- Alphabet stock is up by more than 7% year-to-date, and its earnings report could either extend the upside or trigger e reversal

- Many analysts are predicting increased capex rising up to $130 billion, but investors will also weigh revenue and margins

- Earnings numbers will not only impact Alphabet stock, but also the broader tech industry stocks

Alphabet stock (NASDAQ: GOOG) has been on a steady climb in early 2026, up over 7% year-to-date, closing at $339.71 on February 3. This follows a strong 2025, where the stock jumped 66%, fueled by substantial developments in AI and growth in cloud services. Investors are waiting for the release of the company’s fourth-quarter 2025 earnings after the market closes today, February 4, which could send the stock up or make it volatile.

Expected Earnings Impact on Stock Price

The word from Yahoo Finance is that analysts predict $111.4 billion in revenue for the quarter, a 15% jump from last year, driven by Google Cloud’s 36% growth and strong ad sales. Earnings per share are expected to be $2.62, up 22% from the previous year.

If Alphabet exceeds these numbers, mainly in AI areas like Gemini, the stock could reach new record levels.

What Alphabet’s Earnings Mean For the Broader Tech Industry

Alphabet doesn’t trade in a vacuum. As one of the largest companies in the world, a big rise in Google Cloud revenue could lead to a rally in other AI infrastructure stocks. A good report, showing AI making money and cloud deals with companies like Meta and Apple, could help other companies like Amazon and Nvidia, even after recent AI stock sales.

Charles Schwab’s earnings preview notes that positive guidance on infrastructure spending might reinforce optimism in semiconductors and hyperscalers, potentially boosting the Nasdaq.

What to Watch Closely

What’s important in the coming earnings report isn’t just the profit but also the capital expenditure (Capex) forecasts for 2026. Some analysts estimate that Alphabet might spend up to $130 billion on AI infrastructure this year. Also, keep an eye on operating margins and how stable search revenue is, given possible AI changes. These things will affect Alphabet and the market’s faith in tech’s future.

Alphabet stock price prediction

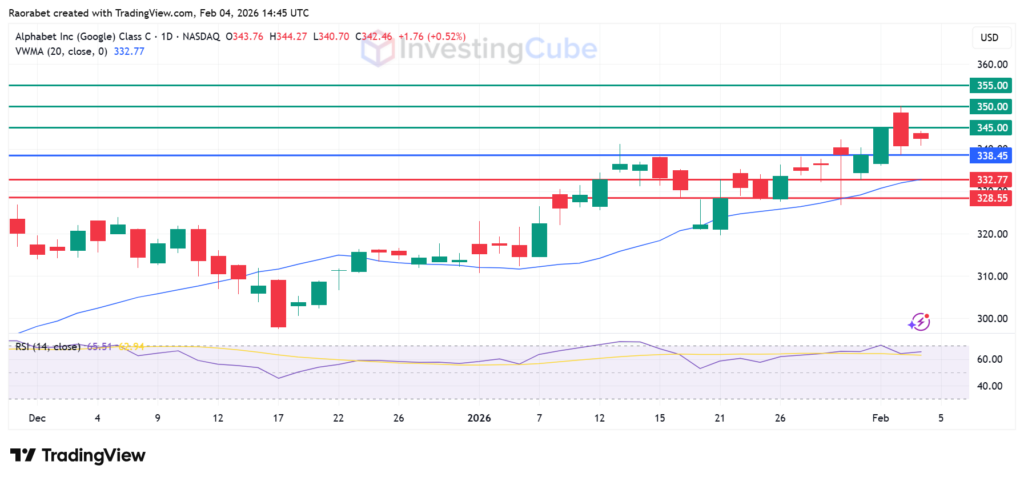

Alphabet is currently trading in a strong medium-term rising channel, having recently broken out above the $338 resistance level. The Relative Strength Index (RSI) at 65 shows strong buying activity, bordering on overbought conditions. The next goal is $345, which traders could try to target if they believe the the company will report positive numbers.

If they manage to break past that level, they will likely target $350. A break past that could potentially set the stage to rise higher to $350. If the numbers disappoint, there’s support around $332.77, aligning with the Volume Weighted Moving Average (VWMA) with a stronger floor at $328.55.

Alphabet stock price with key support and resistance levels for February 4, 2026. Created on TradingView

Yes, with more than 7% YTD gains and AI momentum, but earnings misses could test support at 321, potentially reversing recent gains.

If Alphabet’s cloud margins go up, it suggests good demand for AI. A poor report from Alphabet could cause a sell-off in AI stocks across the board.

The main risk is capital expenditure. If Alphabet indicates it needs to spend much more than the expected $130 billion on AI infrastructure without a similar revenue increase, its high valuation could be strained.