- Bitcoin underperforms equities in a 10-year divergence, raising questions about cycle timing and Bitcoin’s outlook for 2026.

Bitcoin is sending a signal that has not appeared in more than a decade. For the first time since 2014, US equities are firmly higher while Bitcoin is negative on a year-to-date basis, raising fresh questions about how the current cycle may evolve into 2026.

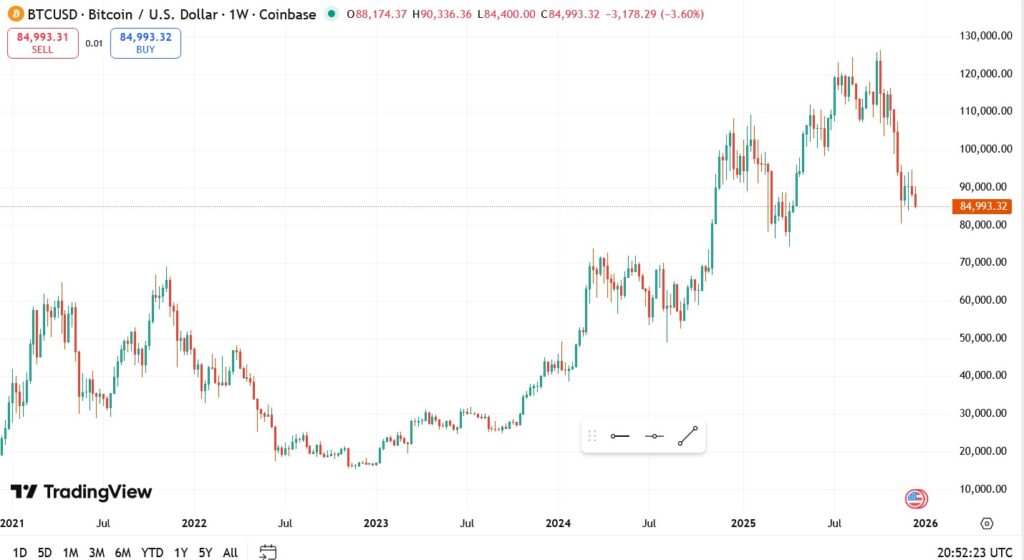

As of mid-December, the S&P 500 is up roughly 15% year to date, while Bitcoin is down about 7–8% over the same period, trading at 85,445 as of writing. That divergence stands out sharply given that Bitcoin peaked near $125,000 in October, marking a drawdown of more than 30% from its cycle high.

While the year-to-date decline is modest in percentage terms, the depth of the pullback from peak levels reflects a meaningful post-rally reset rather than routine consolidation.

Why Bitcoin Is Underperforming Stocks in 2025

Historically, Bitcoin has tended to move alongside risk assets during strong bull phases. Extended periods where equities rally while Bitcoin underperforms have been rare. The last comparable instance occurred in 2014, when the S&P 500 advanced while Bitcoin declined across the full calendar year.

That earlier divergence followed the unwinding of a speculative excess, exacerbated by structural failures in the crypto ecosystem at the time. Today’s market structure is fundamentally different, shaped by institutional custody, regulated exchanges, and spot Bitcoin ETFs. Yet the parallel is still relevant: in both cases, decoupling emerged after a powerful advance, signalling a digestion phase rather than a definitive trend reversal.

In the current cycle, the divergence appears driven less by systemic stress and more by positioning dynamics following the approval and rapid adoption of spot Bitcoin ETFs earlier this year.

Bitcoin’s Halving Cycle and What Typically Happens After a Market Peak

Bitcoin’s price behaviour continues to track its historical halving rhythm. The most recent halving occurred in April 2024, with Bitcoin reaching its cycle peak roughly 18 months later in October 2025. Previous cycles suggest that once this peak window passes, Bitcoin often enters a prolonged digestion phase marked by volatility, corrections, and range-bound trading.

If history holds, this consolidation phase could extend into late 2026 before momentum rebuilds ahead of the next halving in 2028. Importantly, this does not imply a collapse, but rather a period where price appreciation slows while the market absorbs prior gains.

This pattern helps explain why Bitcoin can underperform equities even as its longer-term adoption narrative remains intact.

Bitcoin Price Forecasts for 2026: What Major Banks Are Predicting

Despite near-term caution, several major financial institutions maintain constructive long-term forecasts.

Analysts at Standard Chartered and Bernstein both project Bitcoin reaching approximately $150,000 in 2026. While these targets represent downward revisions from earlier, more aggressive forecasts, they still imply upside of roughly 70–75% from current levels.

Looking further out, Standard Chartered’s Geoff Kendrick estimates Bitcoin could approach $500,000 by 2030, while Bernstein’s Gautam Chhugani has outlined scenarios where Bitcoin reaches $1 million by the early 2030s.

These projections are based largely on continued institutional allocation, ETF inflows, and improving regulatory clarity rather than speculative retail demand.

Bitcoin’s Technical Structure and Key Levels to Watch

From a technical perspective, Bitcoin’s correction has reset momentum without breaking its broader long-term structure. The $80,000–$85,000 zone has emerged as a critical support area, aligning with prior consolidation ranges and longer-term trend dynamics where buyers previously stepped in.

While momentum indicators have cooled following the October peak, price action so far suggests controlled distribution rather than panic selling. A sustained hold above this region would reinforce the view that Bitcoin is consolidating within a larger structural uptrend rather than entering a new bear market.

Bitcoin Price Outlook 2026: Why This Cycle Looks Different

Bitcoin’s decoupling from equities is not necessarily a bearish omen. Instead, it reflects a maturing market transitioning from explosive upside into a phase where fundamentals, positioning, and institutional behaviour matter more than momentum alone.

History suggests that periods of relative underperformance following a peak often set the groundwork for the next expansion phase. For investors, the key takeaway is not whether Bitcoin outperforms stocks every year, but whether the long-term adoption thesis remains intact through these quieter phases.

If institutional participation continues to deepen and the ETF framework keeps attracting capital, Bitcoin’s current divergence from equities may ultimately prove less a warning sign and more a pause before the next structural move higher.