- Bitcoin price has stayed on the downtrend despite the recent interest rate cut by the Federal Reserve

- ETF flows still point to strong institutional uptake of Bitcoin but the appetite is tamed

- The less-dovish-than-expected stance by the Fed raises the prospect of increased cautious stance

Bitcoin price’s recent dip below $90,000 has everyone in finance talking, especially since it happened after the Federal Reserve decided to cut interest rates for the third time this year. Usually, when the Fed makes it easier to borrow money, assets like Bitcoin should do well. But the market’s reaction suggests there’s more going on than meets the eye. Over the weekend, lower liquidity pushed Bitcoin to $89,000 amid broader market declines, with Ethereum down 4%. However, trading volumes don’t show panic selling yet. So how did we get here and what’s the near-term outlook?

Fed Rate Cut Fails to Trigger “Selling the News”

The BTC price dip was mostly from a classic buy the rumor, sell the news reaction. The Fed’s rate cut was expected and already factored into the prevailing price. Bitcoin briefly jumped to $93,000-$94,000 range after the announcement but quickly fell back.

The Fed’s cautious approach disappointed some, with inflation at 2.3% and unemployment at 4.2% limiting aggressive easing. The careful tone reduced risk appetite, causing profit-taking and a move away from high-risk assets like Bitcoin. It shows that Bitcoin, even though it’s decentralized, is still affected by what’s happening in traditional financial markets.

Bitcoin ETF Flows Send A Mixed Signal

Bitcoin ETFs, which allow institutions to invest in Bitcoin, paint a somewhat positive picture, but with some reservations. Through December 12, net inflows reached $258.7 million, with Fidelity FBTC leading at $198.85 million, which offset BlackRock’s IBIT outflows of $135.44 million. Since their launch in early 2024, the iShares Bitcoin Trust (IBIT) and others have seen positive net flows and that suggests steady demand from institutions.

However, recent data points to a short-term pause. Some analysis including Fintel’s look into institutional holdings, suggests a recent reduction in long positions for IBIT in the last quarter. This also signals that some institutions may be de-risking or taking profits.

Is the Organic Demand For Bitcoin Reducing?

A more concerning sign, highlighted by Santiment, is the decline shown by long-term utility metrics. The number of daily active addresses on the Bitcoin network has dropped by about 35% from its 2021 peak. A sustained decrease in active users and network growth can signal systemic weakness in organic demand, independent of speculative trading.

Bitcoin Price Prediction

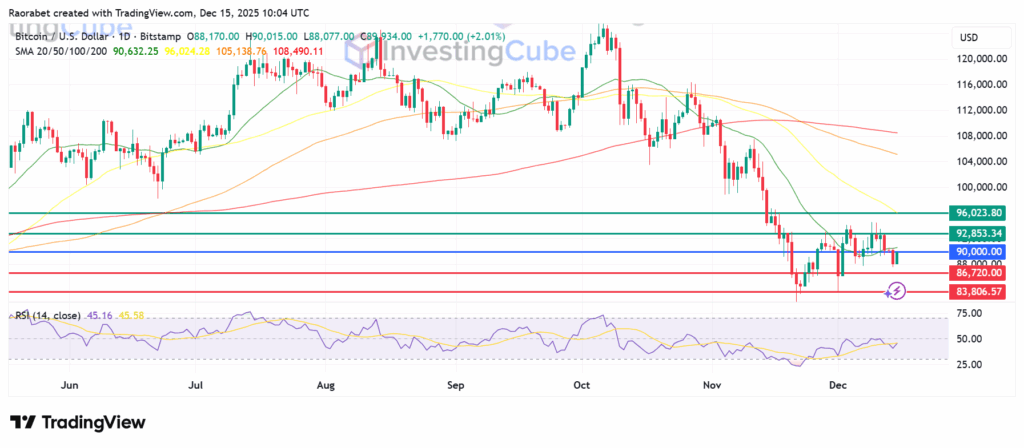

Bitcoin price is faces immediate resistance at the psychological support at $90,000, with the RSI at 45 favouring the sellers. The first support is likely to be at $86,720, but an extended control by the sellers could push the pair lower and test $83,806, near the multi-month lows. Conversely, action above $90k will likely result in a strong upside traction that could see it target the next resistance at $92,853.

If BTC USD breaks above that level, the next barrier will likely be at the 20-day SMA at $96,023. close below this level could lead to a test of the $88,000 and $82,000 support range. On the other hand, resistance is near the recent high of $94,000, followed by the $100,000 barrier. Unless it moves above $94,000, the technical outlook stays range-bound.

Bitcoin price daily chart on December 15, 2025 with 20,50 and 100 and 200-day SMA indicators and key support and resistance levels. Created on TradingView

The hawkish tone by the Federal Reserve, with only one 2026 cut projected, dashed dovish hopes, triggering the slide amid extended profit-taking.

While the ETFs have generated significant long-term structural demand, recent reports show a temporary slowdown in net inflows and even a period of institutional de-risking, applying short-term price pressure.

On-chain metrics indicate a divergence where long-term holders are currently engaged in some profit-taking and distribution, which contributes to the persistent selling pressure.