- Ethereum price is propelled by a high institutional appetite and but a cost-basis analysis shows that more investors are more likely to sell.

Ethereum price hit 15-week highs of $2,835 backed by a strong institutional appetite. The crypto coin had subsided to trade at $2,793 at the time of writing, supporting a cost basis analysis pointing to a potential weakening of momentum near the $2,800 level. The coin’s 24-hour trading volume was up by 28%, signaling rising investor interest. In addition, ETH weekly active addresses hit new all-time highs of 17.4 million, adding credence to the upbeat view.

Meanwhile, ETH price upside is also supported by an uptick in open interest . According to Coinanalyze, ETH’s open interest rose by 8.77% in the last 24 hours, hitting $18.6 billion. The rising investor confidence is also reflected in the ETF market, where the coin’s nine US-traded spot ETFs recorded $125 million worth of inflows on Tuesday-the largest inflows in a single day since February 4th. Also, the number of ETH staked has risen to a record 38,824,598 coins, translating to reduced supply on exchanges, which could mean reduced sell-side pressures.

ETH Cost Basis Data Sends Warning

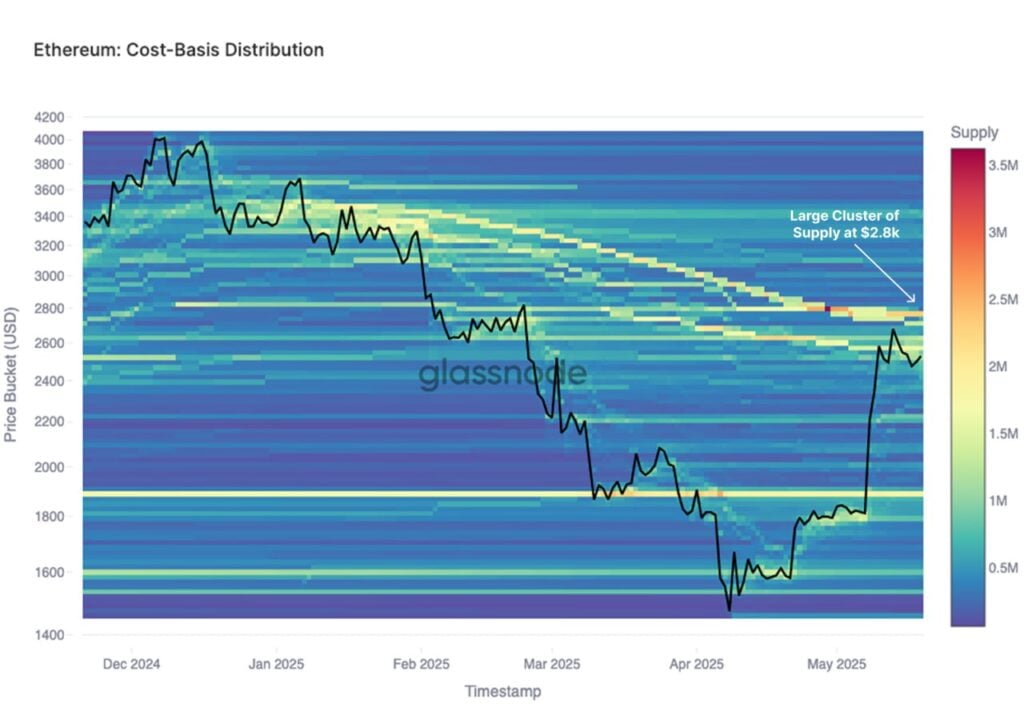

However, ETH could encounter headwinds in the near-term. According to blockchain data aggregation site, Glassnode, Ethereum price has entered a zone of investor concentration, with a substantial number of ETH coin holders set to break even at $2,800. That will likely increase selling pressure, which could limit the coin’s upside.

Ethereum Price Prediction

Ethereum price pivots at $2,760 and the momentum calls for further upside above that level. The coin will likely meet initial resistance at $2,820, but an extended control by the bulls will break above that level and potentially test $2,870.

On the other hand, going below $2,760 will invite the sellers to take control. That will likely see the first support established at $2,710. The upside narrative will be invalid below that level. In addition, a stronger downward momentum could extend the decline and test the second support at $2,660.