- Bitcoin price has been trading in a tight range and even threatened to retest the $110k support. What's going on? Will it recover?

Bitcoin price has struggled for upside momentum in the last month, with a negative return of about 2.8% and threatening to retest the psychological $110k support. After rising strongly in the earlier part of Q3, consolidation has kicked in and many people wonder what it could take to break out again.

Futures are now tied to spot, and there are no longer any high-interest liquidation setups, so the market is trading more like traditional finance. Retail traders aren’t rushing in, and even while institutions are helping, there hasn’t been enough purchasing power to push breakouts forward.

Why is Bitcoin Price Declining?

Profit Taking

Institutional investors, long-term holders, and whales have been selling off their holdings, with a notable spike in appetite to take profit. For example, whales sold more than 100,000 BTC in the last 30 days, which is the highest since mid-2022. On-chain data also suggests that realized gains peaked in July, hence the incentive to sell. Trade tariffs have also sparked panic selling and a buildup of currency reserves that are taking in new demand have only worsened the situation.

Macroeconomic pressures

The underperformance of the broader economy is one of the main reasons why Bitcoin has been having a hard time lately. The crypto market does not operate in isolation from the rest of the world; it is very connected to global financial trends. Bitcoin and other risk-on assets are encountering challenges as central banks, notably the US Federal Reserve, deal with inflationary pressures and tough interest rate decisions.

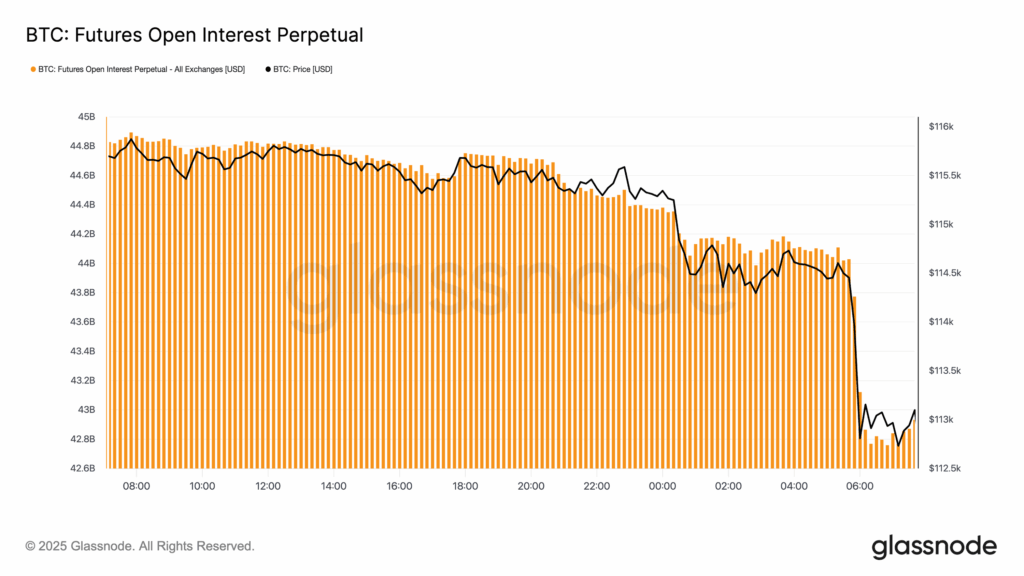

According to Glassnode, BTC futures open interest fell from $44.8 billion to $42.8 billion on Tuesday, as the price dropped below $112,000. Open interest going down can imply that people are taking profits after a rally or that they are being careful because they think the market will be volatile. Either way, it indicates people are less willing to take risks in derivatives markets. Also, less speculation can help the derivatives market stay stable and lower the risk of liquidation.

Bitcoin Open Interest Futures performance. Source: Glassnode

However, as Bitcoin continues to struggle for traction, the S&P 5000 and gold prices are rising to new highs. This might hurt Bitcoin price as investors go for safer, more profitable options in traditional assets.

Technical lockdown

Also, much of the recent decline in Bitcoin price might be explained by technical factors. The coin has been holding steady inside a well-defined trading range, marked by strong resistance and support levels. Notably, there has been a significant psychological and technical barrier that the price has failed to convincingly overcome on multiple occasions. As a result of this, traders are playing a wait and see game and are hesitant to pick a direction until a clear breakout happens.

What’s the Path to Recovery?

Potential catalysts for accelerated upside by BTC include a robust US economy, widespread adoption, or geopolitical events that support hard assets. On the other hand, higher inflation or policy changes could make things worse. In addition, large inflows into spot ETFs and Bitcoin treasury adoptions could start up again, and that would absorb supply and provide a stable floor for the coin. Both mainstream adoption and fear of missing out (FOMO) could be intensified by actions such as the potential inclusion of Bitcoin-related stocks like MicroStrategy in the S&P 500.

In Conclusion

In conclusion, the recent limited movement by Bitcoin price may not be very exciting, but it is a good way to settle down after a prolonged time on the rise. There is a lot of uncertainty in the global economy right now, and the market is also facing technical resistance. The next major development that will happen with Bitcoin will probably be caused by a mix of more institutions adopting it, a better overall economy, or the long-term impacts of its supply-side.

Bitcoin’s price has been struggling because of uncertainties in the economy as a whole, such as central bank policy, and investors taking profits after initial rally.

Some possible drivers are more institutions adopting it, a better macroeconomic environment, and the long-term repercussions of the recent halving event.

There is a lot of unpredictability in the global economy due to developments like interest rate changes and inflation. Because of this, Bitcoin and other high-risk assets are being handled with caution by investors.