain order book, very low gas fees, and quick execution. This is different from many DEXs that use off-chain order books.

Thanks to these features, trading is nearly as easy as on a centralized exchange, but with the added safety and transparency of on-chain settlement. The ecosystem is powered by HYPE, its native coin.

Why is the coin soaring?

Strong on-chain fundamentals and major market developments have recently propelled Hyperliquid’s native token, HYPE, to new heights. The platform has experienced an enormous rise in trade volume and daily earnings, making it one of the best blockchain platforms for generating revenue.

The rise, which is up 23% in the last week, is attributed to Hyperliquid’s announcement of USDH, a “Hyperliquid-first” stablecoin. Issuers such as Sky, Paxos, Frax Finance, and Agora are engaged in a heated bidding war to launch USDH. Some of the proposals include validator voting and income sharing for the ecosystem. HYPE’s gains have seen it beat leading crypto coins, with Bitcoin price having risen by 2%, Ethereum having declined by 0.5% and XRP up by 7% in the same period.

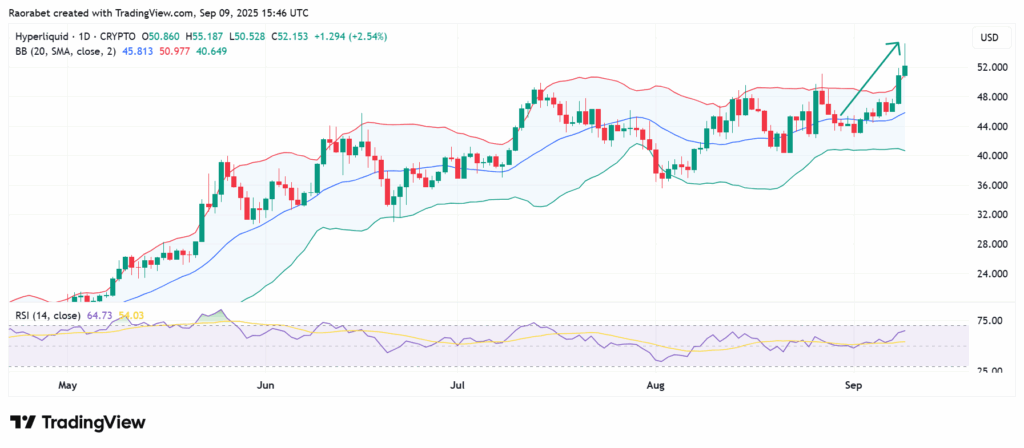

HYPE Price has recently broken above the upper Bollinger Band on the daily chart with the RSI at 64. Source: TradingView

Meanwhile, Lion Group, which is listed on Nasdaq, is converting its Solana and SUI assets into HYPE. The company says this is because the USDH stablecoin custody is coming soon and they have a systematic plan for how to build up their holdings.

Adding fuel to the fire, Jan van Eck, the CEO of VanEck, openly backed Hyperliquid, showing that institutions are interested as whale behavior and speculative trading rise. This comes after August’s record $105 million in protocol revenue, which was 21% more than the month before.

What are its Growth Prospects?

Hyperliquid’s growth seems to be on track for a good run for 2025 and beyond. Some analysts believe HYPE could exceed $100 if the user numbers of USDH, DeFi integrations, and trading volume rise substantially. Also, if the launch of the stablecoin USDH goes well and more institutions get involved, the HYPE token could stay in high demand. The buyback mechanism supported by stablecoin yield could help with this.

Hyperliquid has a lot of potential for growth, but there are also risks. The platform has shown that it can compete with and even beat established competitors in some metrics, but its future success hinges on a few critical things. In addition, there are the usual risks that come with crypto, such as price swings, unclear regulations, and the risks of associated with transaction bottlenecks such as slow execution.